- New Zealand

- /

- Healthcare Services

- /

- NZSE:ARV

Did Arvida Group's (NZSE:ARV) Share Price Deserve to Gain 35%?

By buying an index fund, investors can approximate the average market return. But many of us dare to dream of bigger returns, and build a portfolio ourselves. For example, Arvida Group Limited (NZSE:ARV) shareholders have seen the share price rise 35% over three years, well in excess of the market return (23%, not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 14% in the last year, including dividends.

See our latest analysis for Arvida Group

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

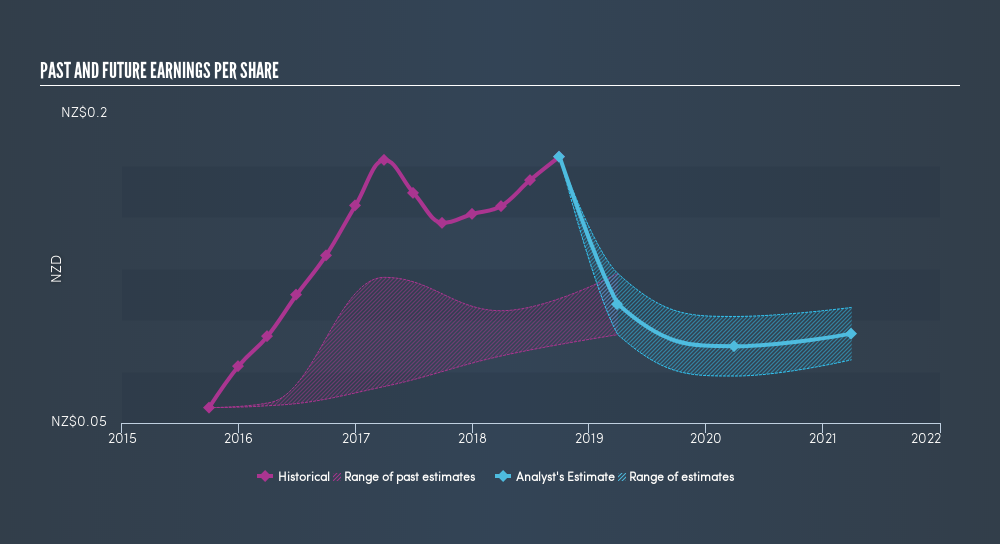

During three years of share price growth, Arvida Group achieved compound earnings per share growth of 46% per year. The average annual share price increase of 10% is actually lower than the EPS growth. So one could reasonably conclude that the market has cooled on the stock. This cautious sentiment is reflected in its (fairly low) P/E ratio of 7.14.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It is of course excellent to see how Arvida Group has grown profits over the years, but the future is more important for shareholders. It might be well worthwhile taking a look at our freereport on how its financial position has changed over time.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Arvida Group's TSR for the last 3 years was 58%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that Arvida Group shareholders have gained 14% (in total) over the last year. That's including the dividend. But the three year TSR of 17% per year is even better. Keeping this in mind, a solid next step might be to take a look at Arvida Group's dividend track record. This freeinteractive graph is a great place to start.

If you like to buy stocks alongside management, then you might just love this freelist of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NZ exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NZSE:ARV

Arvida Group

Owns, develops, and operates retirement villages and care facilities for the elderly in New Zealand.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives