- New Zealand

- /

- Software

- /

- NZSE:SKO

Shareholders May Be More Conservative With Serko Limited's (NZSE:SKO) CEO Compensation For Now

Key Insights

- Serko's Annual General Meeting to take place on 26th of June

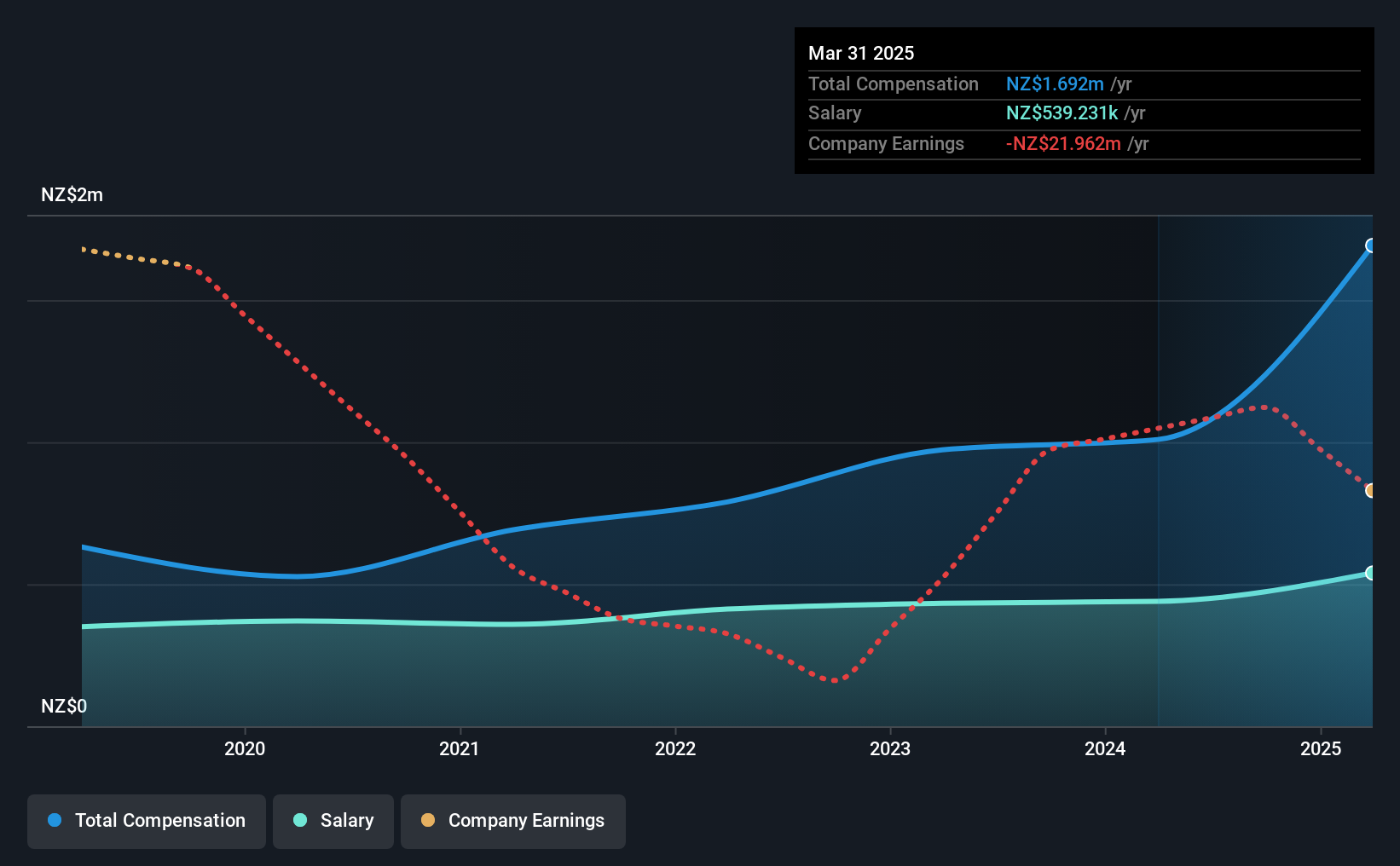

- CEO Darrin Grafton's total compensation includes salary of NZ$539.2k

- Total compensation is 35% above industry average

- Serko's EPS grew by 37% over the past three years while total shareholder loss over the past three years was 22%

Shareholders of Serko Limited (NZSE:SKO) will have been dismayed by the negative share price return over the last three years. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 26th of June. They could also influence management through voting on resolutions such as executive remuneration. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

View our latest analysis for Serko

Comparing Serko Limited's CEO Compensation With The Industry

Our data indicates that Serko Limited has a market capitalization of NZ$365m, and total annual CEO compensation was reported as NZ$1.7m for the year to March 2025. We note that's an increase of 68% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at NZ$539k.

On examining similar-sized companies in the New Zealand Software industry with market capitalizations between NZ$167m and NZ$670m, we discovered that the median CEO total compensation of that group was NZ$1.3m. Accordingly, our analysis reveals that Serko Limited pays Darrin Grafton north of the industry median. Moreover, Darrin Grafton also holds NZ$34m worth of Serko stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | NZ$539k | NZ$439k | 32% |

| Other | NZ$1.2m | NZ$570k | 68% |

| Total Compensation | NZ$1.7m | NZ$1.0m | 100% |

Talking in terms of the industry, salary represented approximately 64% of total compensation out of all the companies we analyzed, while other remuneration made up 36% of the pie. In Serko's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Serko Limited's Growth Numbers

Over the past three years, Serko Limited has seen its earnings per share (EPS) grow by 37% per year. Its revenue is up 29% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Serko Limited Been A Good Investment?

Since shareholders would have lost about 22% over three years, some Serko Limited investors would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Despite the growth in its earnings, the share price decline in the past three years is certainly concerning. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. If there are some unknown variables that are influencing the stock's price, surely shareholders would have some concerns. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 1 warning sign for Serko that investors should be aware of in a dynamic business environment.

Switching gears from Serko, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:SKO

Serko

Provides online travel booking and expense management services in New Zealand, Australia, the United States, Europe, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026