- New Zealand

- /

- Insurance

- /

- NZSE:TWR

Top Three Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate a mixed economic landscape, with U.S. consumer confidence dipping and European stocks showing moderate gains, investors are seeking stability amid fluctuating indices. In such an environment, dividend stocks can provide a reliable income stream and potential for long-term growth, making them an attractive consideration for those looking to balance risk and reward in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.05% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.85% | ★★★★★★ |

Click here to see the full list of 1942 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

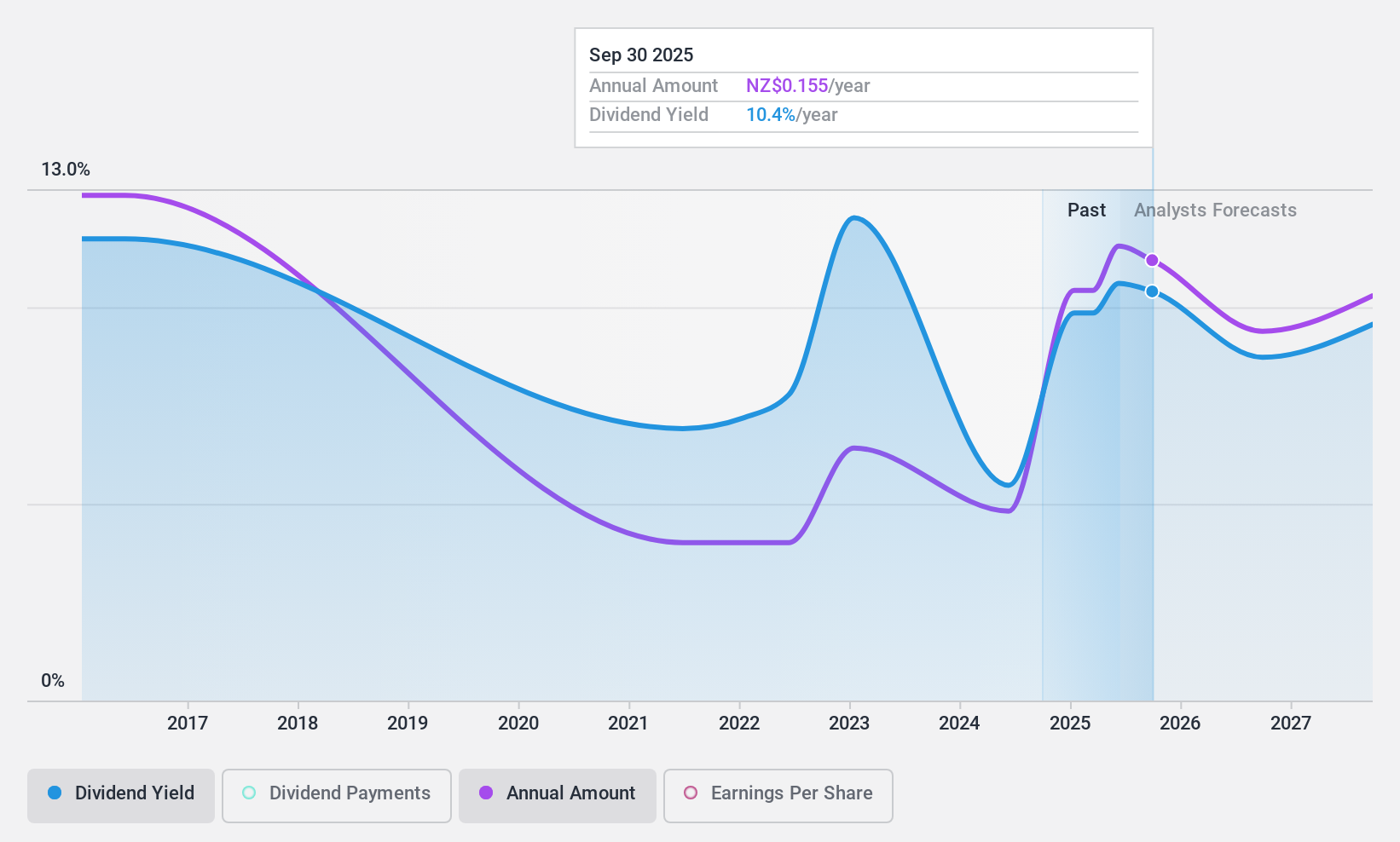

Tower (NZSE:TWR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tower Limited offers general insurance products in New Zealand and the Pacific Islands, with a market cap of NZ$512.30 million.

Operations: Tower Limited's revenue is derived from its operations in New Zealand, contributing NZ$535.53 million, and the Pacific Islands, adding NZ$43.33 million.

Dividend Yield: 9.6%

Tower Limited has shown a significant turnaround in earnings, reporting a net income of NZ$74.29 million for 2024, up from a loss last year. The company's dividend payments are well covered by both earnings and cash flows, with payout ratios of 50.9% and 39.3%, respectively. Despite past volatility in its dividends, the current yield is among the top in New Zealand's market at 9.63%. Tower's inclusion in the S&P/NZX 50 Index further highlights its growing prominence.

- Get an in-depth perspective on Tower's performance by reading our dividend report here.

- Our valuation report here indicates Tower may be overvalued.

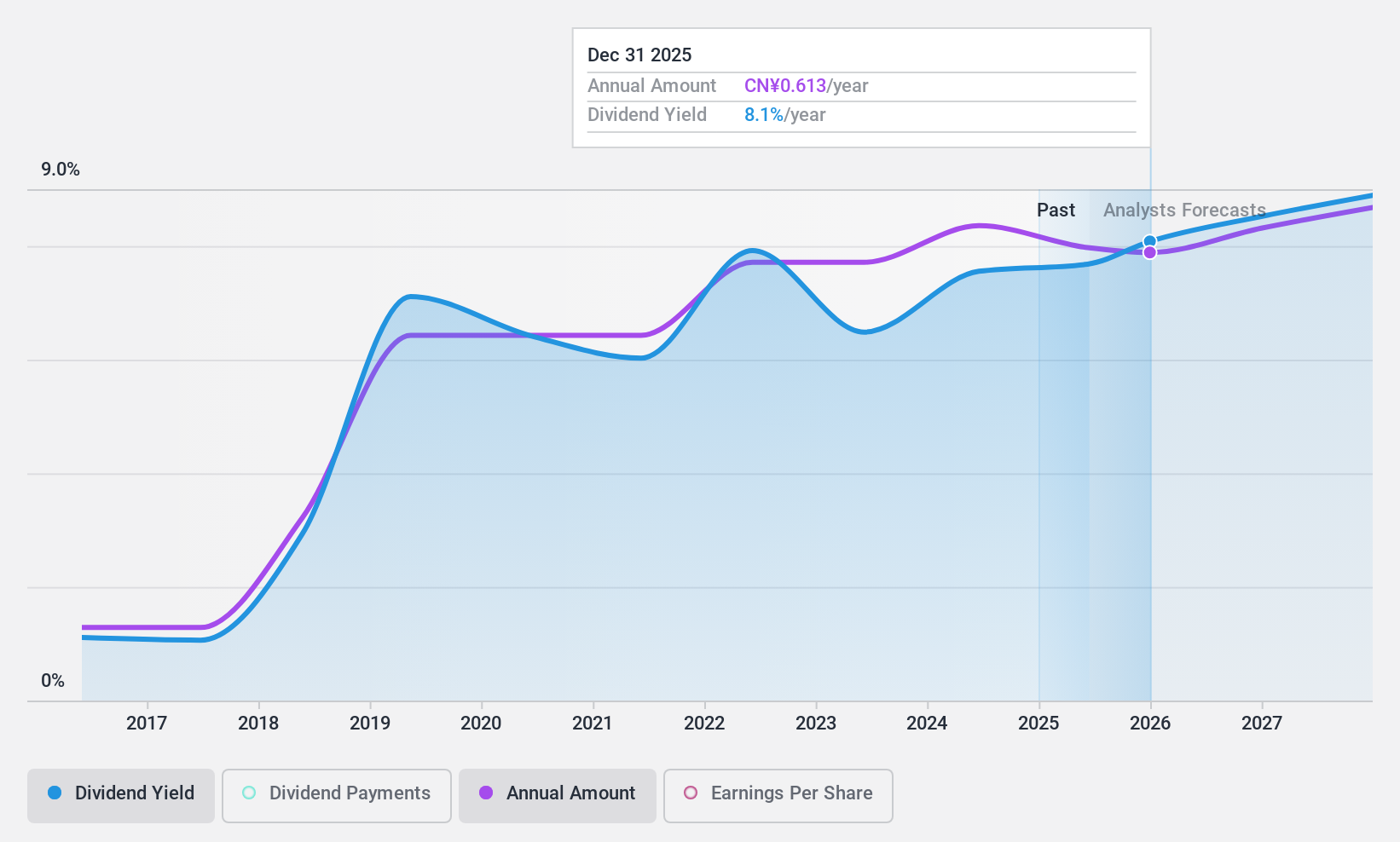

Shenzhen Fuanna Bedding and FurnishingLtd (SZSE:002327)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shenzhen Fuanna Bedding and Furnishing Co., Ltd specializes in the R&D, design, production, and sales of textile home furnishings and living products both in China and internationally, with a market cap of CN¥7.39 billion.

Operations: Shenzhen Fuanna Bedding and Furnishing Co., Ltd generates revenue through its activities in the research and development, design, production, and sales of textile home furnishing and living products within China and on an international scale.

Dividend Yield: 7.4%

Shenzhen Fuanna Bedding and Furnishing Ltd offers a high dividend yield of 7.35%, placing it among the top dividend payers in China. However, this yield is not well supported by earnings or cash flows, with payout ratios exceeding 100%. Despite stable and growing dividends over the past decade, recent financials show a decline in net income to CNY 293.19 million for the first nine months of 2024. The stock trades below estimated fair value, suggesting potential undervaluation relative to peers.

- Dive into the specifics of Shenzhen Fuanna Bedding and FurnishingLtd here with our thorough dividend report.

- Upon reviewing our latest valuation report, Shenzhen Fuanna Bedding and FurnishingLtd's share price might be too pessimistic.

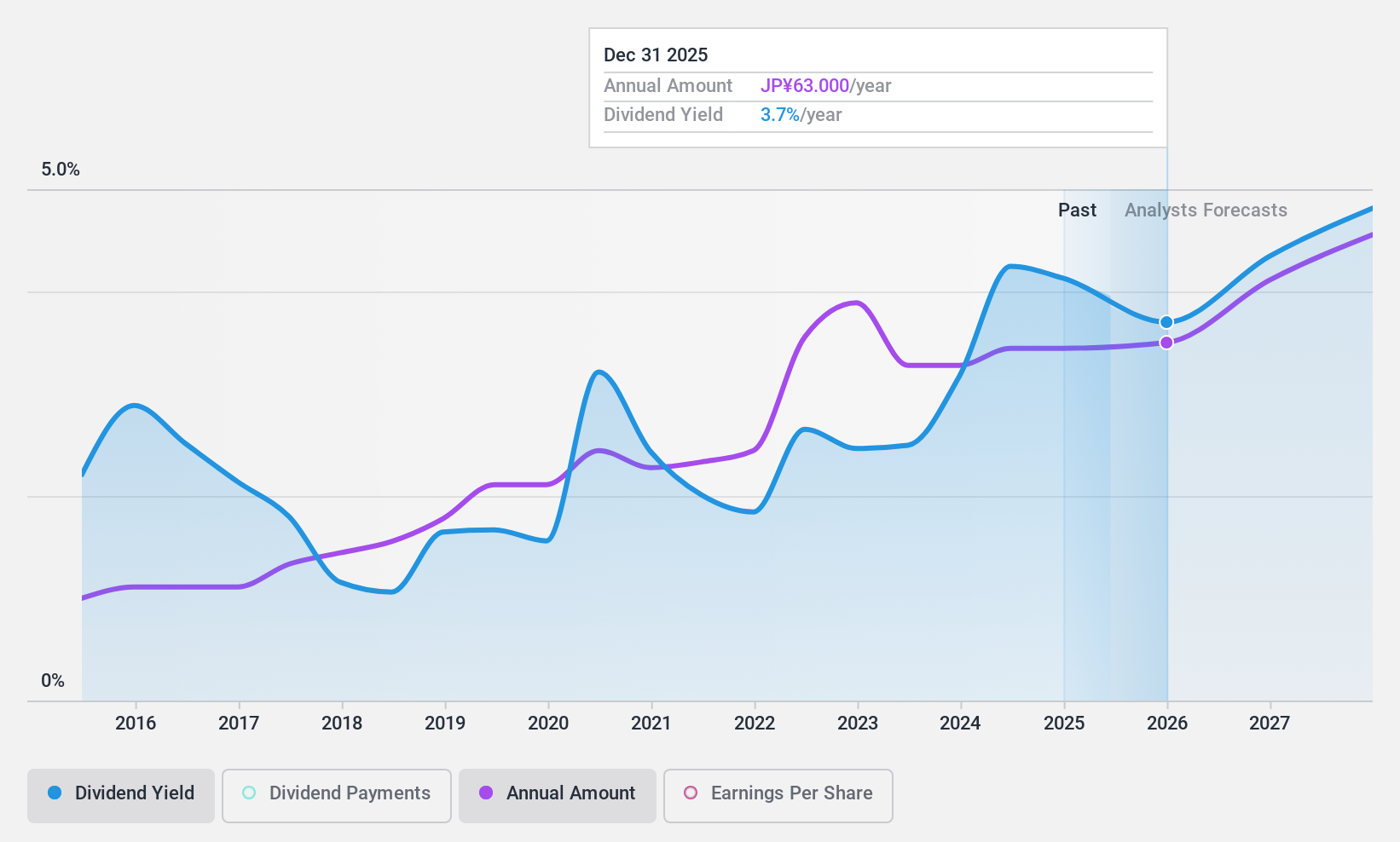

Fullcast Holdings (TSE:4848)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fullcast Holdings Co., Ltd. and its subsidiaries offer human resource solutions in Japan, with a market capitalization of ¥52.22 billion.

Operations: Fullcast Holdings Co., Ltd. generates revenue through its Short-Term Operational Support Business (¥56.07 billion), Food and Beverage Business (¥7.39 billion), Sales Support Business (¥3.31 billion), and Security, Other Businesses (¥2.39 billion).

Dividend Yield: 4.2%

Fullcast Holdings offers a competitive dividend yield of 4.18%, ranking in the top 25% of Japanese dividend payers, supported by a low cash payout ratio of 29.7%. Despite this, its dividends have been historically volatile and unreliable over the past decade. Recent leadership changes could influence future stability, with Takehito Hirano assuming the CEO role. The stock trades at a significant discount to its estimated fair value, suggesting potential undervaluation compared to peers.

- Delve into the full analysis dividend report here for a deeper understanding of Fullcast Holdings.

- Our valuation report unveils the possibility Fullcast Holdings' shares may be trading at a discount.

Where To Now?

- Click here to access our complete index of 1942 Top Dividend Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tower might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:TWR

Tower

Provides general insurance products in New Zealand and the Pacific Islands.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives