- New Zealand

- /

- Airlines

- /

- NZSE:AIR

A Fresh Look at Air New Zealand (NZSE:AIR) Valuation Following Milestone All-Electric Aircraft Flight

Reviewed by Simply Wall St

Air New Zealand (NZSE:AIR) has completed the maiden flight of its all-electric BETA ALIA CX300 aircraft, kicking off a four-month technical demonstrator program. This step marks real progress in the airline’s push for sustainable aviation.

See our latest analysis for Air New Zealand.

While Air New Zealand’s pioneering electric aircraft grabbed headlines this week, investors have seen momentum gradually build over the past year. Although the latest share price at $0.59 has barely shifted in the short term, the stock’s one-year total shareholder return sits at a healthy 13.9%. This is a notable sign that the market is warming to the airline’s sustainability focus, even as disruptions and weather-related delays have cropped up.

If innovation in aviation has sparked your interest, it might be time to broaden your discovery and explore See the full list for free.

So with shares still trading below analysts’ targets despite real progress on sustainability, is Air New Zealand an undervalued bet on the future of green aviation, or is all the good news already reflected in the price?

Most Popular Narrative: 14.2% Undervalued

With Air New Zealand’s shares closing at NZ$0.59, the most widely followed narrative assigns a fair value of NZ$0.69. This suggests analysts still see meaningful upside if growth plans pan out. The stage is set for bold transformation, but it is the mechanics behind this vision that truly demand a closer look.

Transformation and digitalization initiatives, including deployment of AI tools and automation for cost efficiency and enhanced passenger experience, are expected to drive further EBITDA improvement, productivity, and scalability as network capacity returns, boosting future earnings.

Want to know what makes analysts bullish on fair value? The future hinges on ambitious digital upgrades, premium route expansion, and efficiency gains that underpin the valuation narrative. The main drivers behind the price target remain hidden; discover the surprising assumptions inside the full story.

Result: Fair Value of $0.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent engine supply issues and rising operational costs could quickly dampen optimism. These challenges may impact Air New Zealand’s growth narrative and future margins.

Find out about the key risks to this Air New Zealand narrative.

Another View: Peer and Industry Comparisons

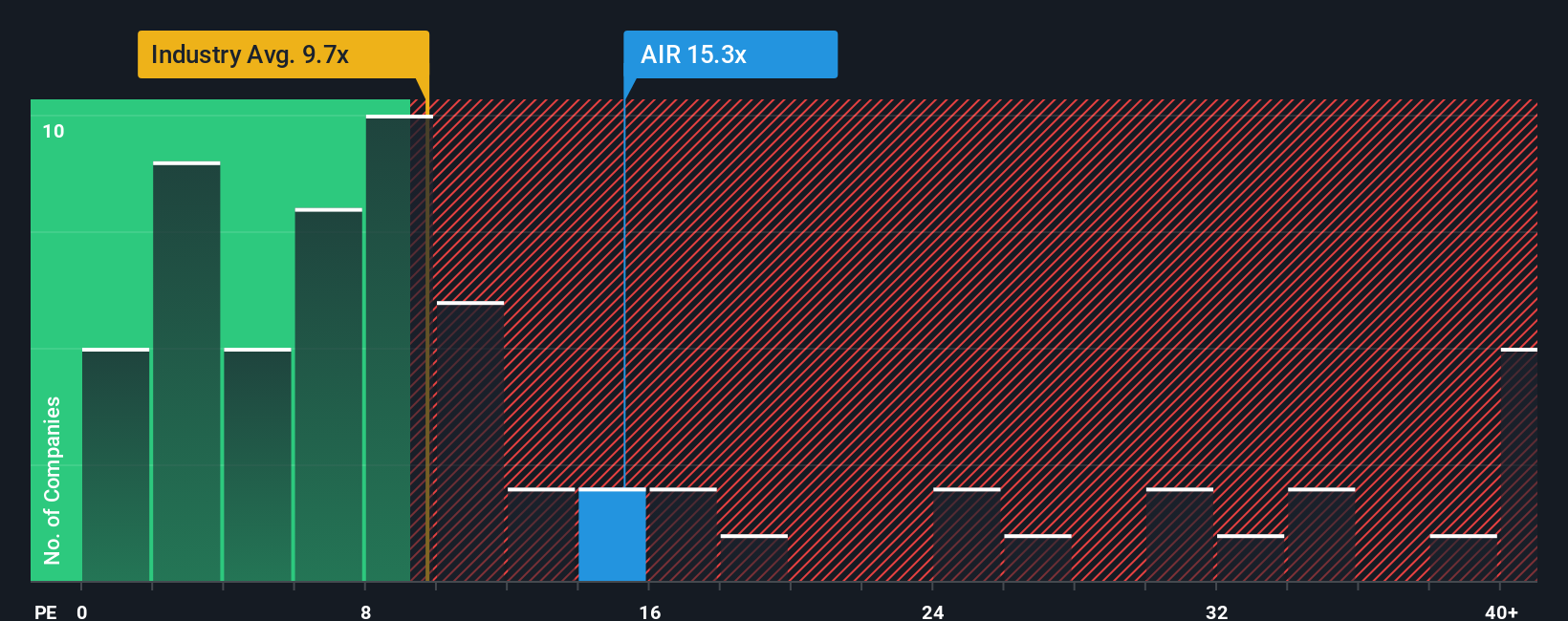

Looking through the lens of the price-to-earnings ratio, Air New Zealand appears pricier than the global industry average, trading at 15.3x earnings versus the sector's 9.7x. However, it is more attractive next to peers at 25.6x earnings and remains well below the suggested fair ratio of 30.8x. This split raises an intriguing question: are investors overlooking greater upside or underestimating the risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Air New Zealand Narrative

If you want to take a more hands-on approach and put your view to the test, it only takes a few minutes to build your own perspective. Do it your way

A great starting point for your Air New Zealand research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Make your next smart move and expand your hunt for opportunities beyond Air New Zealand. The right stock could be just a click away. Seize your edge today.

- Tap into rapid technological breakthroughs by scanning these 24 AI penny stocks which deliver transformative potential across industries and reshape tomorrow’s innovation landscape.

- Kickstart your search for outstanding returns among these 17 dividend stocks with yields > 3% that are primed to reward investors with reliable income and attractive yields above 3%.

- Get ahead of the market by targeting these 878 undervalued stocks based on cash flows that current cash flow analysis indicates are trading below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:AIR

Air New Zealand

Provides air passenger and cargo transportation on scheduled airlines services in New Zealand, Australia, the Pacific Islands, Asia, the United Kingdom, Europe, and the Americas.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives