- New Zealand

- /

- Food and Staples Retail

- /

- NZSE:GXH

Global Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

Global markets have been under pressure recently, with AI concerns weighing heavily on investor sentiment and leading to declines across major indices. Despite this, opportunities still exist for discerning investors, particularly in the realm of penny stocks—an investment area that remains relevant despite its somewhat outdated label. These stocks often represent smaller or newer companies and can offer growth potential at lower price points when backed by strong financial health.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.49 | HK$909.23M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (NasdaqGS:LX) | $3.495 | $588.08M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.99 | A$454.92M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.47 | HK$2.01B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.02 | SGD413.39M | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.35 | SGD13.18B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.6675 | $388.04M | ✅ 4 ⚠️ 2 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.52 | MYR2.59B | ✅ 5 ⚠️ 0 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.80 | NZ$235.47M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,595 stocks from our Global Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Winking Studios (Catalist:WKS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Winking Studios Limited is an investment holding company that functions as an art outsourcing and game development studio with operations in Mainland China, Taiwan, South Korea, the United States, Japan, and other international markets; it has a market cap of SGD112.69 million.

Operations: The company generates revenue from three main segments: Art Outsourcing ($29.68 million), Game Development ($6.22 million), and Global Publishing and Others ($0.16 million).

Market Cap: SGD112.69M

Winking Studios Limited, with a market cap of SGD112.69 million, operates in art outsourcing and game development across multiple regions. The company is debt-free and its short-term assets significantly exceed both short-term and long-term liabilities, indicating solid liquidity management. However, the board's average tenure suggests limited experience at 2.5 years, which may impact strategic direction. Recent financials reveal a decline in profit margins from 4.7% to 1.5%, compounded by a large one-off loss of $123K impacting earnings quality over the past year ending June 2025. Earnings are forecasted to grow significantly despite historical declines in profitability.

- Get an in-depth perspective on Winking Studios' performance by reading our balance sheet health report here.

- Gain insights into Winking Studios' future direction by reviewing our growth report.

Green Cross Health (NZSE:GXH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Green Cross Health Limited operates in New Zealand, offering healthcare and advice services to communities, with a market cap of NZ$140.12 million.

Operations: The company generates revenue from two main segments: Medical Services, contributing NZ$153.39 million, and Pharmacy Services, with NZ$370.37 million.

Market Cap: NZ$140.12M

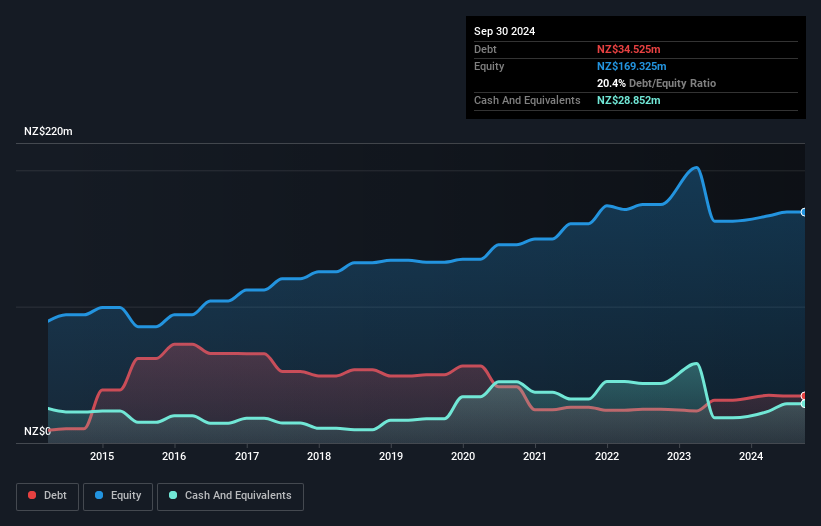

Green Cross Health, with a market cap of NZ$140.12 million, shows mixed financial health typical of smaller stocks. While earnings grew by 32.8% over the past year, surpassing industry averages, the company's long-term liabilities exceed its short-term assets by NZ$38.5 million, raising liquidity concerns. Despite this, debt management appears robust as cash exceeds total debt and interest payments are well-covered by EBIT at 3.8 times coverage. The board and management teams are experienced with average tenures of 14.9 and 7.3 years respectively; however, an unstable dividend track record may deter income-focused investors seeking consistent returns.

- Jump into the full analysis health report here for a deeper understanding of Green Cross Health.

- Assess Green Cross Health's previous results with our detailed historical performance reports.

Serko (NZSE:SKO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Serko Limited offers online travel booking and expense management services across New Zealand, Australia, the United States, Europe, and other international markets, with a market cap of NZ$310.81 million.

Operations: The company does not report specific revenue segments.

Market Cap: NZ$310.81M

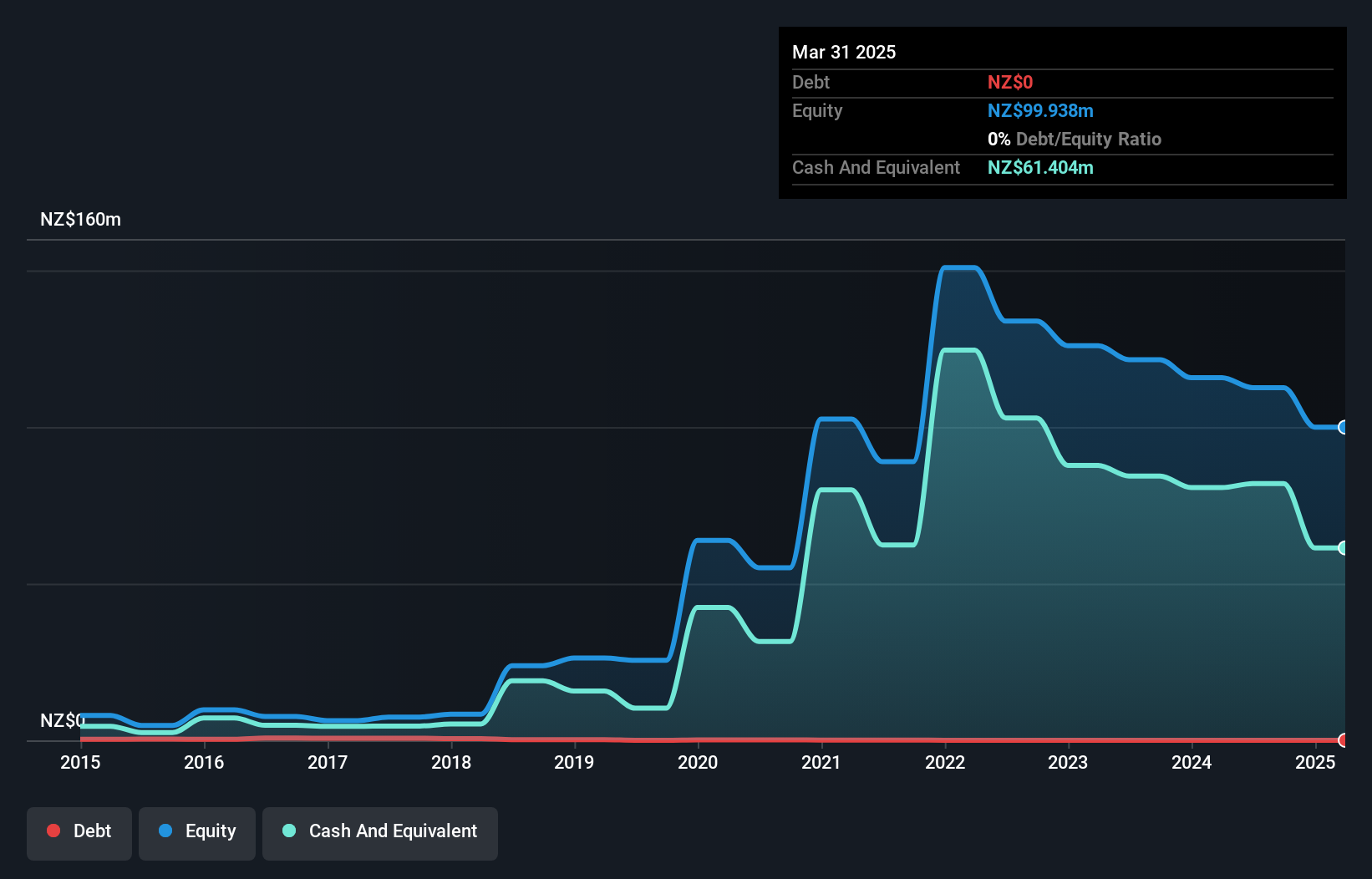

Serko Limited, with a market cap of NZ$310.81 million, demonstrates financial resilience despite being unprofitable. The company reported half-year revenues of NZ$61.77 million, up from NZ$42.72 million the previous year, although net losses increased to NZ$9.52 million from NZ$5.11 million. Serko is debt-free and maintains a robust cash runway exceeding three years due to positive free cash flow growth at 18.3% annually, providing stability in its operations across international markets. Management and board experience further bolster confidence with average tenures of 2.6 and 11.6 years respectively, supporting strategic continuity amidst ongoing challenges in profitability improvement efforts.

- Take a closer look at Serko's potential here in our financial health report.

- Explore Serko's analyst forecasts in our growth report.

Next Steps

- Embark on your investment journey to our 3,595 Global Penny Stocks selection here.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:GXH

Green Cross Health

Provides health care and advice services to communities in New Zealand.

Good value with proven track record.

Market Insights

Community Narratives