- New Zealand

- /

- Office REITs

- /

- NZSE:PCT

Precinct Properties New Zealand (NZSE:PCT) Has Compensated Shareholders With A Respectable 69% Return On Their Investment

If you buy and hold a stock for many years, you'd hope to be making a profit. But more than that, you probably want to see it rise more than the market average. Unfortunately for shareholders, while the Precinct Properties New Zealand Limited (NZSE:PCT) share price is up 36% in the last five years, that's less than the market return. Zooming in, the stock is actually down 11% in the last year.

Check out our latest analysis for Precinct Properties New Zealand

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Precinct Properties New Zealand's earnings per share are down 27% per year, despite strong share price performance over five years.

This means it's unlikely the market is judging the company based on earnings growth. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

It is not great to see that revenue has dropped by 2.2% per year over five years. It certainly surprises us that the share price is up, but perhaps a closer examination of the data will yield answers.

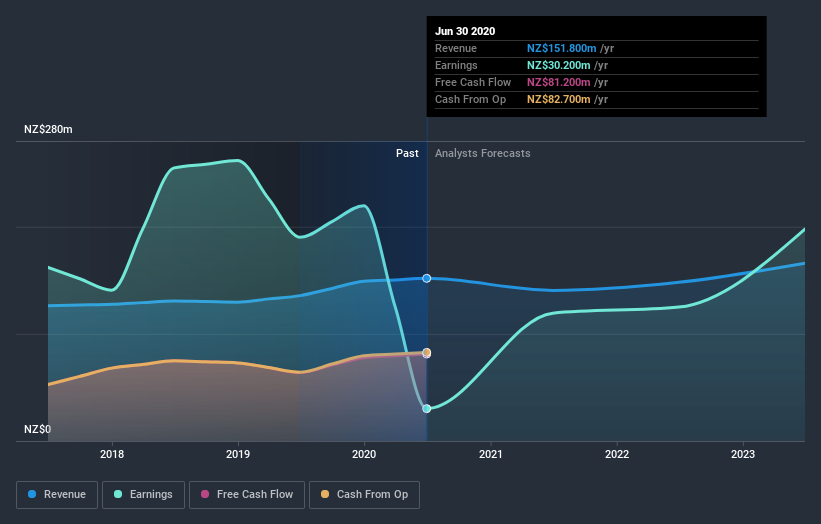

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Precinct Properties New Zealand stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Precinct Properties New Zealand's TSR for the last 5 years was 69%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Precinct Properties New Zealand shareholders are down 7.4% for the year (even including dividends), but the market itself is up 12%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 11% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Precinct Properties New Zealand better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with Precinct Properties New Zealand (including 1 which doesn't sit too well with us) .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NZ exchanges.

When trading Precinct Properties New Zealand or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Precinct Properties NZ & Precinct Properties Investments, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NZSE:PCT

Precinct Properties NZ & Precinct Properties Investments

Precinct is New Zealand’s only listed city centre specialist investing predominantly in premium and Agrade commercial office property.

Average dividend payer and fair value.

Market Insights

Community Narratives