- New Zealand

- /

- Pharma

- /

- NZSE:BLT

BLIS Technologies Limited (NZSE:BLT) Stock Has Shown Weakness Lately But Financials Look Strong: Should Prospective Shareholders Make The Leap?

BLIS Technologies (NZSE:BLT) has had a rough three months with its share price down 8.1%. But if you pay close attention, you might gather that its strong financials could mean that the stock could potentially see an increase in value in the long-term, given how markets usually reward companies with good financial health. Particularly, we will be paying attention to BLIS Technologies' ROE today.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Put another way, it reveals the company's success at turning shareholder investments into profits.

Check out our latest analysis for BLIS Technologies

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for BLIS Technologies is:

31% = NZ$1.9m ÷ NZ$6.1m (Based on the trailing twelve months to September 2020).

The 'return' is the yearly profit. So, this means that for every NZ$1 of its shareholder's investments, the company generates a profit of NZ$0.31.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

BLIS Technologies' Earnings Growth And 31% ROE

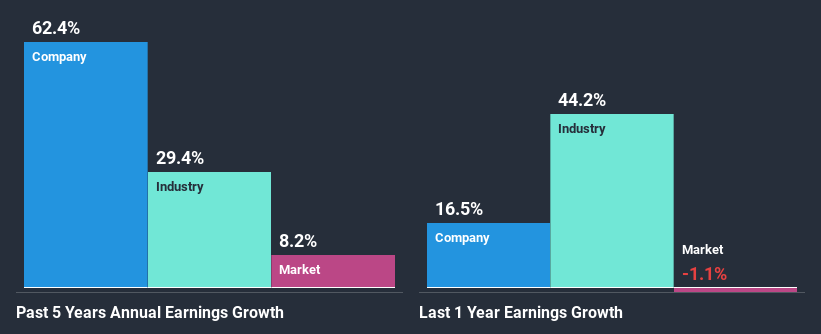

To begin with, BLIS Technologies has a pretty high ROE which is interesting. Secondly, even when compared to the industry average of 17% the company's ROE is quite impressive. So, the substantial 62% net income growth seen by BLIS Technologies over the past five years isn't overly surprising.

As a next step, we compared BLIS Technologies' net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 11%.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about BLIS Technologies''s valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is BLIS Technologies Making Efficient Use Of Its Profits?

Summary

In total, we are pretty happy with BLIS Technologies' performance. In particular, it's great to see that the company is investing heavily into its business and along with a high rate of return, that has resulted in a sizeable growth in its earnings. If the company continues to grow its earnings the way it has, that could have a positive impact on its share price given how earnings per share influence long-term share prices. Let's not forget, business risk is also one of the factors that affects the price of the stock. So this is also an important area that investors need to pay attention to before making a decision on any business. Our risks dashboard would have the 2 risks we have identified for BLIS Technologies.

When trading BLIS Technologies or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if BLIS Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NZSE:BLT

BLIS Technologies

Develops and sells healthcare products based on strains of bacteria that produce bacteriocin activity in New Zealand, Asia Pacific, Europe Middle East and Africa, and North America.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.