- New Zealand

- /

- Healthcare Services

- /

- NZSE:TAH

Subdued Growth No Barrier To Third Age Health Services Limited's (NZSE:TAH) Price

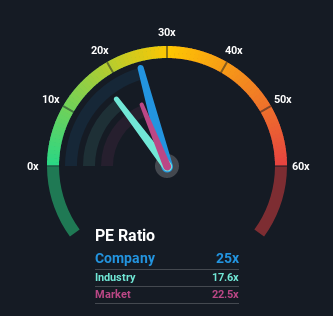

Third Age Health Services Limited's (NZSE:TAH) price-to-earnings (or "P/E") ratio of 25x might make it look like a sell right now compared to the market in New Zealand, where around half of the companies have P/E ratios below 22x and even P/E's below 10x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

It looks like earnings growth has deserted Third Age Health Services recently, which is not something to boast about. One possibility is that the P/E is high because investors think the benign earnings growth will improve to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Third Age Health Services

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Third Age Health Services would need to produce impressive growth in excess of the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. This isn't what shareholders were looking for as it means they've been left with a 98% decline in EPS over the last three years in total. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to decline by 0.9% over the next year, or less than the company's recent medium-term annualised earnings decline.

With this information, it's strange that Third Age Health Services is trading at a higher P/E in comparison. In general, when earnings shrink rapidly the P/E premium often shrinks too, which could set up shareholders for future disappointment. Maintaining these prices will be extremely difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

What We Can Learn From Third Age Health Services' P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Third Age Health Services revealed its sharp three-year contraction in earnings isn't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to shrink less severely. When we see below average earnings, we suspect the share price is at risk of declining, sending the high P/E lower. We're also cautious about the company's ability to stay its recent medium-term course and resist even greater pain to its business from the broader market turmoil. Unless the company's relative performance improves markedly, it's very challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Third Age Health Services that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20x).

Valuation is complex, but we're here to simplify it.

Discover if Third Age Health Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NZSE:TAH

Third Age Health Services

Provides general practice health care services for older people living in retirement villages, private hospitals, and secure dementia units in New Zealand.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives