- New Zealand

- /

- Specialty Stores

- /

- NZSE:HLG

Here's Why I Think Hallenstein Glasson Holdings (NZSE:HLG) Might Deserve Your Attention Today

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Hallenstein Glasson Holdings (NZSE:HLG). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Hallenstein Glasson Holdings

Hallenstein Glasson Holdings's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. It's no surprise, then, that I like to invest in companies with EPS growth. Over the last three years, Hallenstein Glasson Holdings has grown EPS by 11% per year. That growth rate is fairly good, assuming the company can keep it up.

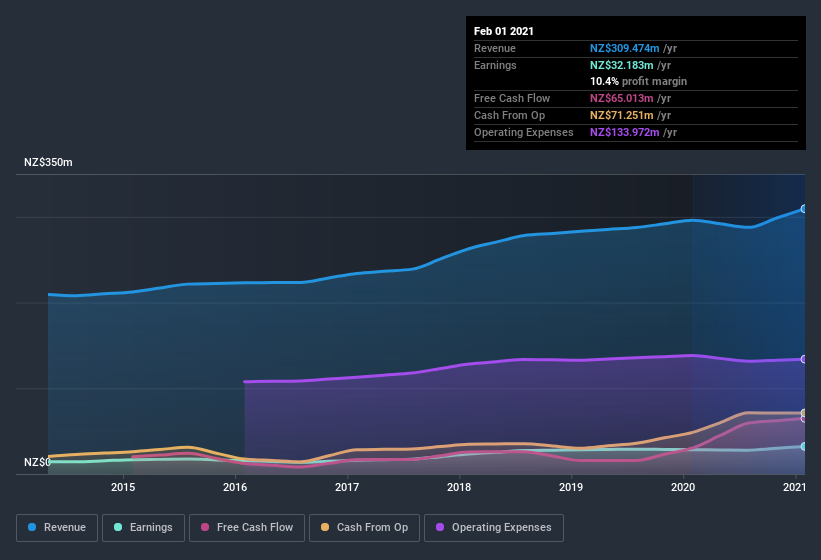

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Hallenstein Glasson Holdings maintained stable EBIT margins over the last year, all while growing revenue 4.5% to NZ$309m. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Hallenstein Glasson Holdings Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's good to see Hallenstein Glasson Holdings insiders walking the walk, by spending NZ$577k on shares in just twelve months. And when you consider that there was no insider selling, you can understand why shareholders might believe that lady luck will grace this business. We also note that it was the Chief Executive Officer of Glassons Australia, James Glasson, who made the biggest single acquisition, paying NZ$305k for shares at about NZ$6.48 each.

On top of the insider buying, it's good to see that Hallenstein Glasson Holdings insiders have a valuable investment in the business. With a whopping NZ$98m worth of shares as a group, insiders have plenty riding on the company's success. At 22% of the company, the co-investment by insiders gives me confidence that management will make long-term focussed decisions.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Mary Devine, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like Hallenstein Glasson Holdings with market caps between NZ$286m and NZ$1.1b is about NZ$831k.

Hallenstein Glasson Holdings offered total compensation worth NZ$706k to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. I'd also argue reasonable pay levels attest to good decision making more generally.

Does Hallenstein Glasson Holdings Deserve A Spot On Your Watchlist?

As I already mentioned, Hallenstein Glasson Holdings is a growing business, which is what I like to see. Better yet, insiders are significant shareholders, and have been buying more shares. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Hallenstein Glasson Holdings is trading on a high P/E or a low P/E, relative to its industry.

The good news is that Hallenstein Glasson Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Hallenstein Glasson Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hallenstein Glasson Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NZSE:HLG

Hallenstein Glasson Holdings

Operates as a retailer of men’s and women’s clothing in New Zealand and Australia.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives