- New Zealand

- /

- Paper and Forestry Products

- /

- NZSE:ARB

We Think Rubicon (NZSE:RBC) In Taking Some Risk With Its Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies. Rubicon Limited (NZSE:RBC) makes use of debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Rubicon

How Much Debt Does Rubicon Carry?

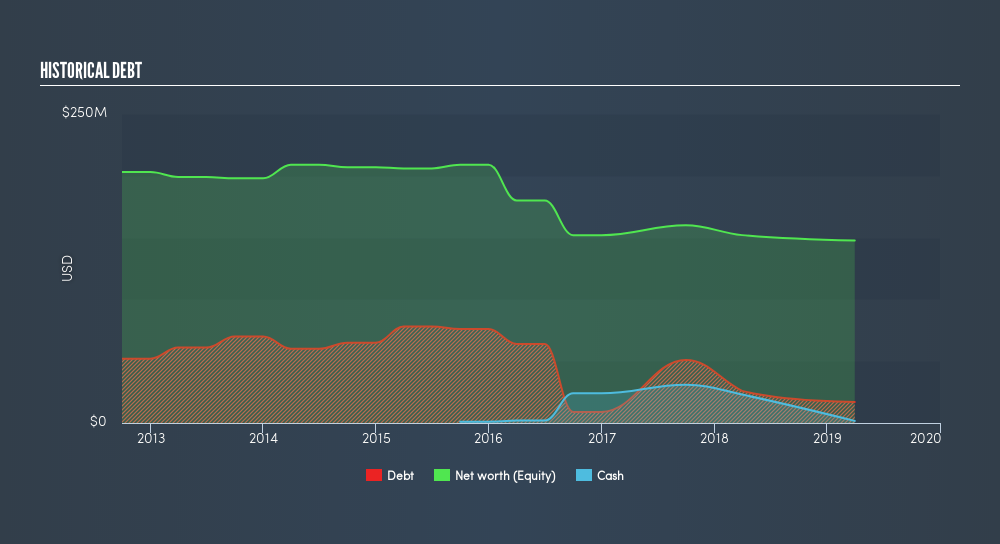

As you can see below, Rubicon had US$29.0m of debt at March 2019, down from US$39.0m a year prior. On the flip side, it has US$1.70m in cash leading to net debt of about US$27.3m.

How Strong Is Rubicon's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Rubicon had liabilities of US$15.8m due within 12 months and liabilities of US$30.6m due beyond that. Offsetting these obligations, it had cash of US$1.70m as well as receivables valued at US$7.90m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$36.8m.

While this might seem like a lot, it is not so bad since Rubicon has a market capitalization of US$62.2m, and so it could probably strengthen its balance sheet by raising capital if it needed to. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk. Either way, since Rubicon does have more debt than cash, it's worth keeping an eye on its balance sheet.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While we wouldn't blink an eye at Rubicon's net debt to EBITDA ratio of 2.79, we think its super-low interest cover of 0.50 times is a bad sign. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. Even worse, Rubicon saw its EBIT tank 82% over the last 12 months. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Rubicon can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the most recent three years, Rubicon recorded free cash flow worth 56% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

To be frank both Rubicon's interest cover and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Overall, we think it's fair to say that Rubicon has enough debt that there are some real risks around the balance sheet. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. While Rubicon didn't make a statutory profit in the last year, its positive EBIT suggests that profitability might not be far away.Click here to see if its earnings are heading in the right direction, over the medium term.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NZSE:ARB

Adequate balance sheet low.

Market Insights

Community Narratives