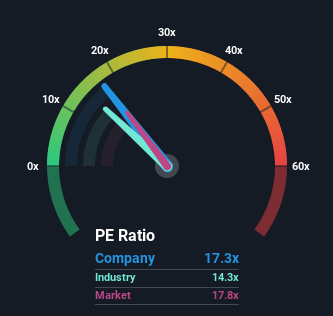

With a median price-to-earnings (or "P/E") ratio of close to 18x in New Zealand, you could be forgiven for feeling indifferent about Bremworth Limited's (NZSE:BRW) P/E ratio of 17.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

The earnings growth achieved at Bremworth over the last year would be more than acceptable for most companies. It might be that many expect the respectable earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Check out our latest analysis for Bremworth

How Is Bremworth's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Bremworth's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 29% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Weighing the recent medium-term upward earnings trajectory against the broader market's one-year forecast for contraction of 1.1% shows it's a great look while it lasts.

With this information, we find it odd that Bremworth is trading at a fairly similar P/E to the market. It looks like most investors are not convinced the company can maintain its recent positive growth rate in the face of a shrinking broader market.

The Bottom Line On Bremworth's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Bremworth revealed its growing earnings over the medium-term aren't contributing to its P/E as much as we would have predicted, given the market is set to shrink. When we see its superior earnings with some actual growth, we assume potential risks are what might be placing pressure on the P/E ratio. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader market turmoil. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Having said that, be aware Bremworth is showing 3 warning signs in our investment analysis, and 2 of those are a bit concerning.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20x).

If you're looking to trade Bremworth, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bremworth might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:BRW

Bremworth

Engages in the manufacture and sale of carpets and rugs in New Zealand, Australia, the United States, Canada, and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives