- Italy

- /

- Diversified Financial

- /

- BIT:ILTY

3 Reliable Dividend Stocks With Up To 9.6% Yield

Reviewed by Simply Wall St

As global markets reach record highs, driven by strong performances in major indices like the Dow Jones and S&P 500, investors are navigating a landscape influenced by domestic policies and geopolitical developments. Amidst this backdrop, dividend stocks stand out as attractive options for those seeking steady income streams; they offer potential stability and yield benefits even when market conditions fluctuate.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.28% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.18% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.89% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.23% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.62% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.87% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.43% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.92% | ★★★★★★ |

Click here to see the full list of 1966 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

illimity Bank (BIT:ILTY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: illimity Bank S.p.A. operates in Italy, offering private banking and investment and trading services, with a market cap of €248.87 million.

Operations: illimity Bank S.p.A.'s revenue segments include €15.60 million from B-Ilty, €82.60 million from Corporate Banking, €15.70 million from Investment Banking, and €62.20 million from Specialised Credit in Italy.

Dividend Yield: 8.3%

illimity Bank offers a compelling dividend yield of 8.3%, ranking in the top 25% in Italy, with dividends well-covered by a low payout ratio of 34.5%. However, its high bad loans ratio of 13.9% and declining profit margins could pose risks. Despite trading at a significant discount to estimated fair value, recent earnings show net income declines, which may impact future dividend sustainability despite current coverage forecasts remaining favorable.

- Delve into the full analysis dividend report here for a deeper understanding of illimity Bank.

- Insights from our recent valuation report point to the potential undervaluation of illimity Bank shares in the market.

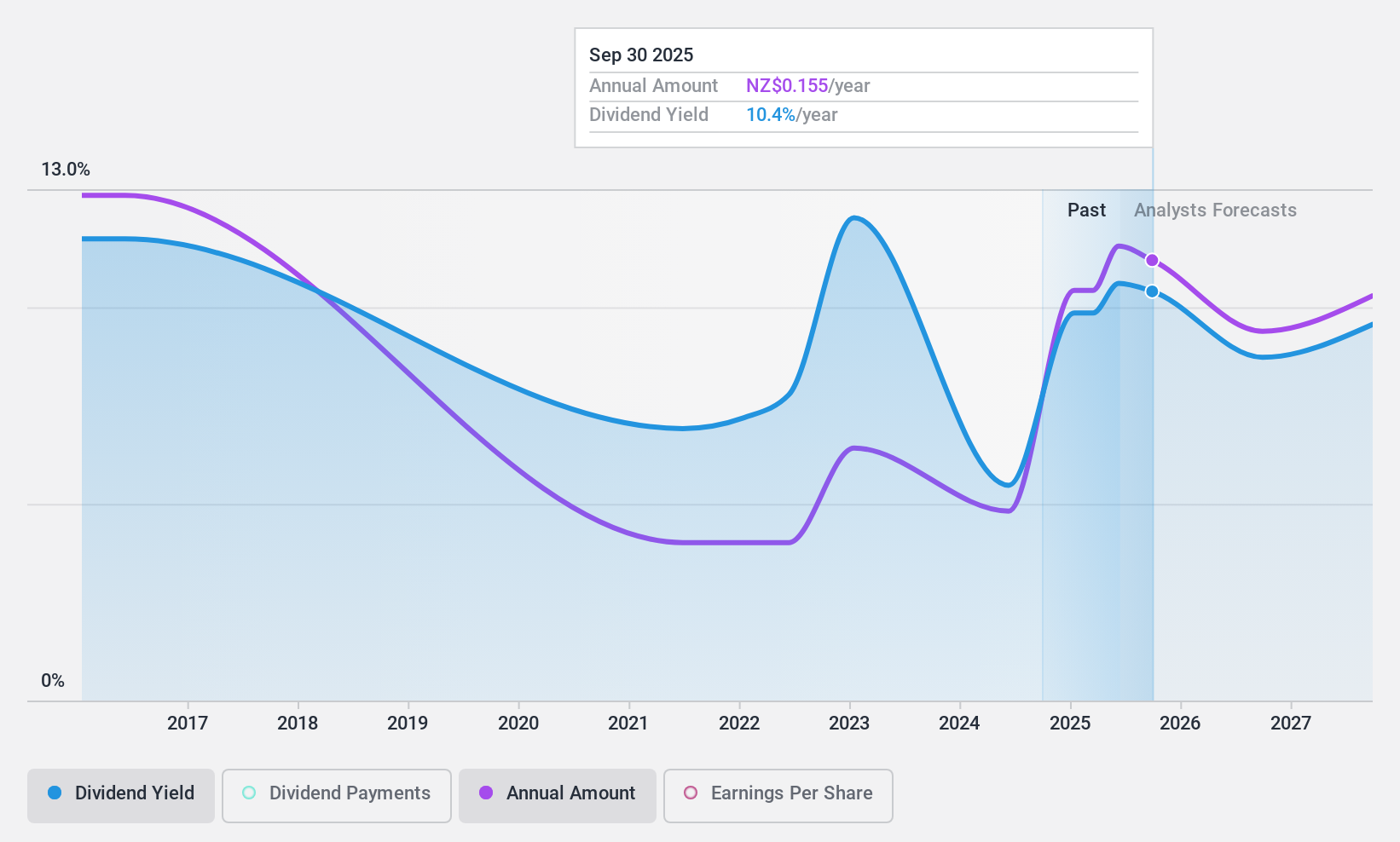

Tower (NZSE:TWR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tower Limited offers general insurance products in New Zealand and the Pacific Islands, with a market capitalization of NZ$512.30 million.

Operations: Tower Limited's revenue is derived from its operations in New Zealand, contributing NZ$535.53 million, and the Pacific Islands, adding NZ$43.33 million.

Dividend Yield: 9.6%

Tower Limited's dividend yield of 9.63% ranks in the top 25% of New Zealand payers, supported by a sustainable payout ratio of 50.9%. However, its dividends have been volatile over the past decade despite recent growth. Earnings surged to NZ$74.29 million from a loss last year, affirming dividend coverage with cash flows at a low 39.3% ratio. The company announced total dividends for fiscal year 2024 at 9.5 cents per share, payable January 2025.

- Unlock comprehensive insights into our analysis of Tower stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Tower is priced higher than what may be justified by its financials.

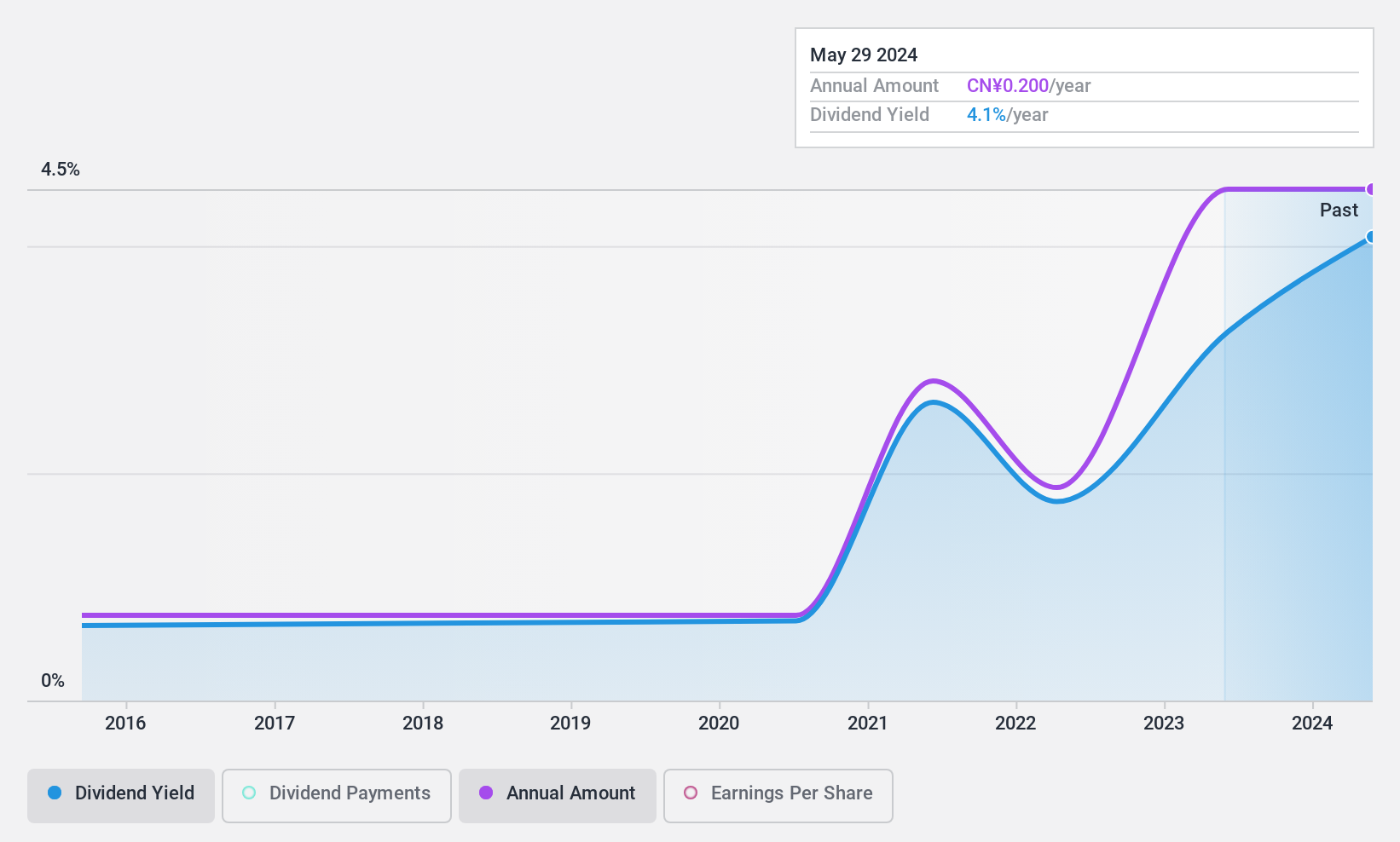

Guizhou TyreLtd (SZSE:000589)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Guizhou Tyre Co., Ltd. is involved in the research, development, production, and sale of tires in China with a market cap of CN¥7.75 billion.

Operations: The company's revenue primarily comes from the manufacture and sale of various tires, totaling CN¥10.41 billion.

Dividend Yield: 4%

Guizhou Tyre Ltd. offers a 4% dividend yield, placing it among the top 25% in China, yet its dividends have been volatile and not fully covered by free cash flows. Despite a low payout ratio of 33.8%, earnings coverage is insufficient due to recent profit declines—net income dropped to CNY 560.49 million from CNY 628.05 million year-over-year. The company trades at a favorable P/E ratio of 10.1x compared to the market average of 36.3x, enhancing its relative value appeal amidst ongoing share buybacks totaling CNY 32.99 million.

- Get an in-depth perspective on Guizhou TyreLtd's performance by reading our dividend report here.

- Our expertly prepared valuation report Guizhou TyreLtd implies its share price may be lower than expected.

Next Steps

- Dive into all 1966 of the Top Dividend Stocks we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if illimity Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ILTY

illimity Bank

Provides private banking, and investment and trading services in Italy.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives