- Norway

- /

- Renewable Energy

- /

- OB:NOFIN

While Aega (OB:AEGA) shareholders have made 89% in 3 years, increasing losses might now be front of mind as stock sheds 57% this week

Aega ASA (OB:AEGA) shareholders will doubtless be very grateful to see the share price up 32% in the last month. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Since Aega has shed kr11m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

View our latest analysis for Aega

Aega recorded just €3,294,344 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. You have to wonder why venture capitalists aren't funding it. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. It seems likely some shareholders believe that Aega will significantly advance the business plan before too long.

Companies that lack both meaningful revenue and profits are usually considered high risk. You should be aware that the company needed to issue more shares recently so that it could raise enough money to continue pursuing its business plan. While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized). It certainly is a dangerous place to invest, as Aega investors might realise.

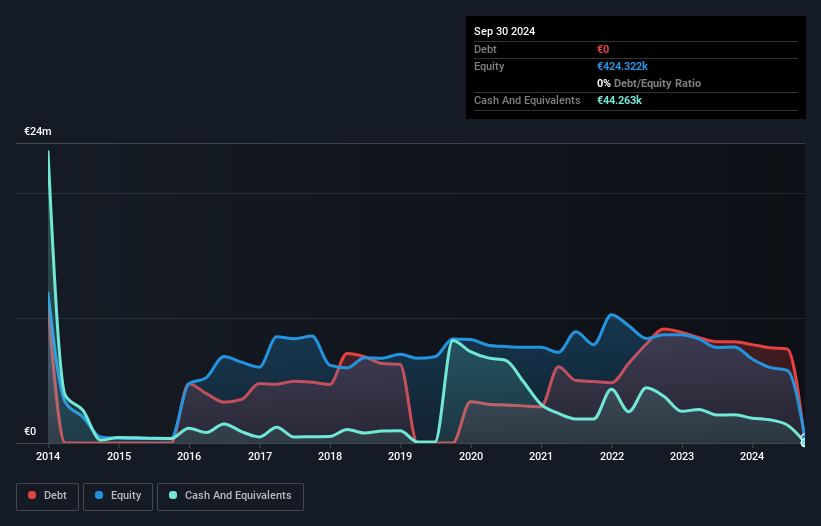

Aega had liabilities exceeding cash when it last reported, according to our data. That put it in the highest risk category, according to our analysis. But with the share price diving 24% per year, over 3 years , it's probably fair to say that some shareholders no longer believe the company will succeed or they are worried about dilution with the recent cash injection. The image below shows how Aega's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. Would it bother you if insiders were selling the stock? I would feel more nervous about the company if that were so. It only takes a moment for you to check whether we have identified any insider sales recently.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Aega's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Aega's TSR of 89% over the last 3 years is better than the share price return.

A Different Perspective

We're pleased to report that Aega shareholders have received a total shareholder return of 292% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 26% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 6 warning signs for Aega (of which 3 are a bit concerning!) you should know about.

We will like Aega better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Norwegian exchanges.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nordic Financials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:NOFIN

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion