Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Allied Farmers (NZSE:ALF). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Allied Farmers

Allied Farmers' Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. To the delight of shareholders, Allied Farmers has achieved impressive annual EPS growth of 39%, compound, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

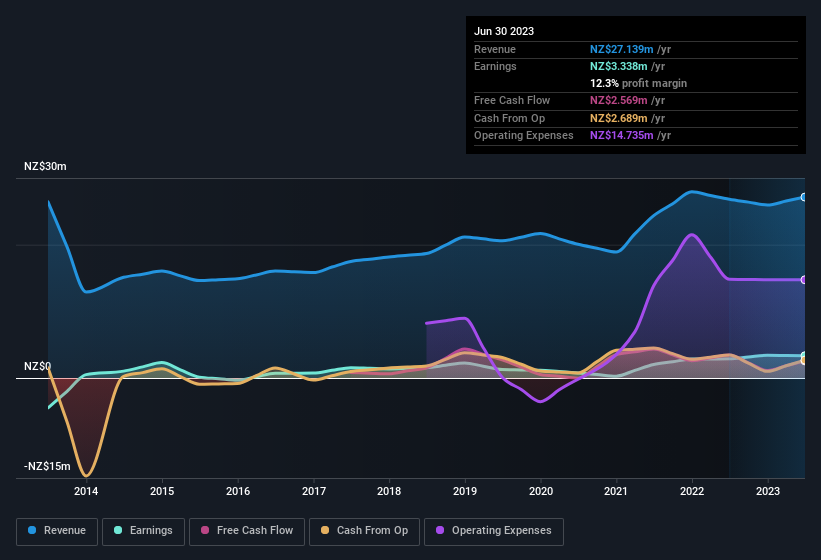

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. It's noted that Allied Farmers' revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. Allied Farmers reported flat revenue and EBIT margins over the last year. That's not bad, but it doesn't point to ongoing future growth, either.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Allied Farmers isn't a huge company, given its market capitalisation of NZ$22m. That makes it extra important to check on its balance sheet strength.

Are Allied Farmers Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Allied Farmers top brass are certainly in sync, not having sold any shares, over the last year. But more importantly, MD & Non Independent Director Richard Milsom spent NZ$197k acquiring shares, doing so at an average price of NZ$0.75. Purchases like this clue us in to the to the faith management has in the business' future.

Recent insider purchases of Allied Farmers stock is not the only way management has kept the interests of the general public shareholders in mind. To be specific, the CEO is paid modestly when compared to company peers of the same size. For companies with market capitalisations under NZ$329m, like Allied Farmers, the median CEO pay is around NZ$644k.

The Allied Farmers CEO received total compensation of only NZ$95k in the year to June 2023. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Allied Farmers Deserve A Spot On Your Watchlist?

Allied Farmers' earnings per share growth have been climbing higher at an appreciable rate. Better yet, we can observe insider buying and the chief executive pay looks reasonable. The strong EPS growth suggests Allied Farmers may be at an inflection point. If so, then its potential for further gains probably merit a spot on your watchlist. You still need to take note of risks, for example - Allied Farmers has 2 warning signs we think you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Allied Farmers isn't the only one. You can see a a curated list of New Zealander companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:ALF

Flawless balance sheet with solid track record.

Market Insights

Community Narratives