Global markets have recently experienced a downturn, with U.S. stocks falling due to cautious Federal Reserve commentary and political uncertainties, while European and Asian indices also faced declines. Amid these challenging market conditions, investors are increasingly looking for opportunities that balance risk with potential rewards. Although the term "penny stock" may seem outdated, it remains relevant as it highlights smaller or newer companies that can offer significant value when built on strong financials. We've identified three penny stocks that combine balance sheet strength with the potential for growth, providing investors a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.42 | MYR1.17B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.73 | MYR431.91M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.13 | HK$45.48B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £148.28M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.55 | £67.7M | ★★★★☆☆ |

Click here to see the full list of 5,847 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Audience Analytics (Catalist:1AZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Audience Analytics Limited develops content and brands across various Asian countries, including Singapore, Malaysia, and China, with a market capitalization of SGD57.21 million.

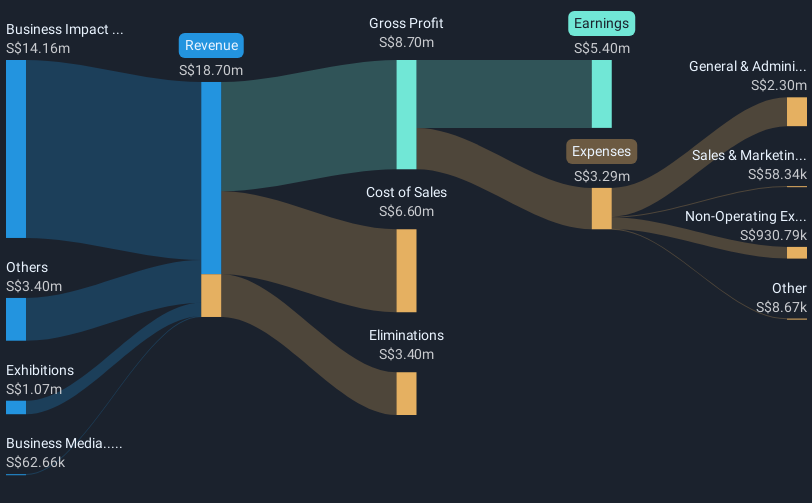

Operations: The company's revenue is primarily derived from Business Impact Assessment and Recognition at SGD14.16 million, followed by Exhibitions generating SGD1.07 million, and Business Media contributing SGD0.06 million.

Market Cap: SGD57.21M

Audience Analytics Limited, with a market capitalization of SGD57.21 million, shows financial stability through its debt-free position and high-quality earnings. Its short-term assets significantly exceed liabilities, indicating strong liquidity management. Despite a decline in earnings growth over the past year, the company maintains a high Return on Equity at 32.4%, suggesting efficient use of equity capital. The management and board are experienced, supporting strategic decision-making. Trading below its estimated fair value may present an opportunity for investors seeking undervalued stocks in the media sector across Asia's dynamic markets like Singapore and Malaysia.

- Dive into the specifics of Audience Analytics here with our thorough balance sheet health report.

- Examine Audience Analytics' past performance report to understand how it has performed in prior years.

Scales (NZSE:SCL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Scales Corporation Limited is involved in the manufacture and trading of food ingredients across New Zealand, Asia, Europe, North America, and other international markets with a market cap of NZ$580.03 million.

Operations: The company's revenue is primarily derived from its Global Proteins segment at NZ$289.15 million, followed by Horticulture at NZ$221.86 million and Logistics at NZ$94.55 million.

Market Cap: NZ$580.03M

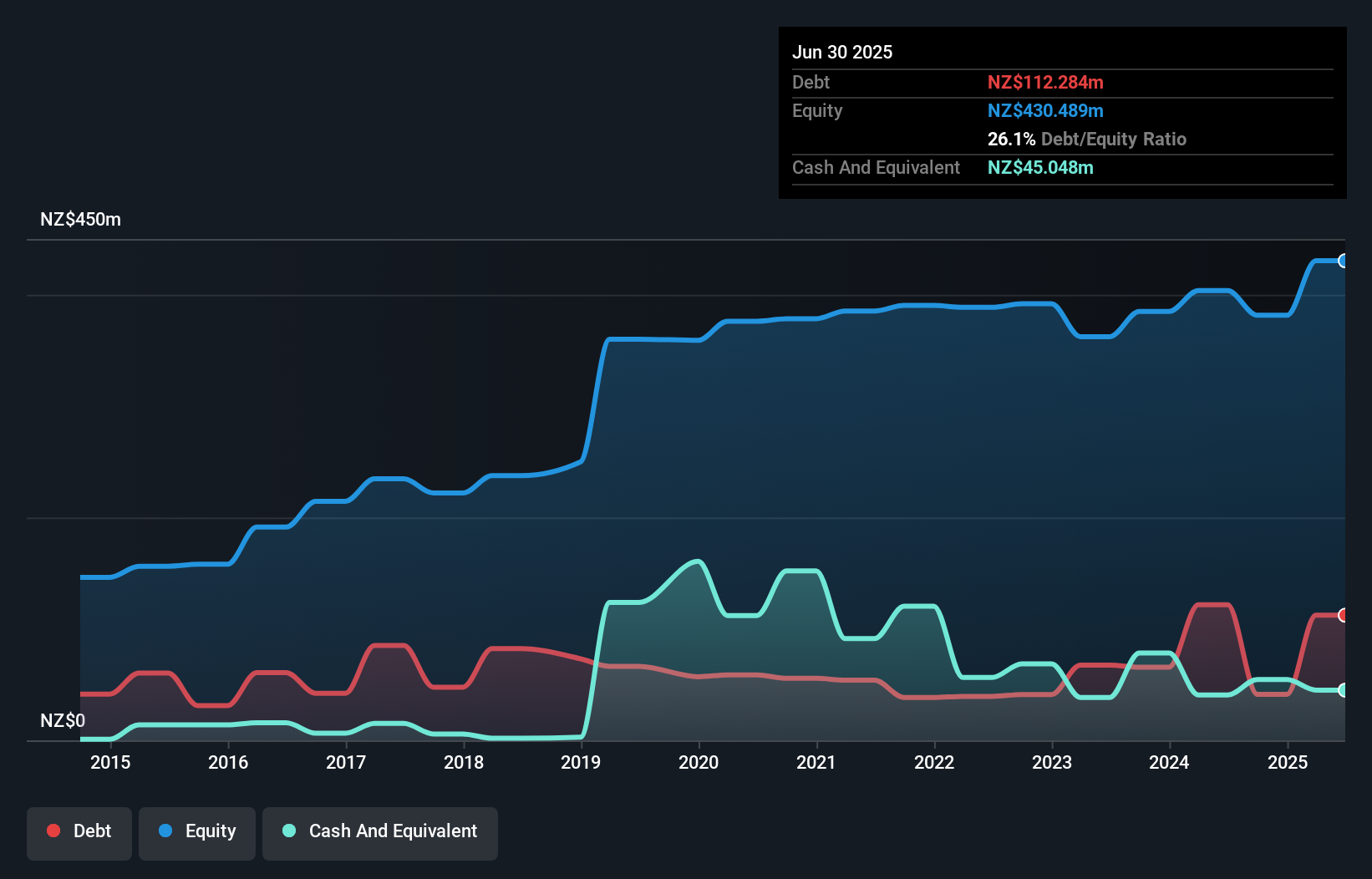

Scales Corporation Limited, with a market cap of NZ$580.03 million, has become profitable this year, driven primarily by its Global Proteins segment generating NZ$289.15 million in revenue. The company trades at 65.7% below its estimated fair value, suggesting potential undervaluation. Its financial health is supported by short-term assets exceeding both short and long-term liabilities and well-covered interest payments on debt (12.7x EBIT coverage). However, the board's average tenure of 2.3 years indicates limited experience, while the Return on Equity remains low at 12%, highlighting areas for operational improvement despite recent profitability gains.

- Click here and access our complete financial health analysis report to understand the dynamics of Scales.

- Evaluate Scales' prospects by accessing our earnings growth report.

Shanghai Bio-heart Biological Technology (SEHK:2185)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shanghai Bio-heart Biological Technology Co., Ltd. (SEHK:2185) is a company focused on developing and commercializing innovative medical devices for cardiovascular diseases, with a market cap of approximately HK$416.24 million.

Operations: Shanghai Bio-heart Biological Technology Co., Ltd. (SEHK:2185) has not reported any revenue segments.

Market Cap: HK$416.24M

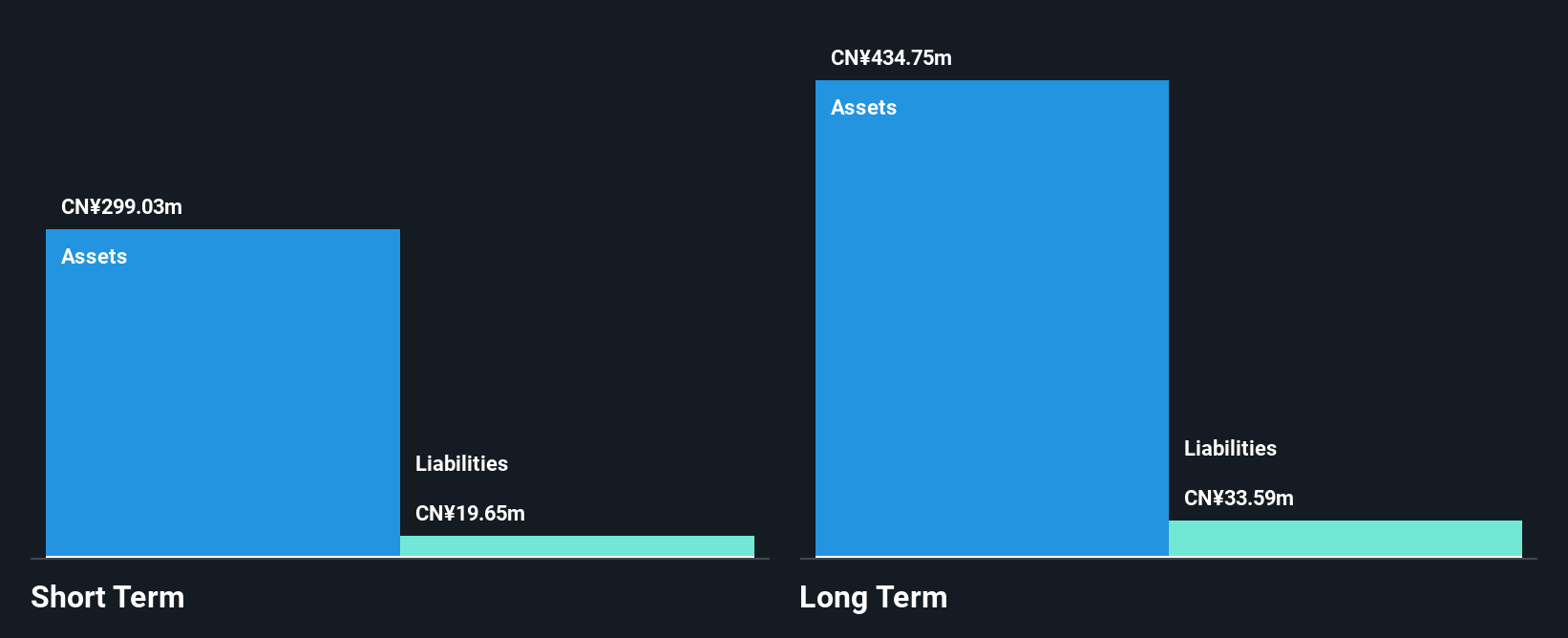

Shanghai Bio-heart Biological Technology, with a market cap of HK$416.24 million, remains pre-revenue and unprofitable but has managed to reduce losses by 16.1% annually over the past five years. The company benefits from a debt-free balance sheet and sufficient cash runway for over two years, indicating financial stability despite its current challenges. Recent developments include the Iberis-HTN study publication in "Circulation," showcasing promising results for its Iberis Renal Denervation System in treating uncontrolled hypertension in Chinese patients, potentially enhancing future revenue prospects if commercialized successfully. Management's experience further supports operational execution amid ongoing product development efforts.

- Get an in-depth perspective on Shanghai Bio-heart Biological Technology's performance by reading our balance sheet health report here.

- Understand Shanghai Bio-heart Biological Technology's track record by examining our performance history report.

Key Takeaways

- Unlock more gems! Our Penny Stocks screener has unearthed 5,844 more companies for you to explore.Click here to unveil our expertly curated list of 5,847 Penny Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About Catalist:1AZ

Audience Analytics

Audience Analytics Limited creates content and brands in Singapore, Malaysia, the People’s Republic of China, Taiwan, the Philippines, Cambodia, India, Indonesia, Macau, South Korea, Sri Lanka, Thailand, the United Arab Emirates, and Vietnam.

Flawless balance sheet and good value.