- Norway

- /

- Renewable Energy

- /

- OB:SCATC

Scatec (OB:SCATC investor three-year losses grow to 64% as the stock sheds kr859m this past week

While not a mind-blowing move, it is good to see that the Scatec ASA (OB:SCATC) share price has gained 21% in the last three months. But over the last three years we've seen a quite serious decline. Tragically, the share price declined 65% in that time. So it's good to see it climbing back up. After all, could be that the fall was overdone.

After losing 6.1% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Scatec

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Scatec became profitable within the last five years. We would usually expect to see the share price rise as a result. So given the share price is down it's worth checking some other metrics too.

Revenue is actually up 7.3% over the three years, so the share price drop doesn't seem to hinge on revenue, either. This analysis is just perfunctory, but it might be worth researching Scatec more closely, as sometimes stocks fall unfairly. This could present an opportunity.

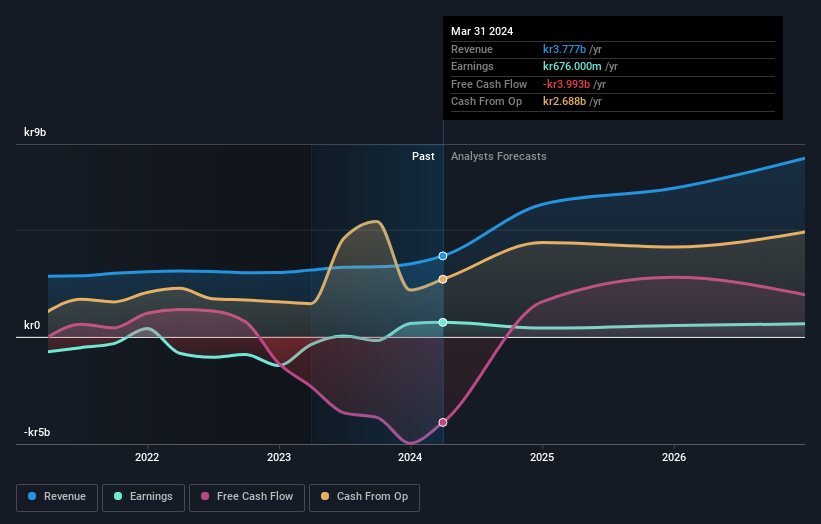

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think Scatec will earn in the future (free profit forecasts).

A Different Perspective

Scatec shareholders are up 13% for the year. But that return falls short of the market. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 0.5% endured over half a decade. So this might be a sign the business has turned its fortunes around. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for Scatec (2 are a bit concerning) that you should be aware of.

Scatec is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Norwegian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SCATC

Good value low.