This article will reflect on the compensation paid to David Mair who has served as CEO of Skellerup Holdings Limited (NZSE:SKL) since 2011. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for Skellerup Holdings

Comparing Skellerup Holdings Limited's CEO Compensation With the industry

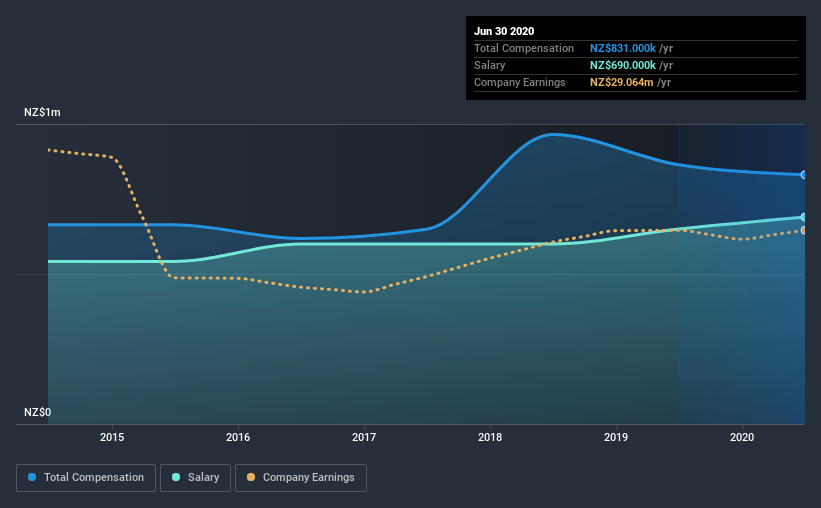

According to our data, Skellerup Holdings Limited has a market capitalization of NZ$742m, and paid its CEO total annual compensation worth NZ$831k over the year to June 2020. That's a slightly lower by 3.8% over the previous year. We note that the salary portion, which stands at NZ$690.0k constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations ranging from NZ$277m to NZ$1.1b, the reported median CEO total compensation was NZ$759k. So it looks like Skellerup Holdings compensates David Mair in line with the median for the industry. What's more, David Mair holds NZ$22m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | NZ$690k | NZ$650k | 83% |

| Other | NZ$141k | NZ$214k | 17% |

| Total Compensation | NZ$831k | NZ$864k | 100% |

Talking in terms of the industry, salary represented approximately 80% of total compensation out of all the companies we analyzed, while other remuneration made up 20% of the pie. Our data reveals that Skellerup Holdings allocates salary more or less in line with the wider market. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Skellerup Holdings Limited's Growth

Over the past three years, Skellerup Holdings Limited has seen its earnings per share (EPS) grow by 9.2% per year. In the last year, its revenue is up 2.3%.

We'd prefer higher revenue growth, but it is good to see modest EPS growth. So there are some positives here, but not enough to earn high praise. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Skellerup Holdings Limited Been A Good Investment?

Most shareholders would probably be pleased with Skellerup Holdings Limited for providing a total return of 153% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

As previously discussed, David is compensated close to the median for companies of its size, and which belong to the same industry. However, the company's EPS growth numbers over the last three years is not that impressive. Meanwhile, shareholder returns have remained positive over the same time frame. There is room for improved company performance, but we don't see the CEO compensation as a big issue here.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 3 warning signs for Skellerup Holdings that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Skellerup Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NZSE:SKL

Skellerup Holdings

Designs, manufactures, and distributes engineered products for various specialist industrial and agricultural applications.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives