- New Zealand

- /

- Food

- /

- NZSE:ATM

Does China’s Regulatory Green Light Change the Bull Case for a2 Milk (NZSE:ATM)?

Reviewed by Sasha Jovanovic

- The a2 Milk Company recently received approvals from New Zealand’s Ministry for Primary Industries and China Customs to progress China label infant milk formula registrations toward a2MC branded products, marking a key regulatory milestone.

- This regulatory development streamlines a2 Milk's pathway for expanding its branded product offerings in China, while the company also provided guidance for low double-digit percentage growth in FY26.

- We’ll now explore how this regulatory milestone in China may influence a2 Milk’s longer-term investment outlook and growth assumptions.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

a2 Milk Investment Narrative Recap

To be an a2 Milk shareholder, you essentially need to believe that regulatory access in China, continued product innovation, and channel expansion can overcome intense market competition and margin pressures in the infant formula sector. While the latest regulatory progress in China is important for the brand’s longer-term growth prospects, it does not appear to materially impact the most immediate catalyst for the company, addressing margin compression risks from high freight and upfront marketing costs in the short term.

Among the recent company announcements, the new earnings guidance projecting low double-digit percentage growth in FY26 is particularly relevant. This outlook reflects management's confidence in ongoing demand, even as the China regulatory process remains multi-staged and the timing for new branded product launches is unchanged until at least late H1 2027. Despite optimism, investors should also be aware that if China market approvals face delays or incremental competition intensifies...

Read the full narrative on a2 Milk (it's free!)

a2 Milk's narrative projects NZ$2.2 billion revenue and NZ$280.4 million earnings by 2028. This requires 5.4% yearly revenue growth and a NZ$77.5 million earnings increase from NZ$202.9 million.

Uncover how a2 Milk's forecasts yield a NZ$9.37 fair value, a 14% downside to its current price.

Exploring Other Perspectives

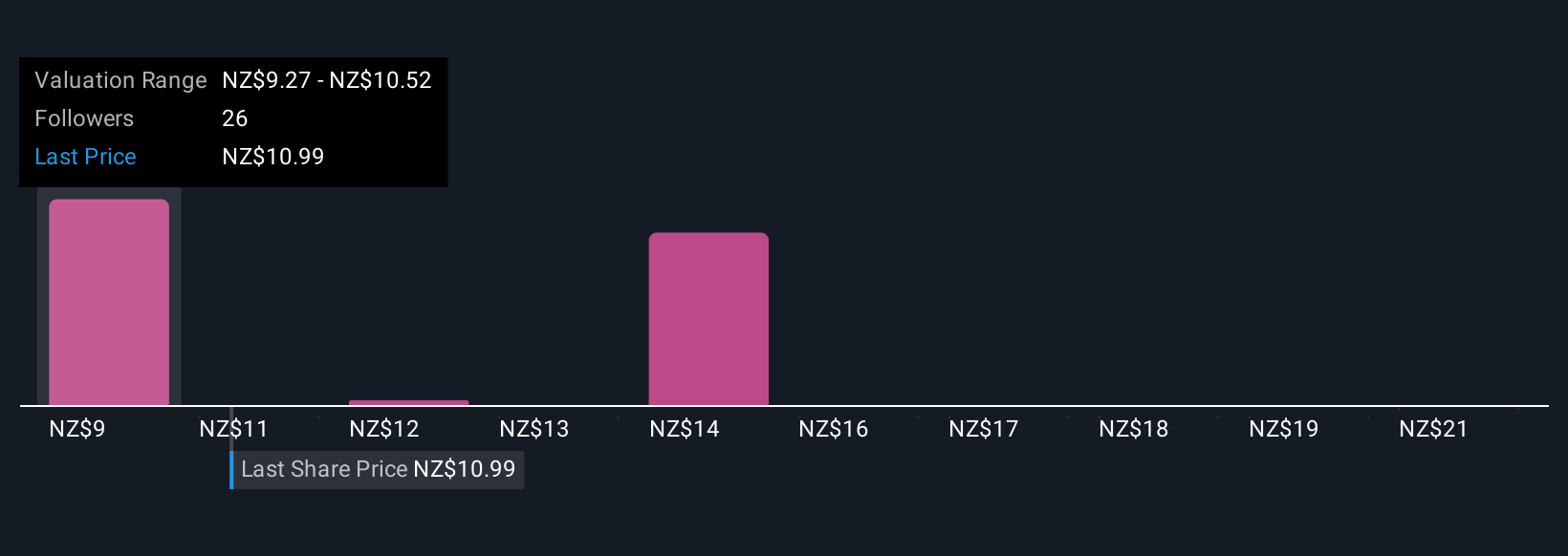

Simply Wall St Community members offered eight fair value estimates for a2 Milk, ranging from NZ$9.27 up to an ambitious NZ$21.81. Several participants also highlight that despite expanding market access in China, intense competition among top brands remains a core performance risk. See how your assumptions compare to these diverse outlooks.

Explore 8 other fair value estimates on a2 Milk - why the stock might be worth over 2x more than the current price!

Build Your Own a2 Milk Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your a2 Milk research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free a2 Milk research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate a2 Milk's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:ATM

a2 Milk

Sells A2-type protein type branded milk and related products in Australia, New Zealand, China, rest of Asia, and the United States.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success