The board of CDL Investments New Zealand Limited (NZSE:CDI) has announced that it will pay a dividend of NZ$0.0412 per share on the 17th of May. This makes the dividend yield 5.0%, which will augment investor returns quite nicely.

See our latest analysis for CDL Investments New Zealand

CDL Investments New Zealand Is Paying Out More Than It Is Earning

If the payments aren't sustainable, a high yield for a few years won't matter that much. Before making this announcement, CDL Investments New Zealand was paying out a fairly large proportion of earnings, and it wasn't generating positive free cash flows either. Generally, we think that this would be a risky long term practice.

If the company can't turn things around, EPS could fall by 17.5% over the next year. Assuming the dividend continues along recent trends, we believe the payout ratio could reach 115%, which could put the dividend under pressure if earnings don't start to improve.

CDL Investments New Zealand Has A Solid Track Record

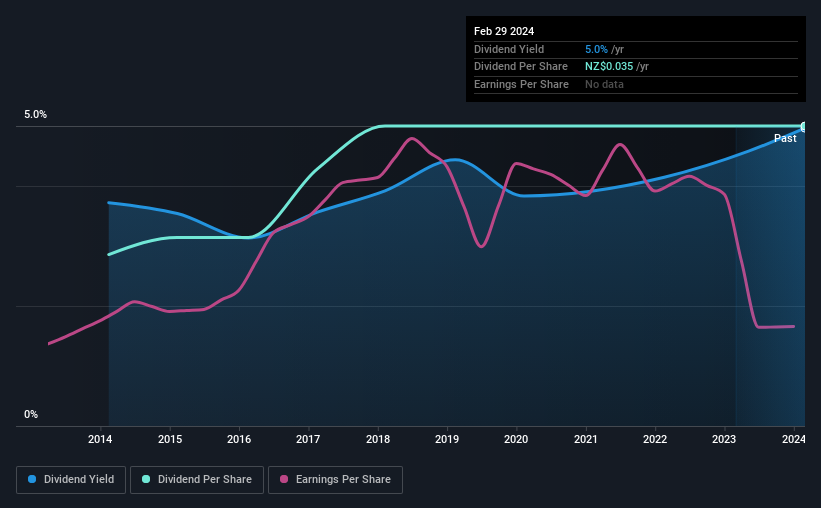

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The dividend has gone from an annual total of NZ$0.02 in 2014 to the most recent total annual payment of NZ$0.035. This implies that the company grew its distributions at a yearly rate of about 5.8% over that duration. The growth of the dividend has been pretty reliable, so we think this can offer investors some nice additional income in their portfolio.

Dividend Growth Potential Is Shaky

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Unfortunately things aren't as good as they seem. Over the past five years, it looks as though CDL Investments New Zealand's EPS has declined at around 17% a year. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future.

CDL Investments New Zealand's Dividend Doesn't Look Sustainable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. In the past the payments have been stable, but we think the company is paying out too much for this to continue for the long term. Overall, we don't think this company has the makings of a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. Just as an example, we've come across 2 warning signs for CDL Investments New Zealand you should be aware of, and 1 of them is concerning. Is CDL Investments New Zealand not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:CDI

CDL Investments New Zealand

Together with its subsidiary, CDL Land New Zealand Limited engages in the investment, development, management, and sale of residential land properties in New Zealand.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success