- New Zealand

- /

- Pharma

- /

- NZSE:AFT

Should You Be Adding AFT Pharmaceuticals (NZSE:AFT) To Your Watchlist Today?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in AFT Pharmaceuticals (NZSE:AFT). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for AFT Pharmaceuticals

AFT Pharmaceuticals's Improving Profits

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. You can imagine, then, that it almost knocked my socks off when I realized that AFT Pharmaceuticals grew its EPS from NZ$0.028 to NZ$0.10, in one short year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement.

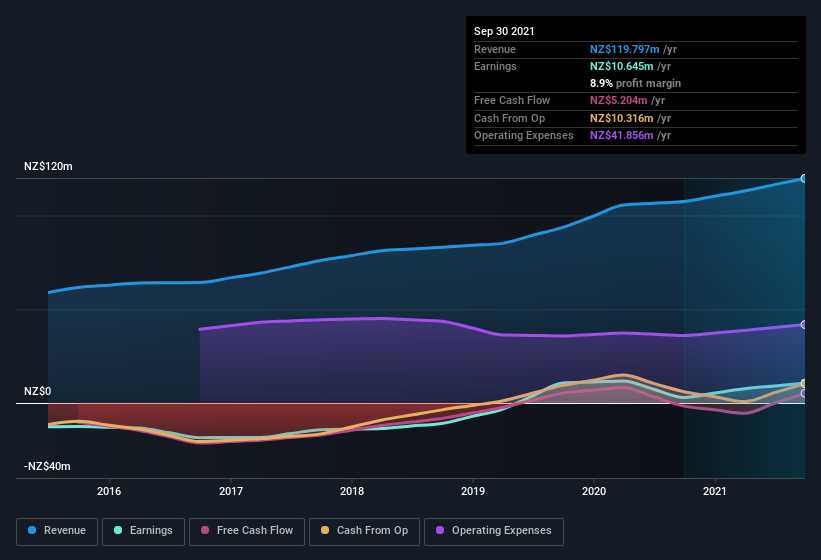

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note AFT Pharmaceuticals's EBIT margins were flat over the last year, revenue grew by a solid 11% to NZ$120m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for AFT Pharmaceuticals's future profits.

Are AFT Pharmaceuticals Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

AFT Pharmaceuticals top brass are certainly in sync, not having sold any shares, over the last year. But the bigger deal is that the Independent Director, Jon Lamb, paid NZ$237k to buy shares at an average price of NZ$4.26.

On top of the insider buying, we can also see that AFT Pharmaceuticals insiders own a large chunk of the company. In fact, they own 71% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. In terms of absolute value, insiders have NZ$270m invested in the business, using the current share price. That should be more than enough to keep them focussed on creating shareholder value!

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. The cherry on top is that the CEO, Hartley Atkinson is paid comparatively modestly to CEOs at similar sized companies. I discovered that the median total compensation for the CEOs of companies like AFT Pharmaceuticals with market caps between NZ$157m and NZ$627m is about NZ$1.1m.

AFT Pharmaceuticals offered total compensation worth NZ$701k to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add AFT Pharmaceuticals To Your Watchlist?

AFT Pharmaceuticals's earnings per share have taken off like a rocket aimed right at the moon. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest AFT Pharmaceuticals belongs on the top of your watchlist. You still need to take note of risks, for example - AFT Pharmaceuticals has 1 warning sign we think you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of AFT Pharmaceuticals, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:AFT

AFT Pharmaceuticals

Engages in the development and sale of pharmaceutical products in New Zealand, Australia, Asia, and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives