Fletcher Building Limited (NZSE:FBU) shareholders should be happy to see the share price up 15% in the last month. But that doesn't change the fact that the returns over the last three years have been less than pleasing. Truth be told the share price declined 52% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

See our latest analysis for Fletcher Building

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Fletcher Building moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. So it's worth looking at other metrics to try to understand the share price move.

We note that the dividend has declined - a likely contributor to the share price drop. In contrast it does not seem particularly likely that the revenue levels are a concern for investors.

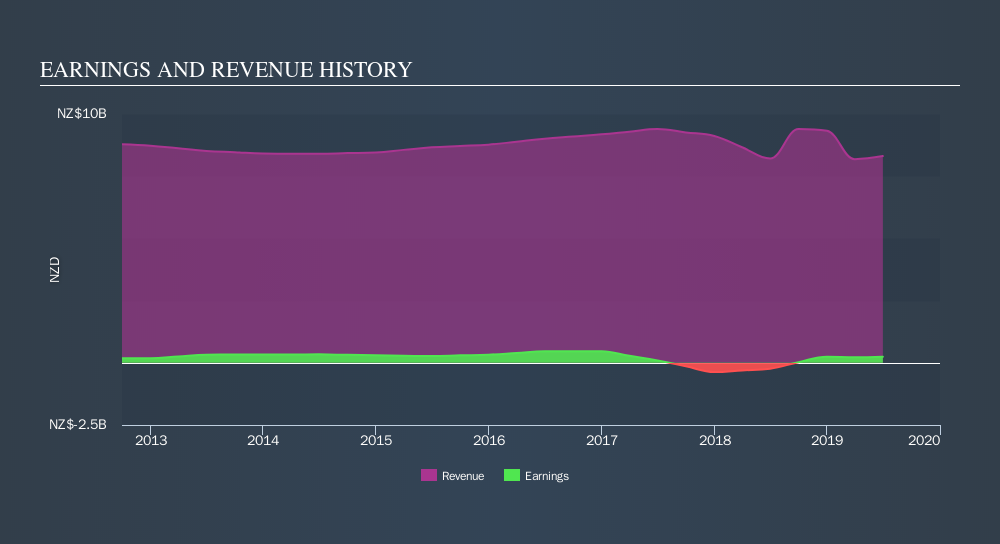

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Fletcher Building is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Fletcher Building in this interactive graph of future profit estimates.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Fletcher Building, it has a TSR of -44% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Investors in Fletcher Building had a tough year, with a total loss of 17% (including dividends) , against a market gain of about 15%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5.5% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Before forming an opinion on Fletcher Building you might want to consider the cold hard cash it pays as a dividend. This free chart tracks its dividend over time.

Of course Fletcher Building may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NZ exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NZSE:FBU

Fletcher Building

Manufactures and distributes building products in New Zealand, Australia, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives