- New Zealand

- /

- Capital Markets

- /

- NZSE:NZX

Discover Atlantic Navigation Holdings (Singapore) And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As global markets navigate mixed performances and economic uncertainties, investors are increasingly looking beyond traditional stocks for potential opportunities. Penny stocks, a term that may seem outdated but remains relevant, represent smaller or newer companies that can offer unique value propositions. By focusing on those with strong financials and growth potential, such as Atlantic Navigation Holdings (Singapore) and others, investors can uncover promising opportunities in this often-overlooked segment of the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.085 | £785.66M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.64 | HK$40.08B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.425 | MYR1.18B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.968 | £152.69M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.46 | £185.93M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.58 | £68.28M | ★★★★☆☆ |

Click here to see the full list of 5,821 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Atlantic Navigation Holdings (Singapore) (Catalist:5UL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Atlantic Navigation Holdings (Singapore) Limited is an investment holding company offering marine logistics, ship repair, fabrication, and other marine services in Qatar, Saudi Arabia, Oman, and internationally with a market cap of SGD35.60 million.

Operations: The company's revenue is primarily derived from Marine Logistics Services, accounting for $99.15 million, and Ship Repair, Fabrication and Other Marine Services, contributing $2.87 million.

Market Cap: SGD35.6M

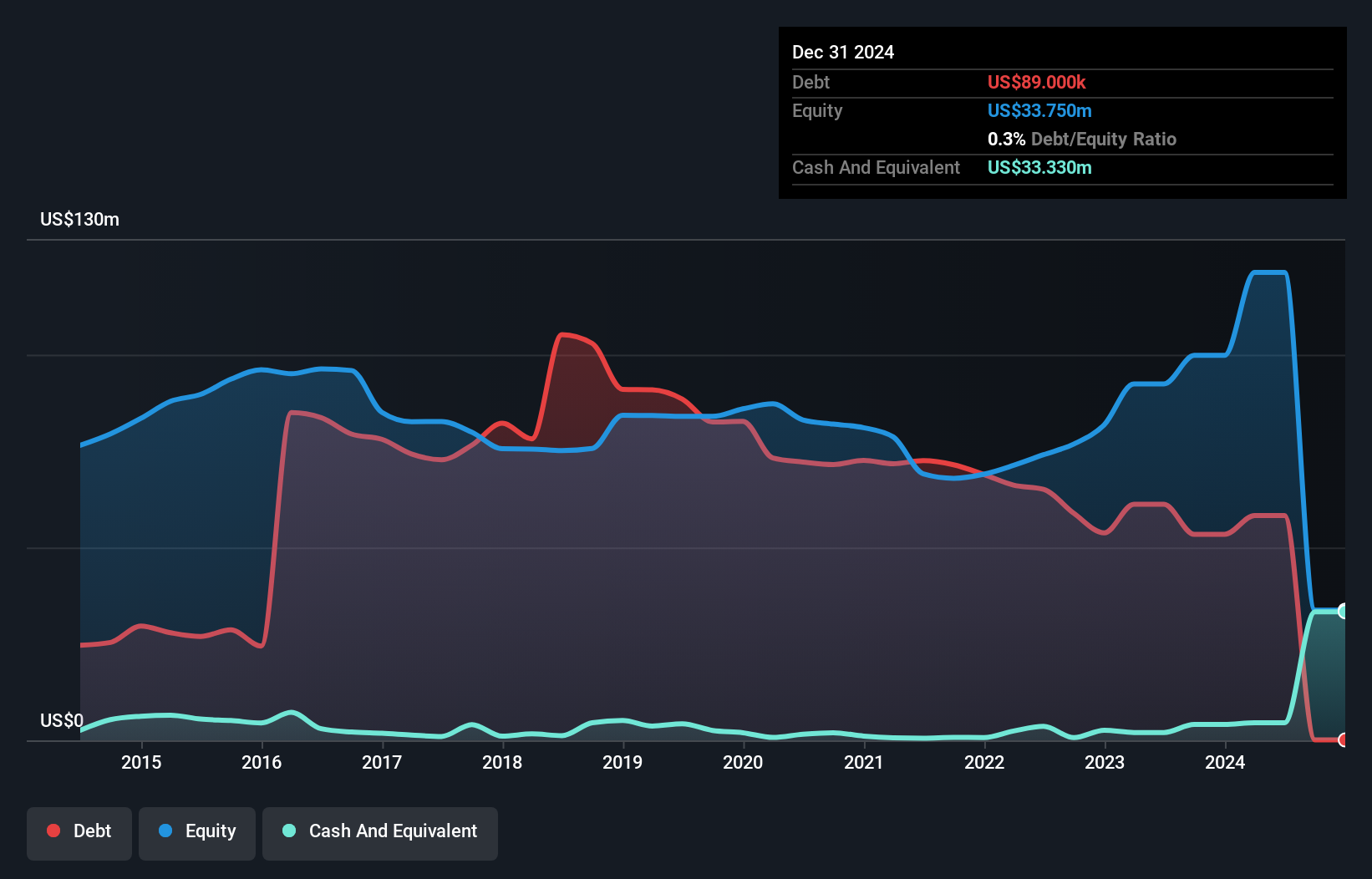

Atlantic Navigation Holdings (Singapore) Limited, with a market cap of SGD35.60 million, has shown robust earnings growth of 68.6% over the past year, surpassing its five-year average growth rate of 59.8%. Despite a high net debt to equity ratio of 44.3%, the company's debt is well covered by operating cash flow at 56.6%, and interest payments are covered by EBIT at 5.1x coverage. The company recently approved significant cash distributions totaling USD120 million (SGD160 million), including special dividends, highlighting its strong financial performance and shareholder returns amidst volatile share price movements and increased weekly volatility from 15% to 24%.

- Navigate through the intricacies of Atlantic Navigation Holdings (Singapore) with our comprehensive balance sheet health report here.

- Gain insights into Atlantic Navigation Holdings (Singapore)'s past trends and performance with our report on the company's historical track record.

NZX (NZSE:NZX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NZX Limited operates a stock exchange in New Zealand and has a market capitalization of NZ$487.26 million.

Operations: The company's revenue segments include Regulation (NZ$3.89 million), Wealth Technology (NZ$8.01 million), Funds Services (NZ$40.27 million), Secondary Markets (NZ$24.75 million), Corporate Services (NZ$0.10 million), Information Services (NZ$19.57 million), and Capital Markets Origination (NZ$15.74 million).

Market Cap: NZ$487.26M

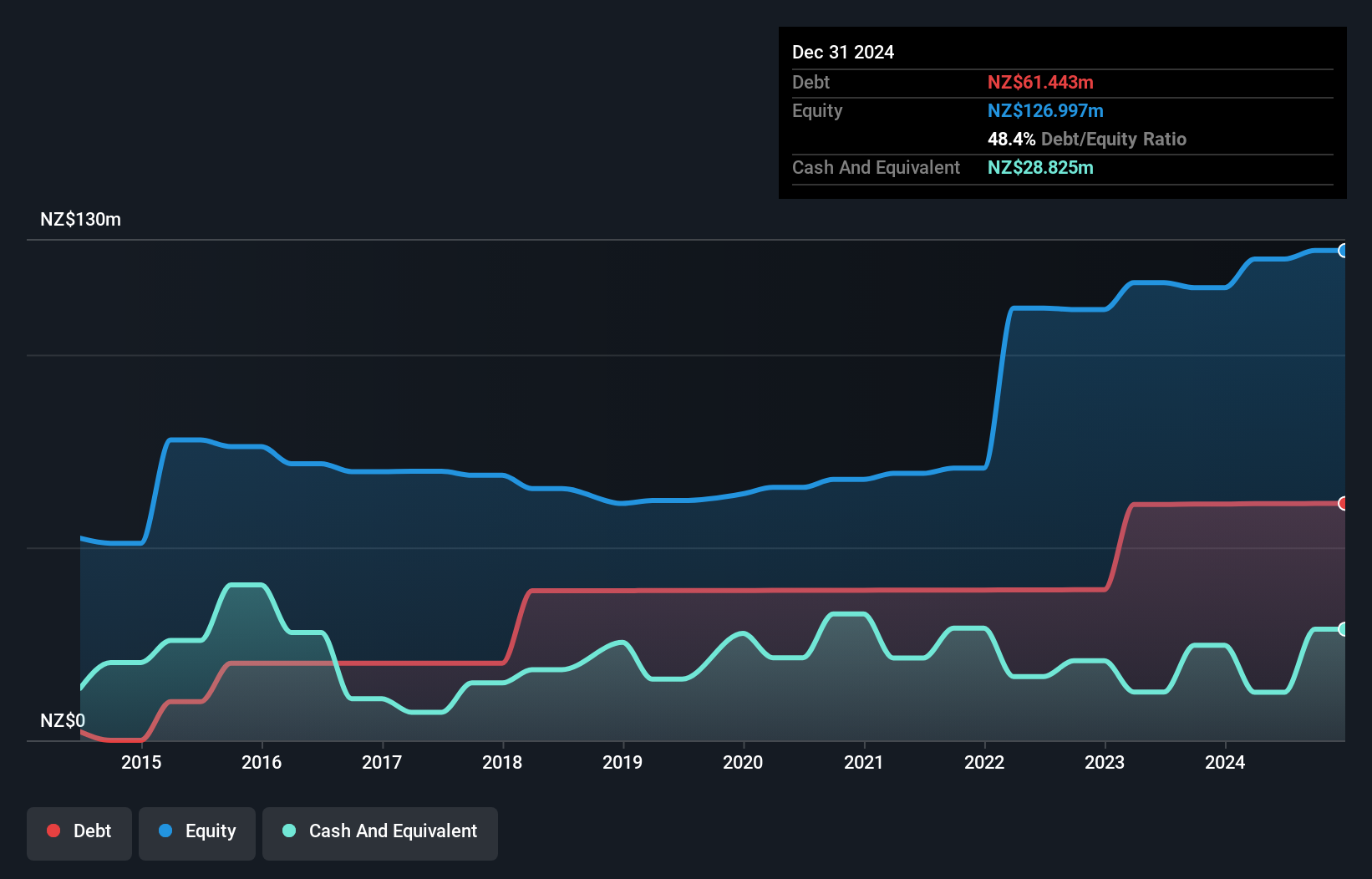

NZX Limited, with a market cap of NZ$487.26 million, has demonstrated significant earnings growth of 58.9% over the past year, outpacing its five-year average. Its debt management is robust, with interest payments well covered by EBIT (6.9x) and operating cash flow effectively covering debt levels (53.4%). Recent board changes include the appointment of David Hunt, bringing extensive governance experience to the company. The firm raised its 2024 earnings guidance due to stronger capital raising activities and growth in funds under management and administration through Smartshares and NZX Wealth Technologies, reflecting positive operational momentum despite a low return on equity at 17.5%.

- Get an in-depth perspective on NZX's performance by reading our balance sheet health report here.

- Assess NZX's future earnings estimates with our detailed growth reports.

Coolpoint Innonism Holding (SEHK:8040)

Simply Wall St Financial Health Rating: ★★★★★☆

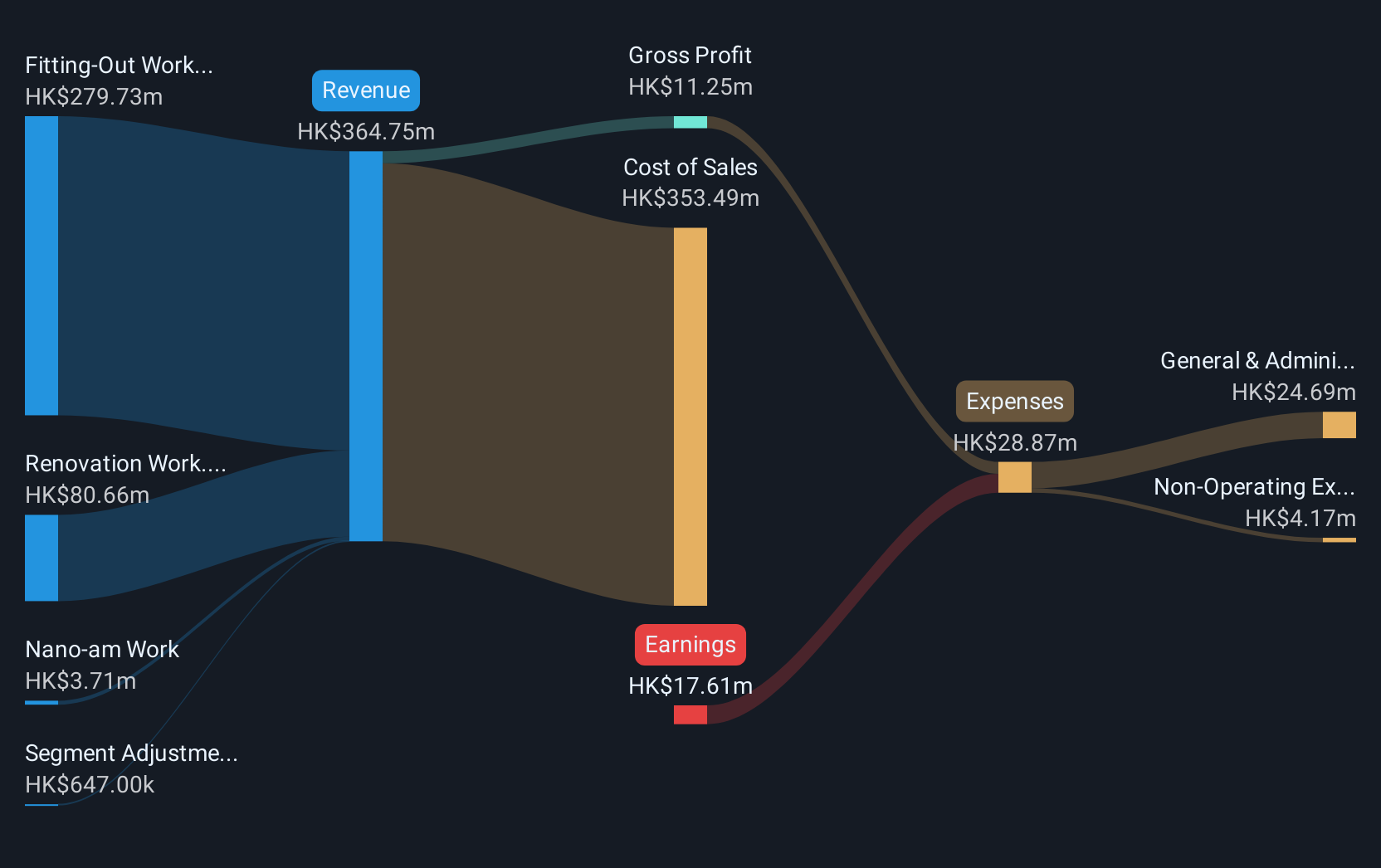

Overview: Coolpoint Innonism Holding Limited is an investment holding company offering fitting-out, renovation, and Nano-AM application services in Hong Kong with a market cap of HK$136 million.

Operations: The company's revenue is derived from three main segments: HK$279.73 million from fitting-out work, HK$80.66 million from renovation work, and HK$3.71 million from Nano-AM application services in Hong Kong.

Market Cap: HK$136M

Coolpoint Innonism Holding Limited, with a market cap of HK$136 million, operates in the fitting-out and renovation sectors in Hong Kong. The company reported revenues of HK$172.61 million for the half-year ending September 2024, up from HK$153.49 million the previous year, yet it remains unprofitable with a net loss increasing to HK$6.34 million. Despite this, Coolpoint's short-term assets (HK$133.8M) comfortably cover both short-term (HK$64.7M) and long-term liabilities (HK$15.1M). While trading significantly below estimated fair value and maintaining a stable cash runway over three years, challenges persist due to its negative return on equity (-28.5%).

- Click here and access our complete financial health analysis report to understand the dynamics of Coolpoint Innonism Holding.

- Explore historical data to track Coolpoint Innonism Holding's performance over time in our past results report.

Seize The Opportunity

- Get an in-depth perspective on all 5,821 Penny Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NZX might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:NZX

Flawless balance sheet with proven track record.

Market Insights

Community Narratives