- New Zealand

- /

- Diversified Financial

- /

- NZSE:GEN

General Capital And 2 Other Penny Stocks Worth Watching

Reviewed by Simply Wall St

Global markets have shown resilience with U.S. indexes approaching record highs, buoyed by a strong labor market and positive sentiment from recent home sales reports. In this context, investors are increasingly exploring opportunities beyond the well-known giants, turning their attention to penny stocks—companies that may be smaller or newer but can offer unique investment potential. While the term "penny stocks" might seem outdated, these companies continue to present intriguing prospects for those looking to uncover value in lesser-known areas of the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.49 | MYR2.44B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$144.95M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$552.27M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.215 | £834.53M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.33 | £169.38M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.18 | £415.73M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.37M | ★★★★☆☆ |

| United U-LI Corporation Berhad (KLSE:ULICORP) | MYR1.52 | MYR331.06M | ★★★★★★ |

Click here to see the full list of 5,774 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

General Capital (NZSE:GEN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: General Capital Limited, with a market cap of NZ$29.09 million, operates in New Zealand offering financial services through its subsidiaries.

Operations: General Capital Limited has not reported any specific revenue segments.

Market Cap: NZ$29.09M

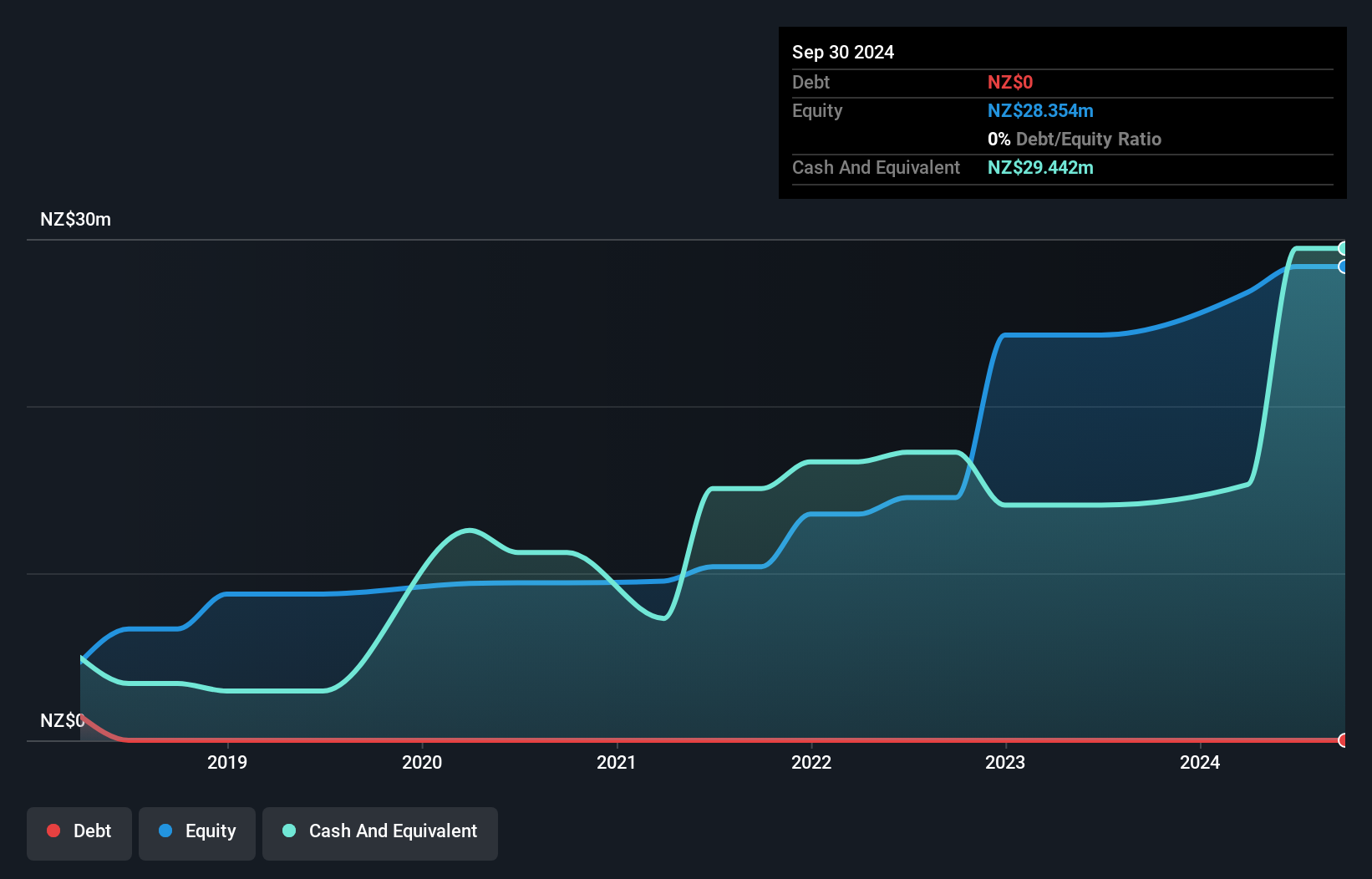

General Capital Limited, with a market cap of NZ$29.09 million, has shown robust financial health characterized by its debt-free status and positive earnings growth. The company reported net income of NZ$1.57 million for the half year ended September 30, 2024, up from NZ$1.2 million the previous year. Despite high volatility in its share price recently, General Capital's profit margins have improved to 30.1%, and it trades below estimated fair value by 30.9%. However, its board is relatively inexperienced with an average tenure of 2.2 years, which could impact strategic decisions moving forward.

- Take a closer look at General Capital's potential here in our financial health report.

- Gain insights into General Capital's past trends and performance with our report on the company's historical track record.

NZME (NZSE:NZM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NZME Limited operates in the integrated media and entertainment sector in New Zealand, with a market capitalization of NZ$196.01 million.

Operations: The company generates revenue from its business segments, including Audio (NZ$115.19 million), Oneroof (NZ$25.32 million), and Publishing (NZ$202.89 million).

Market Cap: NZ$196.01M

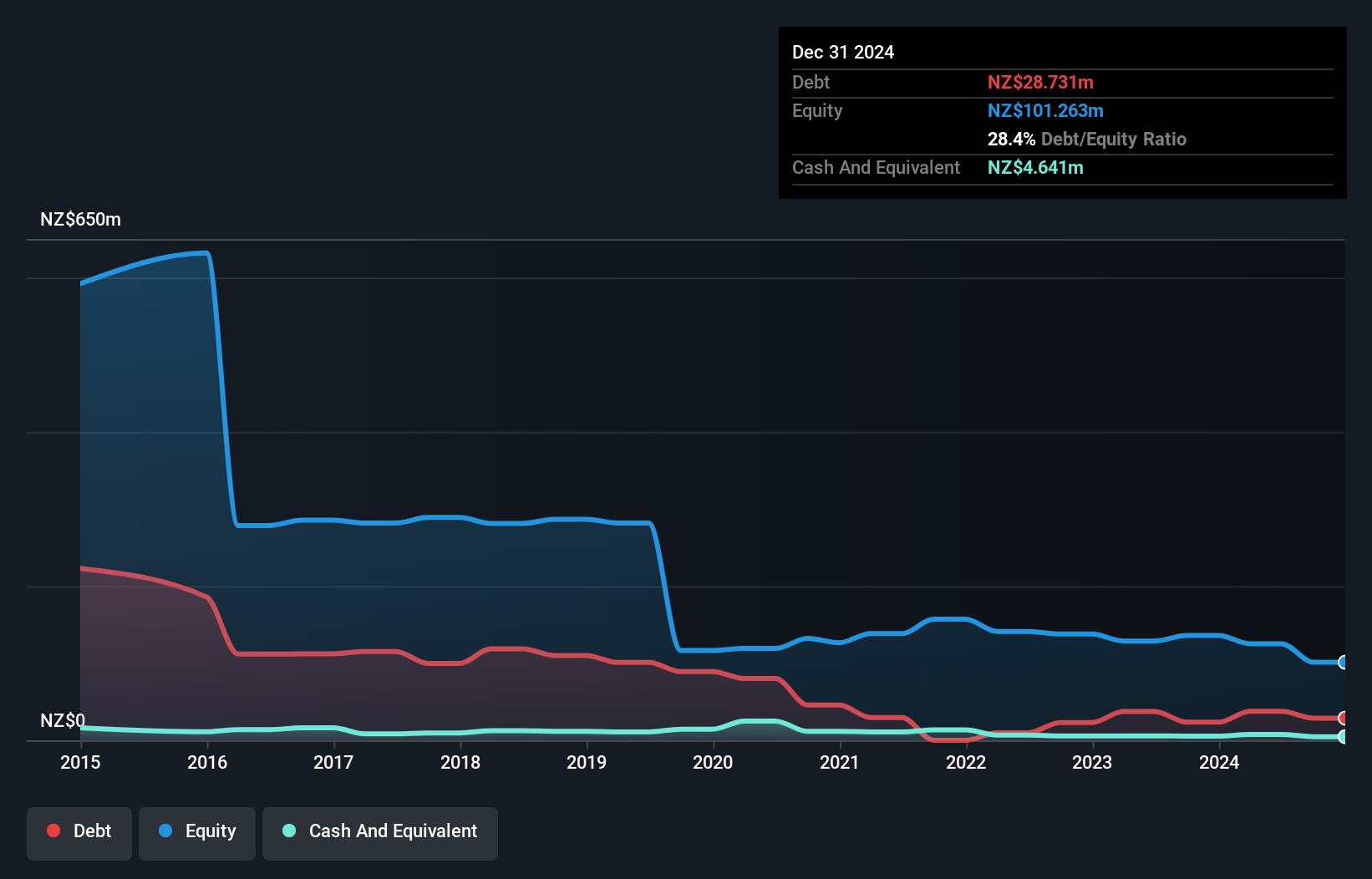

NZME Limited, with a market cap of NZ$196.01 million, operates in the media sector and has shown profitability growth over the past five years. Despite this progress, its recent negative earnings growth and lower net profit margins indicate challenges. The company's debt management is prudent, with a satisfactory net debt to equity ratio of 23.9% and interest payments well covered by EBIT at 3.5 times coverage. However, significant insider selling in the last quarter could raise concerns about confidence in future prospects. Trading significantly below fair value may present an opportunity for investors seeking undervalued stocks within this segment.

- Dive into the specifics of NZME here with our thorough balance sheet health report.

- Explore NZME's analyst forecasts in our growth report.

Triton Holding (SET:TRITN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Triton Holding Public Company Limited is an investment holding company involved in the construction and engineering sector in Thailand, with a market capitalization of THB1.45 billion.

Operations: The company generates revenue from its Constructions Business, contributing THB375.42 million, and its Electricity and Energy Business, which brings in THB73.58 million.

Market Cap: THB1.45B

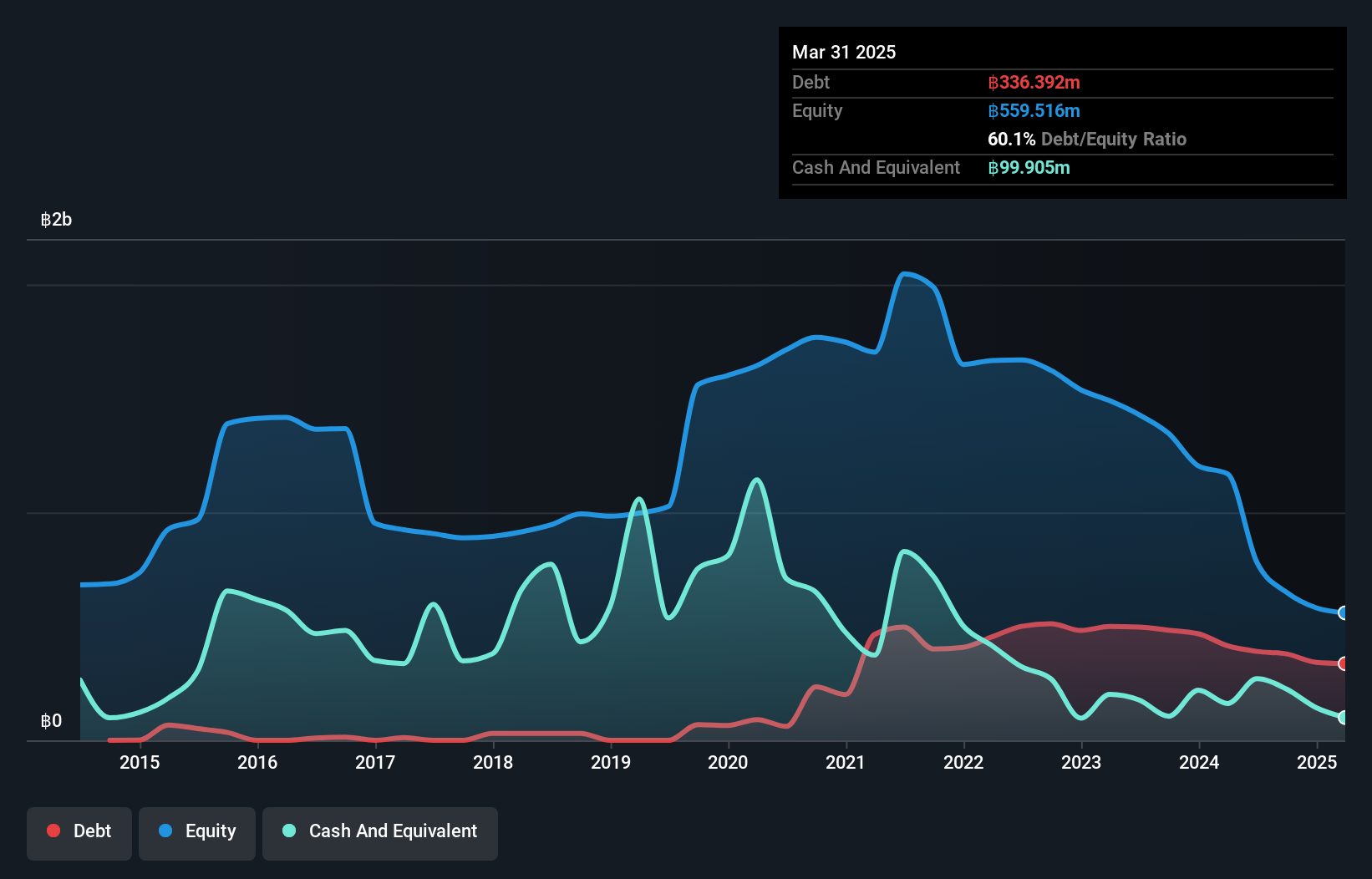

Triton Holding, with a market cap of THB1.45 billion, faces financial challenges as its debt to equity ratio has increased significantly over five years. Despite having sufficient cash runway for over three years if free cash flow continues to reduce at historical rates, the company remains unprofitable with losses growing annually by 55%. Recent earnings reports show declining revenues and increasing net losses compared to the previous year. The announcement of a substantial private placement aims to raise up to THB1.4 billion, potentially stabilizing finances but also indicating reliance on external funding amidst ongoing operational struggles.

- Click here and access our complete financial health analysis report to understand the dynamics of Triton Holding.

- Understand Triton Holding's track record by examining our performance history report.

Where To Now?

- Click this link to deep-dive into the 5,774 companies within our Penny Stocks screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:GEN

Flawless balance sheet and good value.

Market Insights

Community Narratives