As global markets navigate a complex landscape marked by cautious Federal Reserve commentary and political uncertainty, smaller-cap indexes have been particularly affected. In this climate, penny stocks—despite their somewhat outdated moniker—remain an intriguing area for investors seeking opportunities in less-established companies. These stocks, often characterized by their potential for both value and growth, can offer surprising stability when backed by strong financials.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.73 | MYR431.91M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.07 | £779.9M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.13 | HK$45.48B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.42 | MYR1.17B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £148.28M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.55 | £67.7M | ★★★★☆☆ |

Click here to see the full list of 5,846 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Ihlas Gazetecilik (IBSE:IHGZT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ihlas Gazetecilik A.S. is involved in the publishing, selling, distributing, and marketing of newspapers, books, encyclopedias, brochures, and magazines both in Turkey and internationally with a market cap of TRY1.38 billion.

Operations: The company generates revenue primarily from its publishing segment, specifically newspapers, amounting to TRY1.26 billion.

Market Cap: TRY1.38B

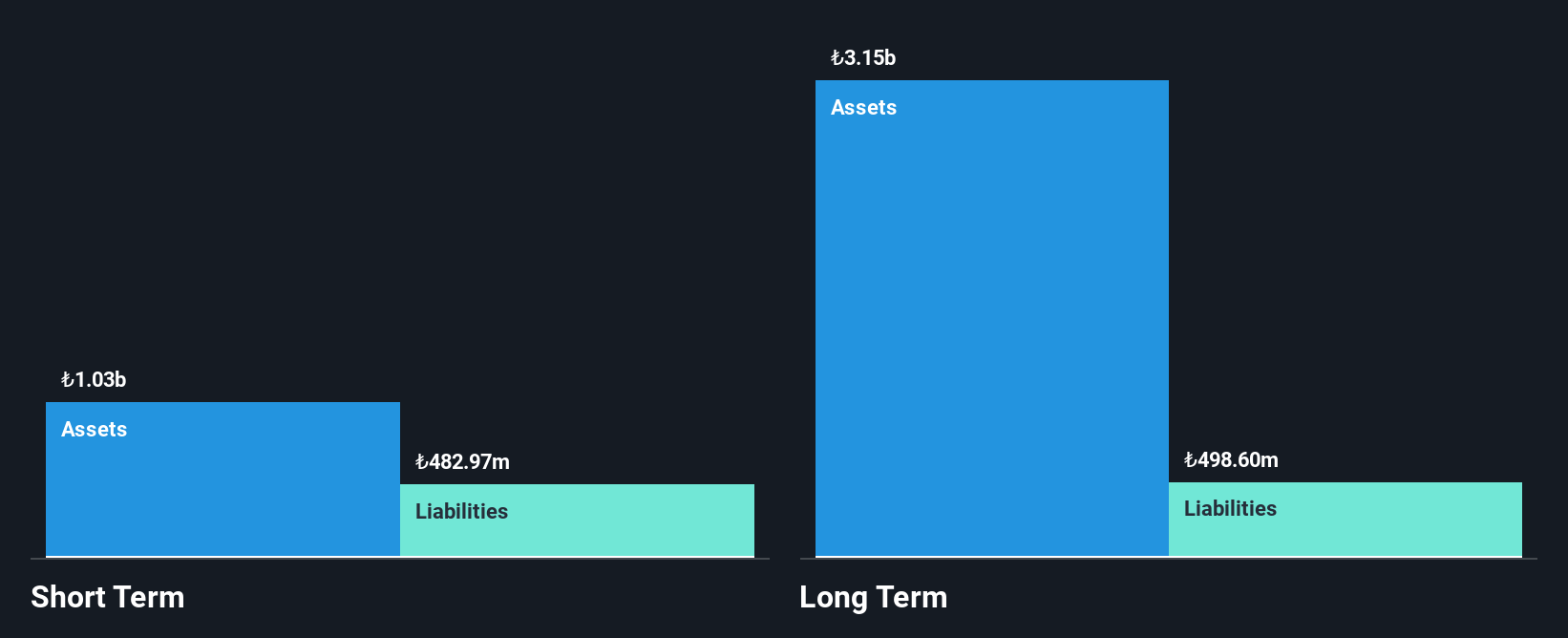

Ihlas Gazetecilik A.S., while unprofitable, has seen its net loss decrease significantly over the past year, with a nine-month net loss of TRY230.76 million compared to TRY391.13 million previously. The company maintains a strong cash position, with short-term assets exceeding both short and long-term liabilities, and more cash than total debt. Despite earnings declines at 68.7% annually over five years, it has reduced its debt-to-equity ratio from 10.9% to 0.2%, indicating improved financial management. However, the share price remains highly volatile and returns on equity are negative at -23.41%.

- Click here to discover the nuances of Ihlas Gazetecilik with our detailed analytical financial health report.

- Examine Ihlas Gazetecilik's past performance report to understand how it has performed in prior years.

ikeGPS Group (NZSE:IKE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ikeGPS Group Limited designs, sells, and delivers solutions for the collection, analysis, and management of distribution assets for electric utilities and communications companies in the United States, with a market cap of NZ$93.23 million.

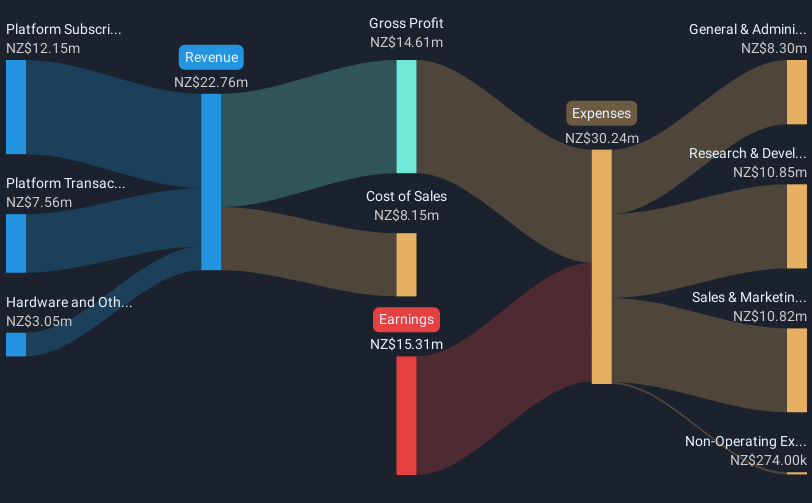

Operations: The company's revenue is derived from three segments: Platform Transactions (NZ$7.56 million), Platform Subscriptions (NZ$12.15 million), and Hardware and Other Services (NZ$3.05 million).

Market Cap: NZ$93.23M

ikeGPS Group Limited, with a market cap of NZ$93.23 million, remains unprofitable as losses have increased over the past five years. Despite this, the company has no debt and maintains sufficient short-term assets (NZ$14.6 million) to cover both short and long-term liabilities. Recent earnings results for the half year ended September 30, 2024, showed sales of NZ$12.17 million but a net loss of NZ$7.11 million persists. The board is seasoned with an average tenure of four years; however, management is relatively new with a tenure of 1.4 years on average.

- Get an in-depth perspective on ikeGPS Group's performance by reading our balance sheet health report here.

- Assess ikeGPS Group's future earnings estimates with our detailed growth reports.

5th Planet Games (OB:5PG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: 5th Planet Games A/S is a global video games publisher with a market cap of NOK336.82 million.

Operations: The company generates revenue from its Computer Graphics segment, amounting to DKK11.76 million.

Market Cap: NOK336.82M

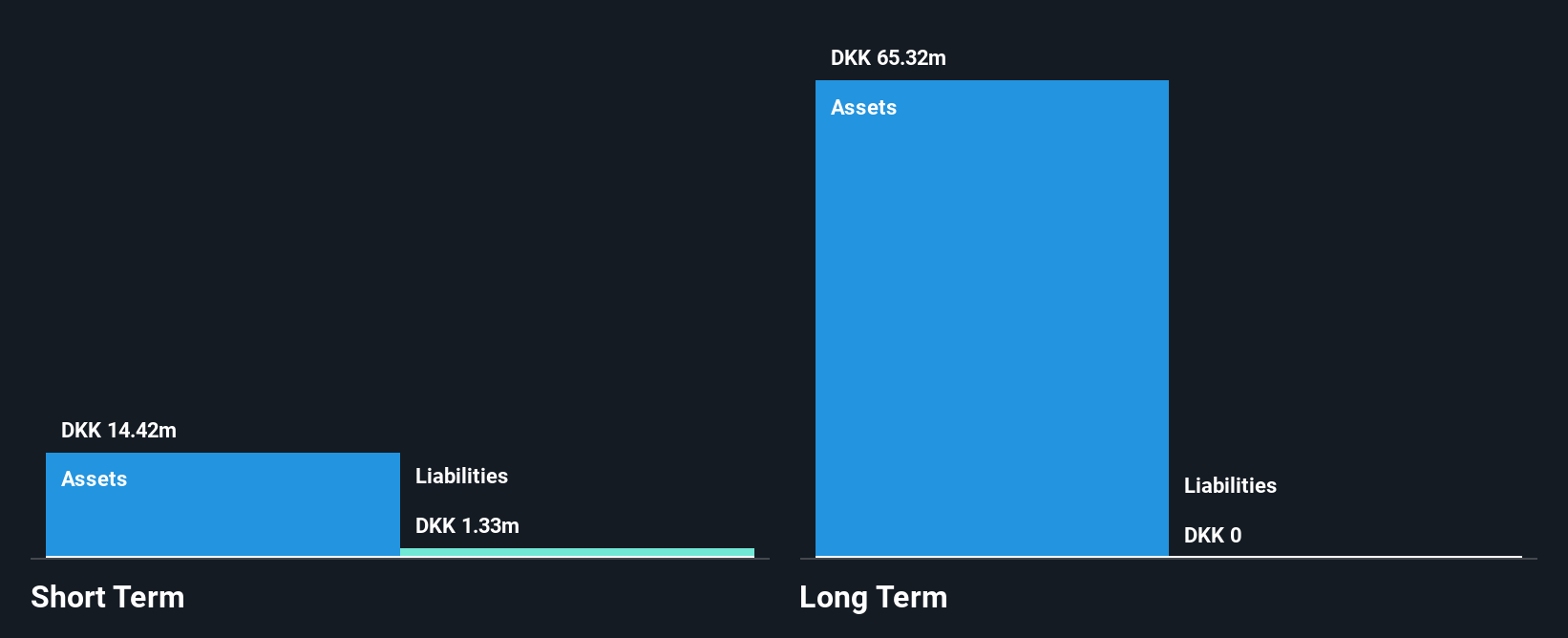

5th Planet Games A/S, with a market cap of NOK336.82 million, is currently unprofitable and lacks meaningful revenue, reporting DKK12 million in sales. Despite this, the company remains debt-free and has no long-term liabilities. Its short-term assets of DKK40.8 million comfortably cover its short-term liabilities of DKK7.9 million. Recent earnings for the third quarter showed an increase in sales to DKK4.17 million from last year but resulted in a net loss of DKK3.41 million compared to a net income previously recorded at DKK27.48 million, highlighting ongoing financial challenges amidst stable weekly volatility levels.

- Unlock comprehensive insights into our analysis of 5th Planet Games stock in this financial health report.

- Explore historical data to track 5th Planet Games' performance over time in our past results report.

Where To Now?

- Dive into all 5,846 of the Penny Stocks we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ikeGPS Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:IKE

ikeGPS Group

Engages in the design, sale, and delivery of a solution for the collection, analysis, and management of distribution assets for electric utilities and communications companies in the United States.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives