The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Vista Group International Limited (NZSE:VGL) makes use of debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Vista Group International

How Much Debt Does Vista Group International Carry?

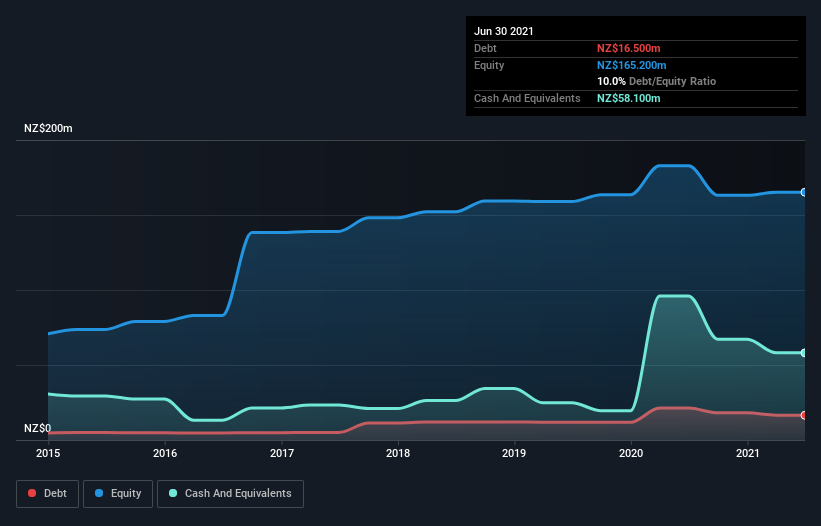

As you can see below, Vista Group International had NZ$16.5m of debt at June 2021, down from NZ$21.3m a year prior. However, it does have NZ$58.1m in cash offsetting this, leading to net cash of NZ$41.6m.

How Strong Is Vista Group International's Balance Sheet?

According to the last reported balance sheet, Vista Group International had liabilities of NZ$41.0m due within 12 months, and liabilities of NZ$44.7m due beyond 12 months. Offsetting this, it had NZ$58.1m in cash and NZ$43.1m in receivables that were due within 12 months. So it actually has NZ$15.5m more liquid assets than total liabilities.

This short term liquidity is a sign that Vista Group International could probably pay off its debt with ease, as its balance sheet is far from stretched. Succinctly put, Vista Group International boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Vista Group International's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Vista Group International made a loss at the EBIT level, and saw its revenue drop to NZ$88m, which is a fall of 28%. To be frank that doesn't bode well.

So How Risky Is Vista Group International?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And the fact is that over the last twelve months Vista Group International lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through NZ$25m of cash and made a loss of NZ$12m. With only NZ$41.6m on the balance sheet, it would appear that its going to need to raise capital again soon. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 1 warning sign for Vista Group International you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NZSE:VGL

Vista Group International

Provides software and data analytics solutions to the film industry.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026