- New Zealand

- /

- Diversified Financial

- /

- NZSE:IFT

Is Infratil's Return to Profitability Reshaping the Investment Outlook for NZSE:IFT?

Reviewed by Sasha Jovanovic

- Infratil Limited recently announced its earnings for the half year ended September 30, 2025, reporting sales of NZ$1,446.1 million and revenue of NZ$1.99 billion, up from the prior year, as well as net income of NZ$605.7 million compared to a net loss a year earlier.

- This turnaround from a net loss to a substantial net profit, alongside higher earnings per share, highlights a marked improvement in the company’s financial performance over the period.

- We'll consider how Infratil's shift to strong profitability could affect its investment outlook and analyst expectations going forward.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Infratil Investment Narrative Recap

To be confident in Infratil, investors typically need to believe in the company’s ability to convert sector tailwinds, especially in data infrastructure and renewables, into sustained profitability and cash flow growth. The latest earnings reversal to a NZ$605.7 million profit signals genuine improvement and reduces concerns about earnings volatility, but it does not significantly change the short-term focus on upcoming data centre contract wins as the next major catalyst or the ongoing regulatory risk related to the Manawa Energy and Contact Energy merger approval process.

The recent announcement of CDC’s partnership with Firmus Technologies and NVIDIA is directly relevant, given the heightened earnings attributed to increased data centre capacity. This deal, pointing to 40MW of new data centre capacity in Melbourne by 2026, could reinforce the revenue growth story if contracts are signed and capacity comes online as expected. However, investors should still watch for any delays or changes in customer requirements that could affect project timelines and realised revenues.

Yet, against these improvements, investors should be closely watching for any prolonged delays in the Manawa-Contact merger process and how...

Read the full narrative on Infratil (it's free!)

Infratil's outlook anticipates NZ$4.1 billion in revenue and NZ$300.1 million in earnings by 2028. This projection is based on a 4.4% annual revenue growth rate and an earnings increase of NZ$808 million from the current level of NZ$-508.3 million.

Uncover how Infratil's forecasts yield a NZ$10.48 fair value, a 17% downside to its current price.

Exploring Other Perspectives

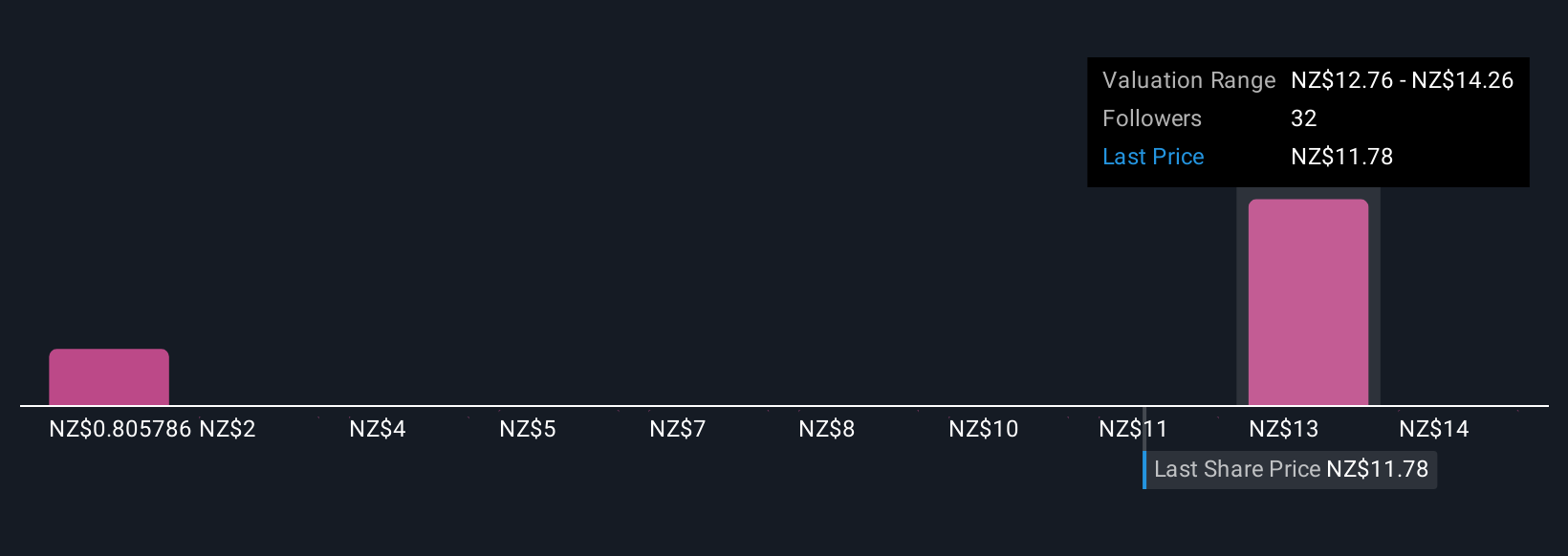

Seven fair value estimates from the Simply Wall St Community span a wide range, from NZ$1.05 to NZ$15.75 per share. In light of strong earnings momentum, questions remain about whether regulatory risks surrounding the Manawa-Contact Energy merger could meaningfully affect near-term performance, explore how differing views inform this debate.

Explore 7 other fair value estimates on Infratil - why the stock might be worth as much as 24% more than the current price!

Build Your Own Infratil Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Infratil research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Infratil research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Infratil's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:IFT

Infratil

An infrastructure investment firm specializing in digital Infrastructure, renewables, and social infrastructure.

Moderate growth potential and slightly overvalued.

Market Insights

Community Narratives