- New Zealand

- /

- Airlines

- /

- NZSE:AIR

Electric Aircraft Trial Might Change The Case For Investing In Air New Zealand (NZSE:AIR)

Reviewed by Sasha Jovanovic

- Air New Zealand and BETA Technologies recently completed the maiden flight of the fully electric BETA ALIA CX300 aircraft from Tauranga Airport, launching a four-month demonstration program to assess the aircraft’s performance in New Zealand conditions and train staff on electric aviation technology.

- This initiative marks a significant step in Air New Zealand’s Next Generation Aircraft programme, highlighting both its commitment to sustainable flight and the introduction of innovative low-emission aircraft into its regional network.

- With electric aircraft testing now underway and future orders signaled, we'll assess how this enhances Air New Zealand’s investment narrative focused on sustainability innovation.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Air New Zealand Investment Narrative Recap

To be a shareholder in Air New Zealand, you need to believe the airline can restore its operating scale and unlock value through fleet modernization, including investments in low-emission aircraft, while managing current cost and demand pressures. The recent test flight of the electric BETA ALIA CX300 highlights the company's sustainability push, but given program timelines and the limited short-term impact on capacity or costs, this news does not materially affect the most immediate catalyst, restoration of full fleet availability, or the ongoing risk from engine supply challenges.

Among recent announcements, Air New Zealand’s order for two CX300s and rights for up to twenty more electric aircraft directly connects with this flight program, reinforcing the airline’s medium-term narrative around sustainability and innovation. That said, near-term results will likely remain more dependent on resolving engine reliability issues, which continue to limit the recovery of capacity and revenue in the current financial period.

In contrast, the technical progress with electric aircraft is promising, but investors should be aware of persistent constraints from supply chain risks and engine availability...

Read the full narrative on Air New Zealand (it's free!)

Air New Zealand's outlook anticipates NZ$7.8 billion in revenue and NZ$239.0 million in earnings by 2028. This reflects an annual revenue growth rate of 4.7% and a NZ$113.0 million increase in earnings from the current NZ$126.0 million.

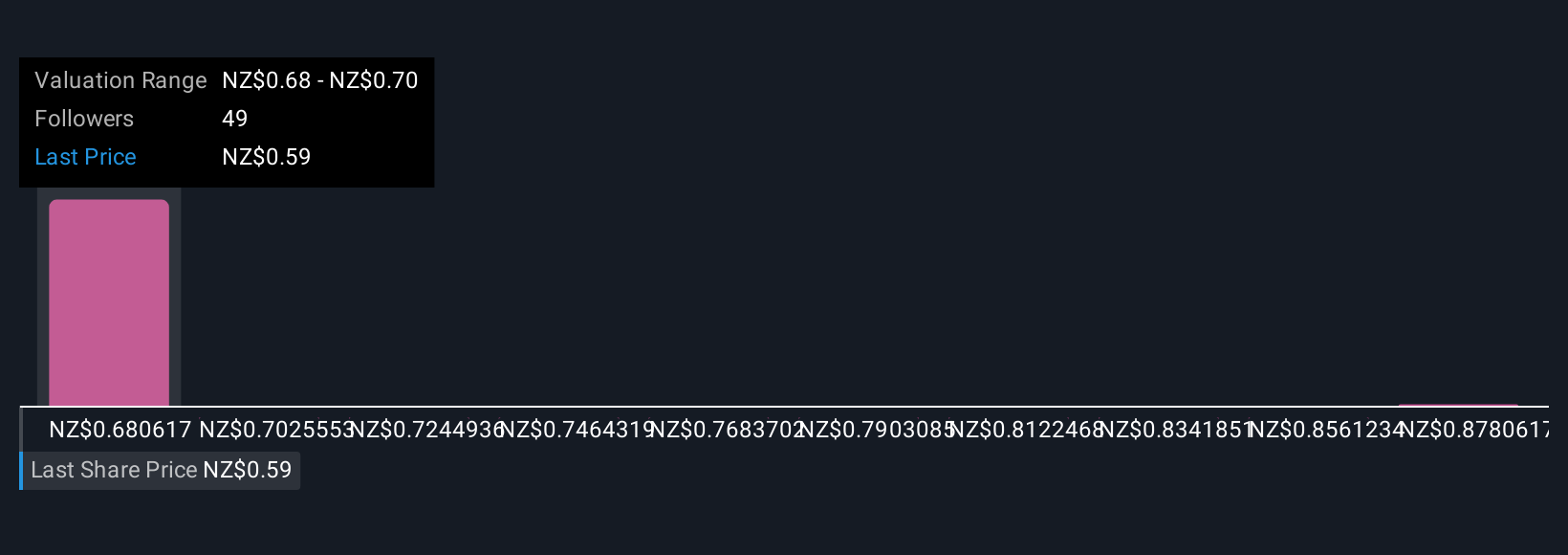

Uncover how Air New Zealand's forecasts yield a NZ$0.688 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have posted fair value estimates between NZ$0.688 and NZ$0.90, based on two independent analyses. With continued engine supply uncertainty impacting short-term profitability, individual perspectives on Air New Zealand’s outlook can vary widely so it helps to compare a range of opinions.

Explore 2 other fair value estimates on Air New Zealand - why the stock might be worth as much as 51% more than the current price!

Build Your Own Air New Zealand Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Air New Zealand research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Air New Zealand research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Air New Zealand's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:AIR

Air New Zealand

Provides air passenger and cargo transportation on scheduled airlines services in New Zealand, Australia, the Pacific Islands, Asia, the United Kingdom, Europe, and the Americas.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives