- Hong Kong

- /

- Industrials

- /

- SEHK:363

Undiscovered Gems And 2 Other Small Caps With Strong Potential

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have faced a challenging environment with key indices such as the S&P 600 experiencing fluctuations amid broader economic uncertainties and geopolitical tensions. Despite these hurdles, opportunities remain for discerning investors to identify promising small-cap companies that can thrive in this volatile climate. A good stock in today's market is one that demonstrates resilience through strong fundamentals and adaptability to changing conditions, making it well-positioned to capitalize on emerging trends. In this article, we explore three undiscovered gems within the small-cap sector that exhibit strong potential for growth.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zhejiang Haisen Pharmaceutical | NA | 7.88% | 10.55% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Gem-Year IndustrialLtd | 1.70% | -3.85% | -33.56% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Xuchang Yuandong Drive ShaftLtd | 0.38% | -11.74% | -29.32% | ★★★★★★ |

| IFE Elevators | NA | 12.67% | 17.10% | ★★★★★★ |

| Shenzhen Jdd Tech New Material | NA | 19.07% | 20.23% | ★★★★★★ |

| Nanjing Well Pharmaceutical GroupLtd | 25.29% | 10.45% | 0.43% | ★★★★★☆ |

| Shanghai Feilo AcousticsLtd | 35.63% | -20.15% | 40.51% | ★★★★☆☆ |

| Yuan Cheng CableLtd | 112.32% | 6.17% | 58.39% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

NRJ Group (ENXTPA:NRG)

Simply Wall St Value Rating: ★★★★★★

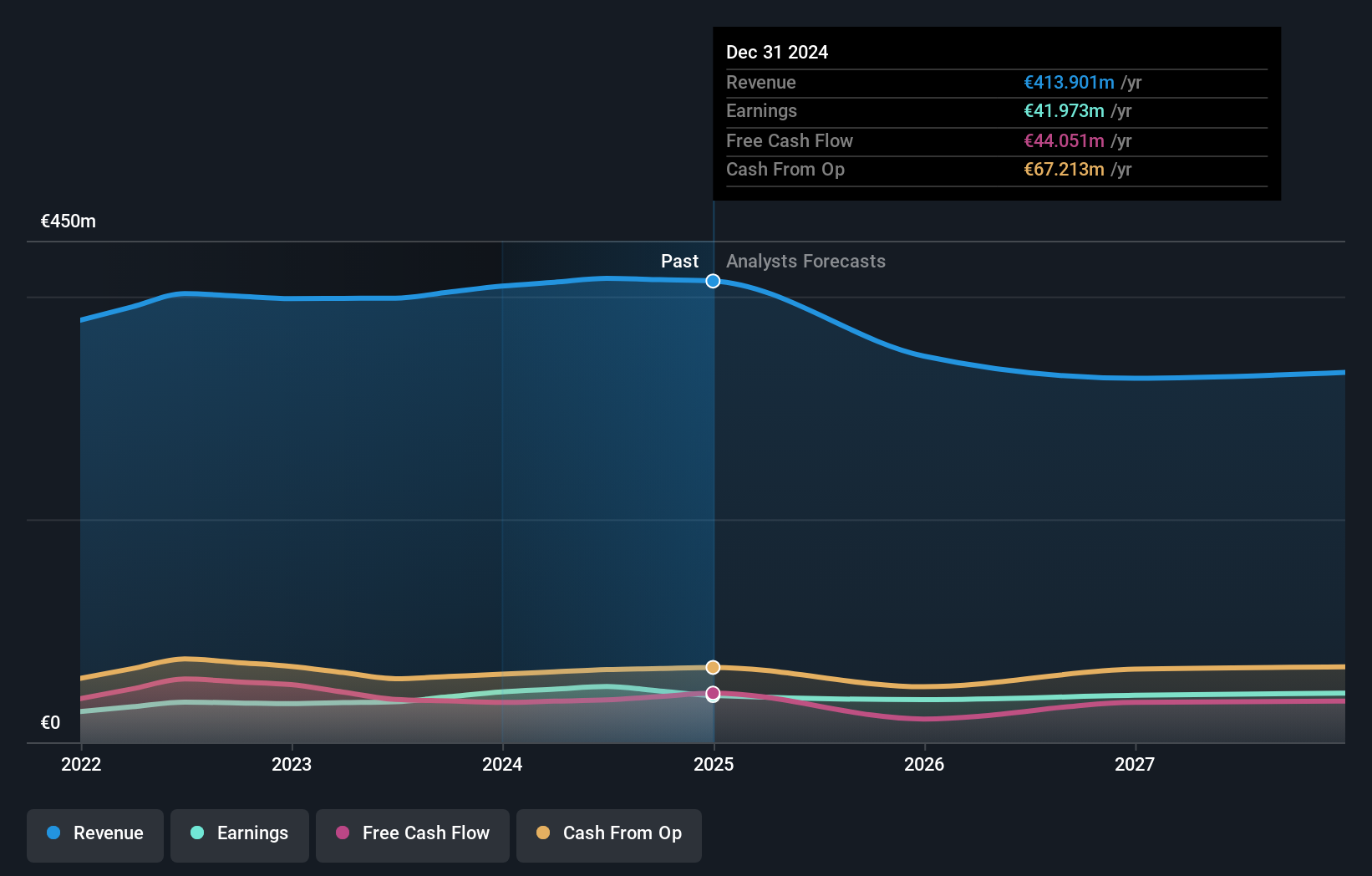

Overview: NRJ Group SA is a private media company that operates as a publisher, producer, and broadcaster in France and internationally with a market capitalization of approximately €534.05 million.

Operations: NRJ Group generates revenue primarily from its Radio segment (€243.01 million), followed by Television (€78.63 million) and Circulation (€77.62 million).

NRJ Group, a nimble player in the media industry, has demonstrated impressive financial health with its debt to equity ratio dropping from 3.1% to 0% over five years. Profits surged by 37%, outpacing the industry average of 31%. The firm trades at a notable discount of about 40% below estimated fair value, suggesting potential undervaluation. With more cash than total debt and robust free cash flow, NRJ's financial position seems solid. Its ability to cover interest payments comfortably further underscores its stability in an evolving market landscape, positioning it as a compelling prospect for discerning investors.

- Delve into the full analysis health report here for a deeper understanding of NRJ Group.

Gain insights into NRJ Group's past trends and performance with our Past report.

Tower (NZSE:TWR)

Simply Wall St Value Rating: ★★★★★☆

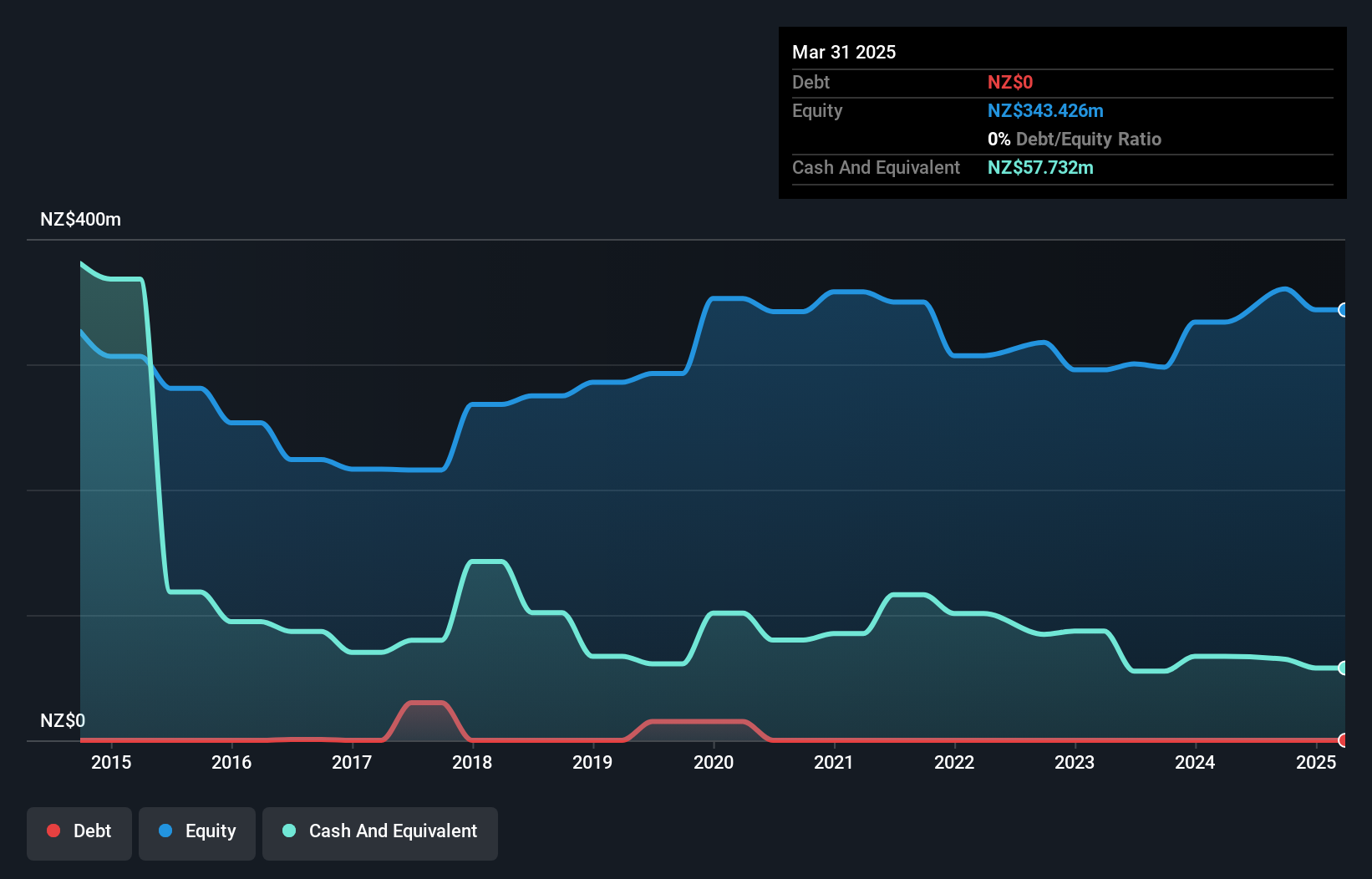

Overview: Tower Limited offers general insurance products in New Zealand and the Pacific Islands, with a market capitalization of NZ$493.33 million.

Operations: Tower Limited generates revenue primarily from its New Zealand operations, contributing NZ$535.53 million, while the Pacific Islands add NZ$43.33 million.

Tower, a small player in the insurance sector, has shown remarkable financial resilience and growth. The company is debt-free, a significant improvement from five years ago when its debt-to-equity ratio was 5.1%. Its earnings skyrocketed by 2640% last year, far outpacing the industry average of 35.7%. With a price-to-earnings ratio of 7.3x, Tower offers good value compared to the New Zealand market's average of 19.9x. Recent executive changes see Paul Johnston stepping in as interim CEO following Blair Turnbull’s resignation, bringing strategic and operational expertise during this transition period.

- Click to explore a detailed breakdown of our findings in Tower's health report.

Understand Tower's track record by examining our Past report.

Shanghai Industrial Holdings (SEHK:363)

Simply Wall St Value Rating: ★★★★☆☆

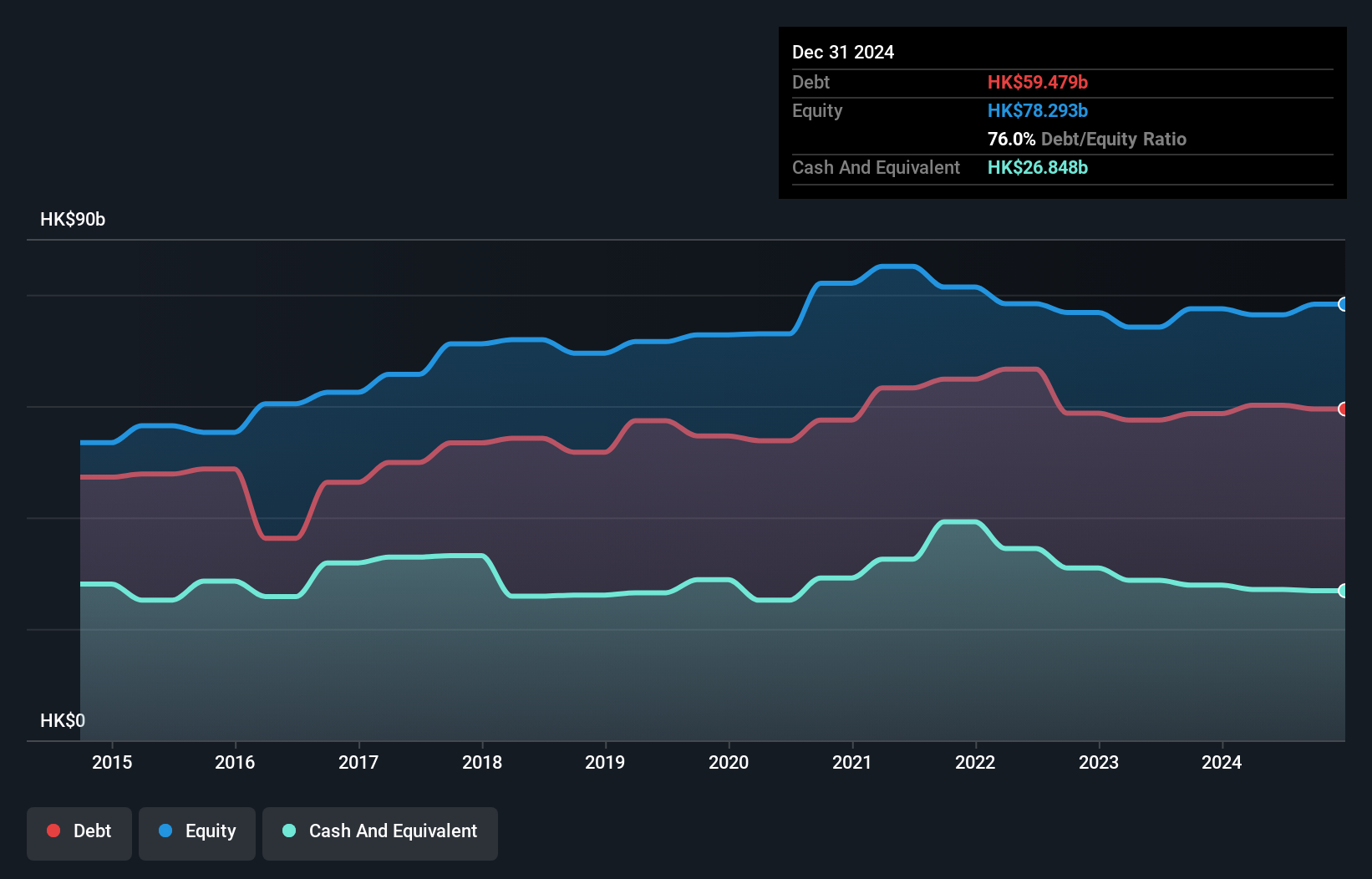

Overview: Shanghai Industrial Holdings Limited is an investment holding company involved in infrastructure and environmental protection, real estate, consumer products, and comprehensive healthcare across Hong Kong, China, the rest of Asia, and internationally with a market cap of approximately HK$12.39 billion.

Operations: The company's primary revenue streams include real estate (HK$17.26 billion), infrastructure and environmental protection (HK$9.42 billion), and consumer products (HK$3.59 billion). The real estate segment is the largest contributor to revenue, followed by infrastructure and environmental protection.

Shanghai Industrial Holdings, a player in the industrial sector, shows promise with its earnings growth of 25.6% over the past year, outpacing the industry average of 4.5%. Despite a high net debt to equity ratio at 43.3%, interest payments are well covered by EBIT at 6.3 times coverage, indicating solid financial management. The company’s price-to-earnings ratio stands attractively low at 3.8x compared to Hong Kong's market average of 10x, highlighting potential undervaluation in this space. While not free cash flow positive currently, its profitability and quality earnings suggest resilience and potential for future value realization.

Next Steps

- Navigate through the entire inventory of 4678 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:363

Shanghai Industrial Holdings

An investment holding company, engages in the infrastructure and environmental protection, real estate, consumer products, and comprehensive healthcare operations businesses.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives