- New Zealand

- /

- Media

- /

- NZSE:SKT

SKY Network Television's (NZSE:SKT) Shareholders Are Down 96% On Their Shares

We're definitely into long term investing, but some companies are simply bad investments over any time frame. We don't wish catastrophic capital loss on anyone. Anyone who held SKY Network Television Limited (NZSE:SKT) for five years would be nursing their metaphorical wounds since the share price dropped 96% in that time. And we doubt long term believers are the only worried holders, since the stock price has declined 78% over the last twelve months. There was little comfort for shareholders in the last week as the price declined a further 4.2%.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

View our latest analysis for SKY Network Television

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

SKY Network Television has made a profit in the past. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. Other metrics may better explain the share price move.

It could be that the revenue decline of 4.7% per year is viewed as evidence that SKY Network Television is shrinking. That could explain the weak share price.

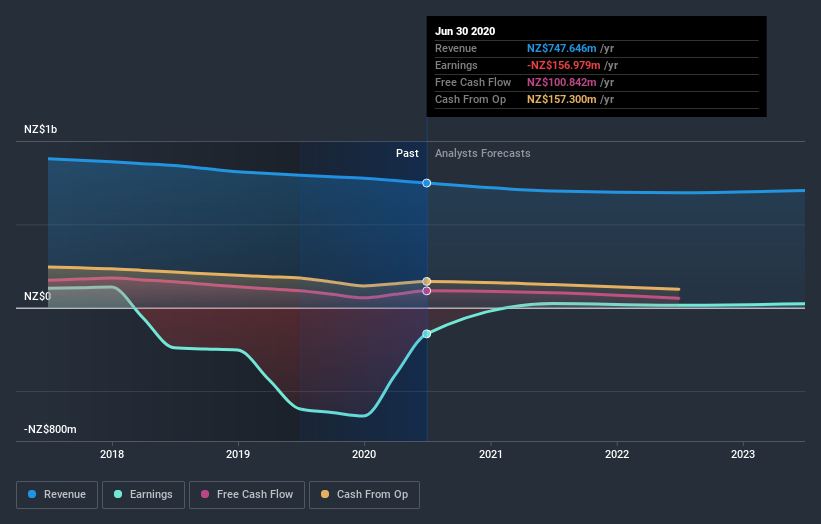

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. You can see what analysts are predicting for SKY Network Television in this interactive graph of future profit estimates.

What about the Total Shareholder Return (TSR)?

We've already covered SKY Network Television's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for SKY Network Television shareholders, and that cash payout explains why its total shareholder loss of 84%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

Investors in SKY Network Television had a tough year, with a total loss of 26%, against a market gain of about 11%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 13% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It's always interesting to track share price performance over the longer term. But to understand SKY Network Television better, we need to consider many other factors. Even so, be aware that SKY Network Television is showing 1 warning sign in our investment analysis , you should know about...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NZ exchanges.

If you’re looking to trade SKY Network Television, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NZSE:SKT

SKY Network Television

An entertainment company, provides sport and entertainment media services, and telecommunications services in New Zealand and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives