- New Zealand

- /

- Telecom Services and Carriers

- /

- NZSE:SPK

Some Shareholders Feeling Restless Over Spark New Zealand Limited's (NZSE:SPK) P/E Ratio

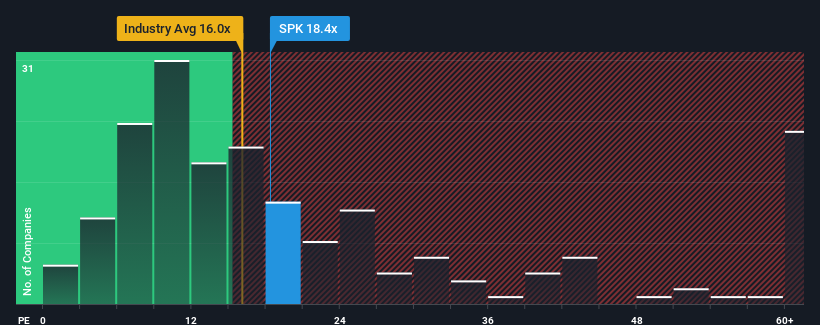

It's not a stretch to say that Spark New Zealand Limited's (NZSE:SPK) price-to-earnings (or "P/E") ratio of 18.4x right now seems quite "middle-of-the-road" compared to the market in New Zealand, where the median P/E ratio is around 18x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings that are retreating more than the market's of late, Spark New Zealand has been very sluggish. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Check out our latest analysis for Spark New Zealand

How Is Spark New Zealand's Growth Trending?

The only time you'd be comfortable seeing a P/E like Spark New Zealand's is when the company's growth is tracking the market closely.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 60%. Regardless, EPS has managed to lift by a handy 8.3% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings should grow by 3.2% per year over the next three years. Meanwhile, the rest of the market is forecast to expand by 17% per year, which is noticeably more attractive.

With this information, we find it interesting that Spark New Zealand is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Spark New Zealand's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 3 warning signs for Spark New Zealand you should be aware of, and 1 of them shouldn't be ignored.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:SPK

Spark New Zealand

Provides telecommunications and digital services in New Zealand.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026