We Take A Look At Why EROAD Limited's (NZSE:ERD) CEO Compensation Is Well Earned

It would be hard to discount the role that CEO Steven Newman has played in delivering the impressive results at EROAD Limited (NZSE:ERD) recently. Shareholders will have this at the front of their minds in the upcoming AGM on 30 July 2021. This would also be a chance for them to hear the board review the financial results, discuss future company strategy and vote on any resolutions such as executive remuneration. Here is our take on why we think CEO compensation is not extravagant.

Check out our latest analysis for EROAD

Comparing EROAD Limited's CEO Compensation With the industry

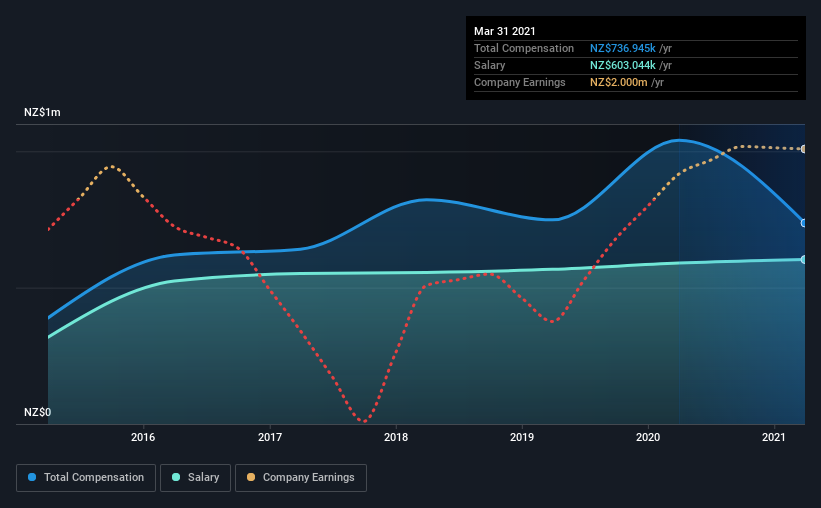

At the time of writing, our data shows that EROAD Limited has a market capitalization of NZ$544m, and reported total annual CEO compensation of NZ$737k for the year to March 2021. Notably, that's a decrease of 29% over the year before. Notably, the salary which is NZ$603.0k, represents most of the total compensation being paid.

On comparing similar companies from the same industry with market caps ranging from NZ$287m to NZ$1.1b, we found that the median CEO total compensation was NZ$678k. So it looks like EROAD compensates Steven Newman in line with the median for the industry. Moreover, Steven Newman also holds NZ$847k worth of EROAD stock directly under their own name.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | NZ$603k | NZ$590k | 82% |

| Other | NZ$134k | NZ$450k | 18% |

| Total Compensation | NZ$737k | NZ$1.0m | 100% |

Talking in terms of the industry, salary represented approximately 66% of total compensation out of all the companies we analyzed, while other remuneration made up 34% of the pie. EROAD is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at EROAD Limited's Growth Numbers

Over the past three years, EROAD Limited has seen its earnings per share (EPS) grow by 98% per year. Its revenue is up 13% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has EROAD Limited Been A Good Investment?

Boasting a total shareholder return of 103% over three years, EROAD Limited has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Seeing that the company has put in a relatively good performance, the CEO remuneration policy may not be the focus at the AGM. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 3 warning signs for EROAD that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if EROAD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NZSE:ERD

EROAD

Provides electronic on-board units and software as a service to the transport industry in New Zealand, the United States, and Australia.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026