- New Zealand

- /

- Software

- /

- NZSE:GTK

Gentrack Group (NZSE:GTK) Is Up 37.3% After Posting Strong FY25 Results and Upbeat 2026 Guidance

Reviewed by Sasha Jovanovic

- Gentrack Group Limited recently released its full year results for the period ended September 30, 2025, reporting sales of NZ$230.19 million and net income of NZ$20.87 million, both up from the previous year.

- The company also shared an optimistic outlook, predicting revenue growth in 2026 will exceed that of 2025, highlighting increasing market demand for its solutions.

- To understand how this combination of earnings growth and forward-looking guidance shapes Gentrack Group's investment narrative, we'll focus on its confident revenue outlook.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Gentrack Group's Investment Narrative?

To be a shareholder in Gentrack Group right now, you need to believe in both its ability to capitalise on meaningful revenue growth and its position within the utility software sector, even with some looming challenges. The recent earnings result demonstrates a robust jump in both top and bottom lines, while management’s guidance for even stronger revenue expansion in 2026 is a clear short-term catalyst. The share price saw a strong bounce after the results, suggesting the market views this as significant and potentially reducing some concern about slow revenue growth. Still, the valuation remains high, especially compared against peers and sector averages. The most prominent risk now shifts to whether this optimism about future growth can be justified in the face of a relatively inexperienced management team and historically volatile share price. Recent developments make future execution and stability even more critical to watch.

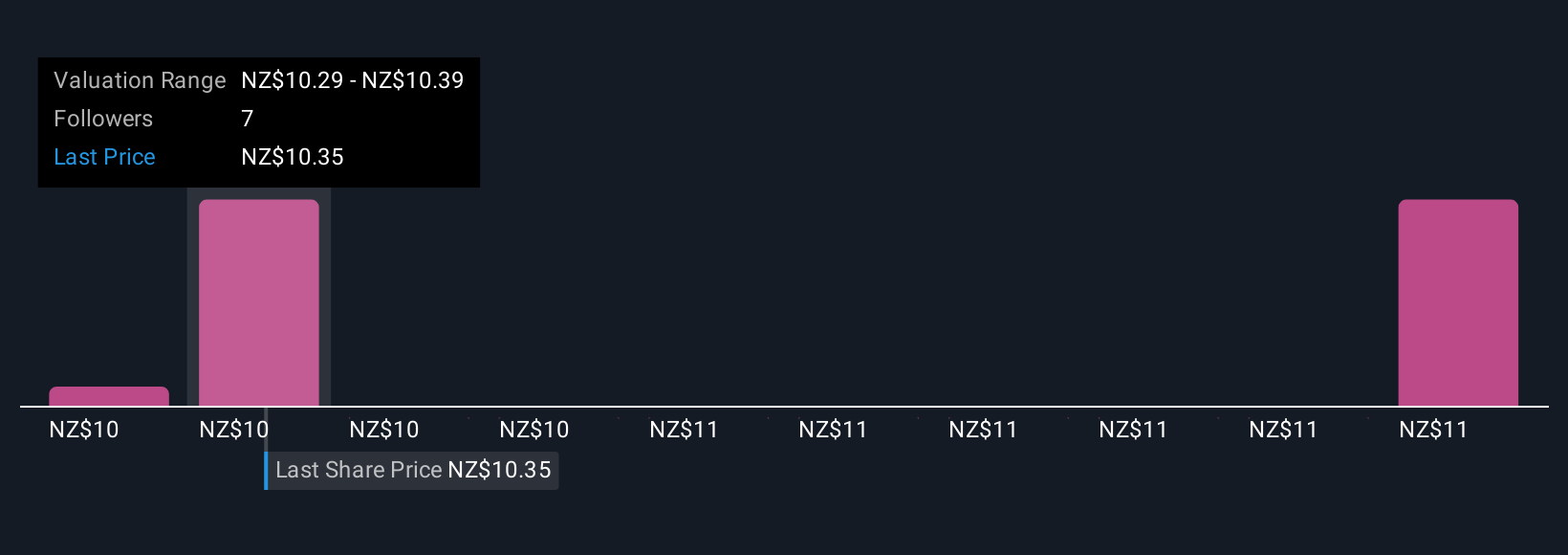

On the other hand, concerns persist over management’s limited track record and the elevated valuation. Gentrack Group's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 4 other fair value estimates on Gentrack Group - why the stock might be worth as much as 8% more than the current price!

Build Your Own Gentrack Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gentrack Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Gentrack Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gentrack Group's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:GTK

Gentrack Group

Engages in the development, integration, and support of enterprise billing and customer management software solutions for the energy and water utility, and airport industries.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success