- Norway

- /

- Marine and Shipping

- /

- OB:ODF

Improved Earnings Required Before Odfjell SE (OB:ODF) Stock's 30% Jump Looks Justified

Odfjell SE (OB:ODF) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 43% in the last twelve months.

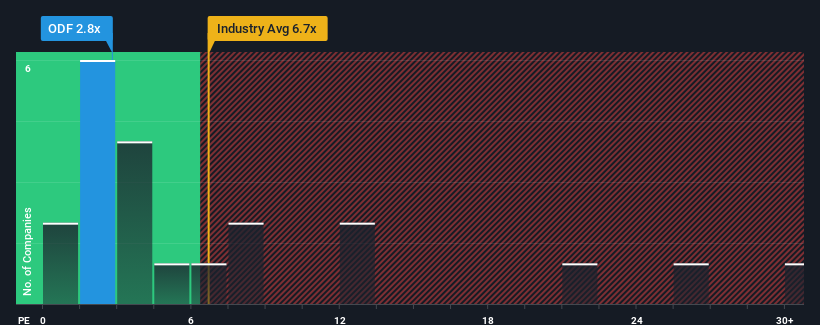

Although its price has surged higher, Odfjell may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 2.8x, since almost half of all companies in Norway have P/E ratios greater than 13x and even P/E's higher than 20x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With earnings growth that's superior to most other companies of late, Odfjell has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Odfjell

Is There Any Growth For Odfjell?

The only time you'd be truly comfortable seeing a P/E as depressed as Odfjell's is when the company's growth is on track to lag the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 37% last year. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Looking ahead now, EPS is anticipated to slump, contracting by 6.8% per year during the coming three years according to the four analysts following the company. Meanwhile, the broader market is forecast to expand by 19% per year, which paints a poor picture.

With this information, we are not surprised that Odfjell is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

Odfjell's recent share price jump still sees its P/E sitting firmly flat on the ground. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Odfjell maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Odfjell (1 is potentially serious!) that you need to be mindful of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:ODF

Odfjell

Provides services for the transportation and storage of bulk liquid chemicals, acids, edible oils, and other specialty products in North America, South America, Norway, the Netherlands, rest of Europe, the Middle East, Asia, Africa, and Australasia.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives