- Norway

- /

- Marine and Shipping

- /

- OB:SNI

3 Reliable Dividend Stocks Offering Up To 8.9% Yield

Reviewed by Simply Wall St

In the wake of recent global market shifts, including a notable rally in U.S. stocks driven by expectations of economic growth and tax reforms, investors are keenly observing how these changes might influence their portfolios. Amidst this backdrop, dividend stocks have emerged as a compelling option for those seeking steady income streams; they offer potential yields that can provide some stability against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.53% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.18% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.54% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.42% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.78% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.86% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.13% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.38% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.44% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.90% | ★★★★★★ |

Click here to see the full list of 1939 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

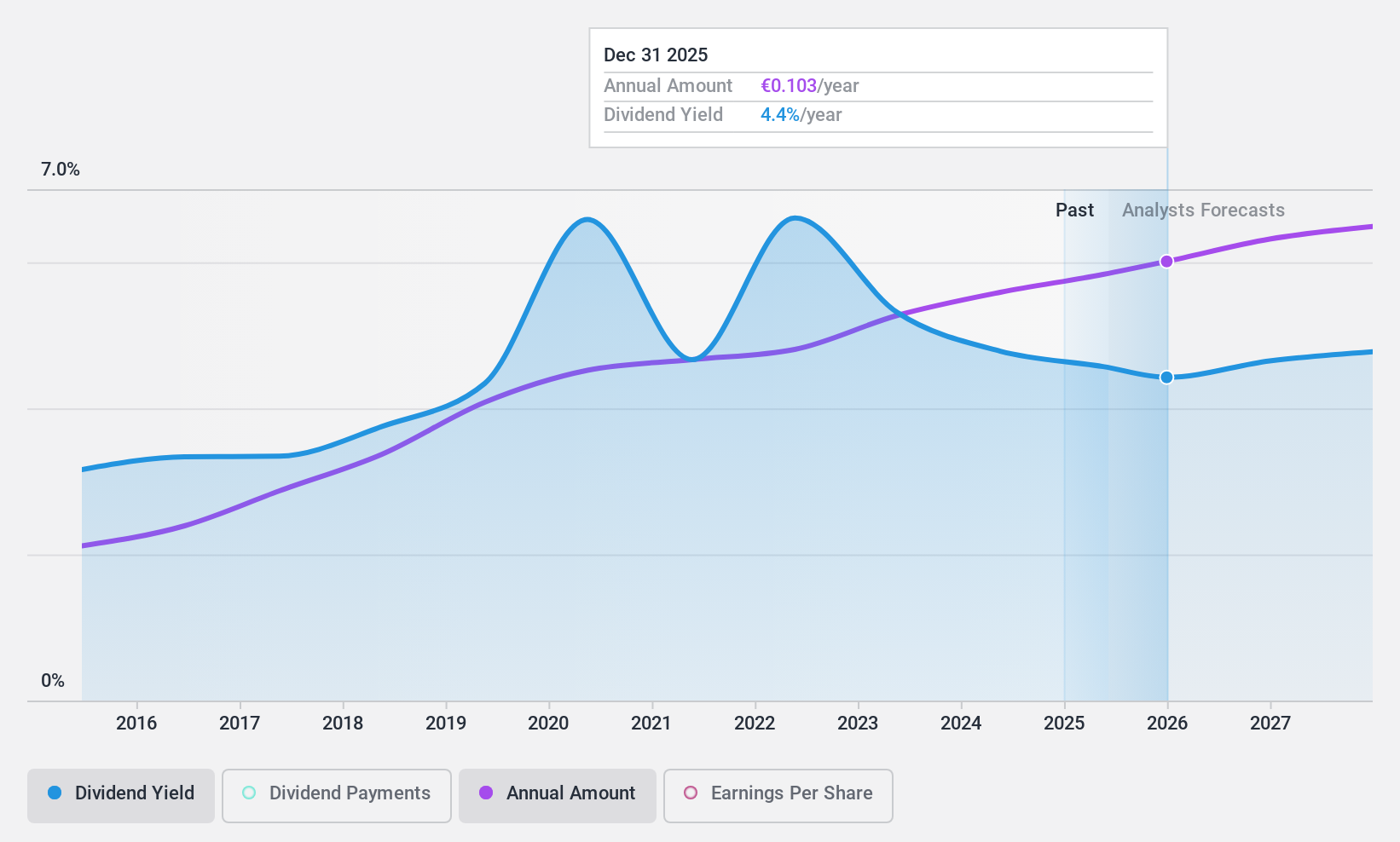

A2A (BIT:A2A)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: A2A S.p.A. is an Italian company involved in the production, sale, and distribution of gas and electricity, as well as district heating both domestically and internationally, with a market cap of €6.29 billion.

Operations: A2A S.p.A.'s revenue segments include Market (€6.48 billion), Corporate (€331 million), Environment (€1.47 billion), Smart Infrastructures (€1.47 billion), and Generation and Trading (€8.61 billion).

Dividend Yield: 4.6%

A2A's dividend payments have been stable and growing over the past decade, supported by a low payout ratio of 34.6%. However, the dividends are not well covered by free cash flows, with a high cash payout ratio of 366%, indicating potential sustainability issues. Despite trading at good value with a price-to-earnings ratio of 7.5x below the Italian market average, A2A faces challenges due to high debt levels and forecasted earnings decline.

- Navigate through the intricacies of A2A with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that A2A is trading behind its estimated value.

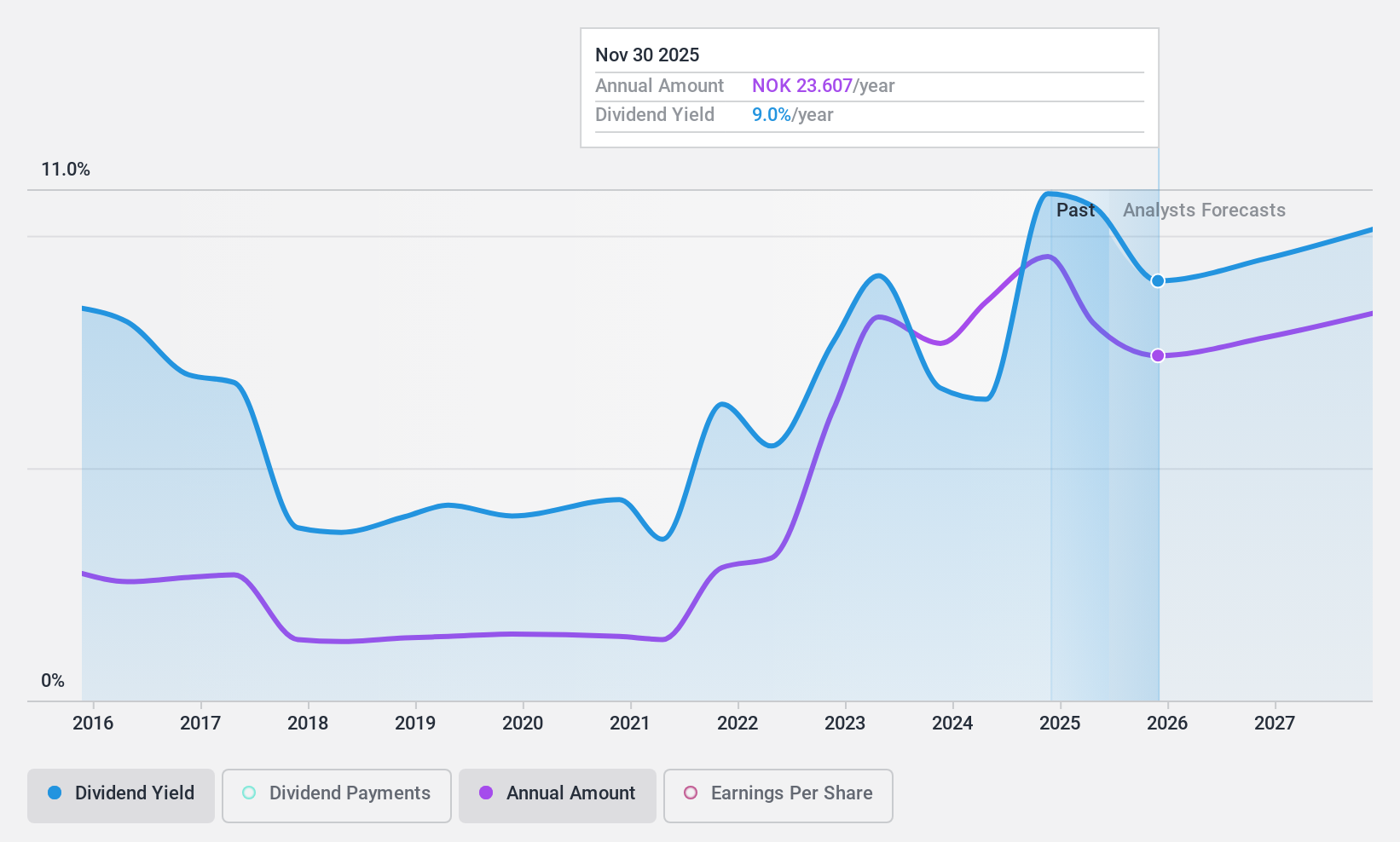

Stolt-Nielsen (OB:SNI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Stolt-Nielsen Limited, along with its subsidiaries, offers global transportation, storage, and distribution solutions for bulk liquid chemicals and specialty liquids, with a market cap of NOK16.19 billion.

Operations: Stolt-Nielsen Limited's revenue segments include Terminals ($306.89 million), Stolt Sea Farm ($122.79 million), and Tank Containers ($640.04 million).

Dividend Yield: 8.9%

Stolt-Nielsen's dividend yield is among the top 25% in Norway, with a recent interim dividend of $1.25 per share. Despite historical volatility in dividends, they are well covered by earnings and cash flows, with payout ratios of 20% and 38.2%, respectively. Earnings grew significantly over the past year but are expected to decline by 6.1% annually for three years. The stock trades at a substantial discount to its estimated fair value but carries high debt levels.

- Dive into the specifics of Stolt-Nielsen here with our thorough dividend report.

- According our valuation report, there's an indication that Stolt-Nielsen's share price might be on the cheaper side.

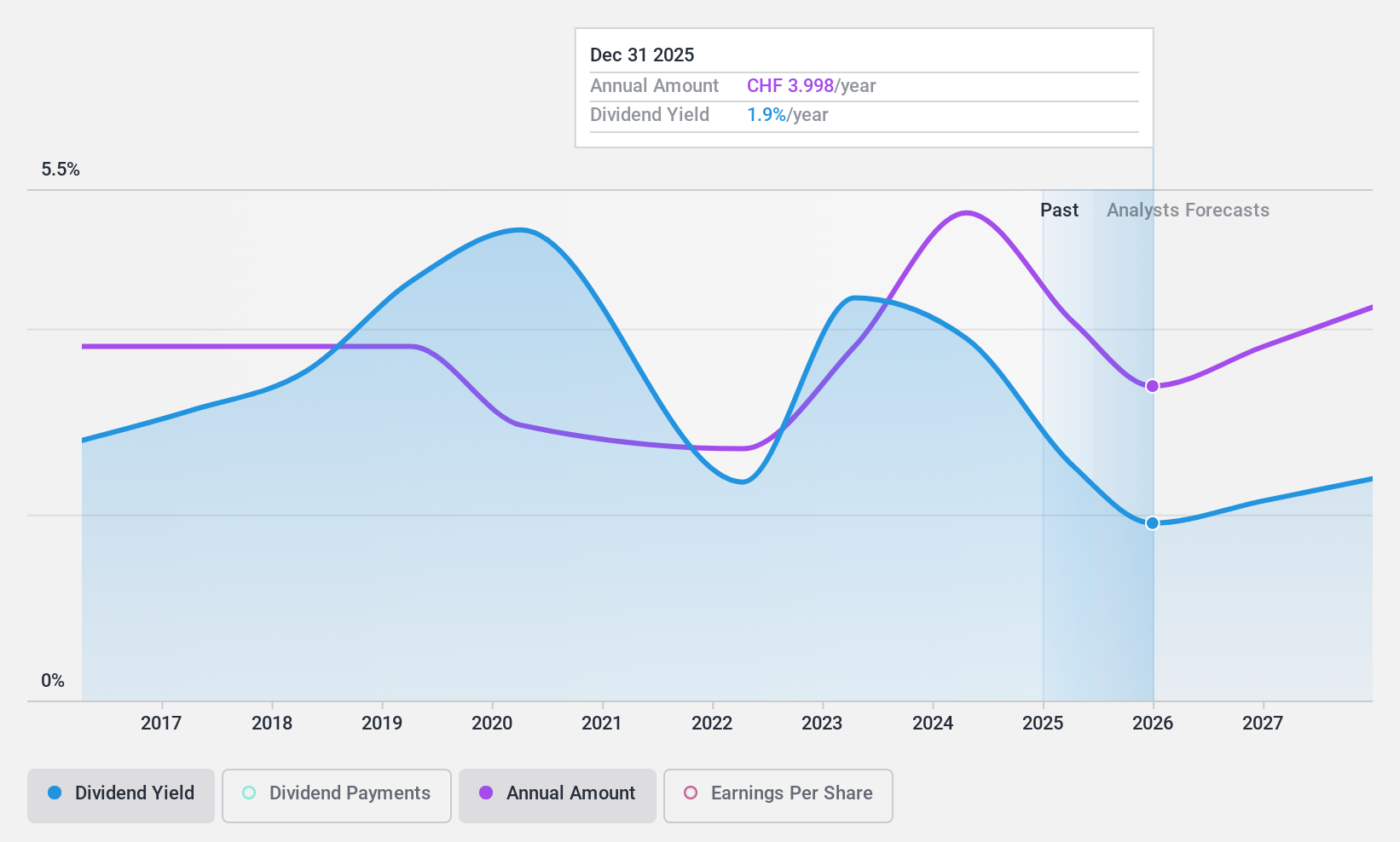

TX Group (SWX:TXGN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TX Group AG operates a network of platforms offering information, orientation, entertainment, and support services in Switzerland, with a market cap of CHF1.60 billion.

Operations: The revenue segments for TX Group AG are Tamedia with CHF427 million, Goldbach with CHF299.10 million, 20 Minutes with CHF115.60 million, TX Markets with CHF126.40 million, and Groups & Ventures contributing CHF159.40 million.

Dividend Yield: 4%

TX Group's dividend payments have grown over the past decade, yet remain volatile and unreliable. The payouts are well-covered by earnings and cash flows, with payout ratios of 59.6% and 43.4%, respectively. Despite a low yield compared to top Swiss dividend payers, TXGN trades significantly below its estimated fair value. Recent profitability marks a positive shift, supported by its addition to the S&P Global BMI Index in September 2024.

- Delve into the full analysis dividend report here for a deeper understanding of TX Group.

- Upon reviewing our latest valuation report, TX Group's share price might be too optimistic.

Turning Ideas Into Actions

- Get an in-depth perspective on all 1939 Top Dividend Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SNI

Stolt-Nielsen

Provides transportation, storage, and distribution solutions for bulk liquid chemicals, edible oils, acids, and other specialty liquids worldwide.

Very undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives