- New Zealand

- /

- Biotech

- /

- NZSE:PEB

Revenues Working Against Pacific Edge Limited's (NZSE:PEB) Share Price Following 26% Dive

The Pacific Edge Limited (NZSE:PEB) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. The recent drop has obliterated the annual return, with the share price now down 2.9% over that longer period.

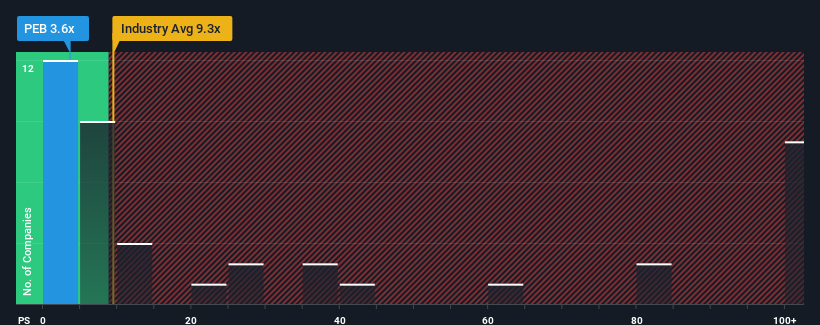

Since its price has dipped substantially, Pacific Edge may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 3.6x, considering almost half of all companies in the Biotechs industry in New Zealand have P/S ratios greater than 9.3x and even P/S higher than 56x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

We've discovered 3 warning signs about Pacific Edge. View them for free.See our latest analysis for Pacific Edge

What Does Pacific Edge's P/S Mean For Shareholders?

Pacific Edge hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Pacific Edge will help you uncover what's on the horizon.How Is Pacific Edge's Revenue Growth Trending?

In order to justify its P/S ratio, Pacific Edge would need to produce anemic growth that's substantially trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 11%. Still, the latest three year period has seen an excellent 96% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 23% during the coming year according to the dual analysts following the company. That's not great when the rest of the industry is expected to grow by 33%.

In light of this, it's understandable that Pacific Edge's P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Pacific Edge's P/S

Pacific Edge's P/S looks about as weak as its stock price lately. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Pacific Edge's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Pacific Edge (of which 1 is a bit unpleasant!) you should know about.

If you're unsure about the strength of Pacific Edge's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:PEB

Pacific Edge

A cancer diagnostics company, engages in development and commercialization of bladder cancer diagnostic and prognostic tests for patients.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives