- New Zealand

- /

- Software

- /

- NZSE:SKO

Here's Why We're Not At All Concerned With Serko's (NZSE:SKO) Cash Burn Situation

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

Given this risk, we thought we'd take a look at whether Serko (NZSE:SKO) shareholders should be worried about its cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. Let's start with an examination of the business' cash, relative to its cash burn.

See our latest analysis for Serko

How Long Is Serko's Cash Runway?

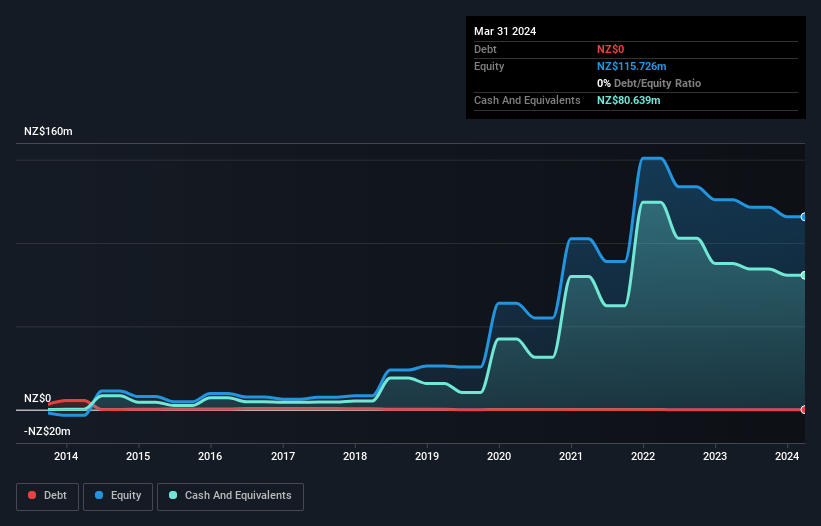

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In March 2024, Serko had NZ$81m in cash, and was debt-free. Importantly, its cash burn was NZ$5.5m over the trailing twelve months. So it had a very long cash runway of many years from March 2024. Notably, however, analysts think that Serko will break even (at a free cash flow level) before then. If that happens, then the length of its cash runway, today, would become a moot point. You can see how its cash balance has changed over time in the image below.

How Well Is Serko Growing?

Happily, Serko is travelling in the right direction when it comes to its cash burn, which is down 85% over the last year. Pleasingly, this was achieved with the help of a 48% boost to revenue. Considering these factors, we're fairly impressed by its growth trajectory. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can Serko Raise Cash?

We are certainly impressed with the progress Serko has made over the last year, but it is also worth considering how costly it would be if it wanted to raise more cash to fund faster growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash and drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Serko's cash burn of NZ$5.5m is about 1.5% of its NZ$358m market capitalisation. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

How Risky Is Serko's Cash Burn Situation?

As you can probably tell by now, we're not too worried about Serko's cash burn. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. But it's fair to say that its cash burn relative to its market cap was also very reassuring. There's no doubt that shareholders can take a lot of heart from the fact that analysts are forecasting it will reach breakeven before too long. Taking all the factors in this report into account, we're not at all worried about its cash burn, as the business appears well capitalized to spend as needs be. While we always like to monitor cash burn for early stage companies, qualitative factors such as the CEO pay can also shed light on the situation. Click here to see free what the Serko CEO is paid..

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:SKO

Serko

Provides online travel booking and expense management services in New Zealand, Australia, the United States, Europe, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.