Norwegian (OB:NAS) Earnings Guidance Lags Market, Undervalued Signals Reinforce Cautious Bull Case

Reviewed by Simply Wall St

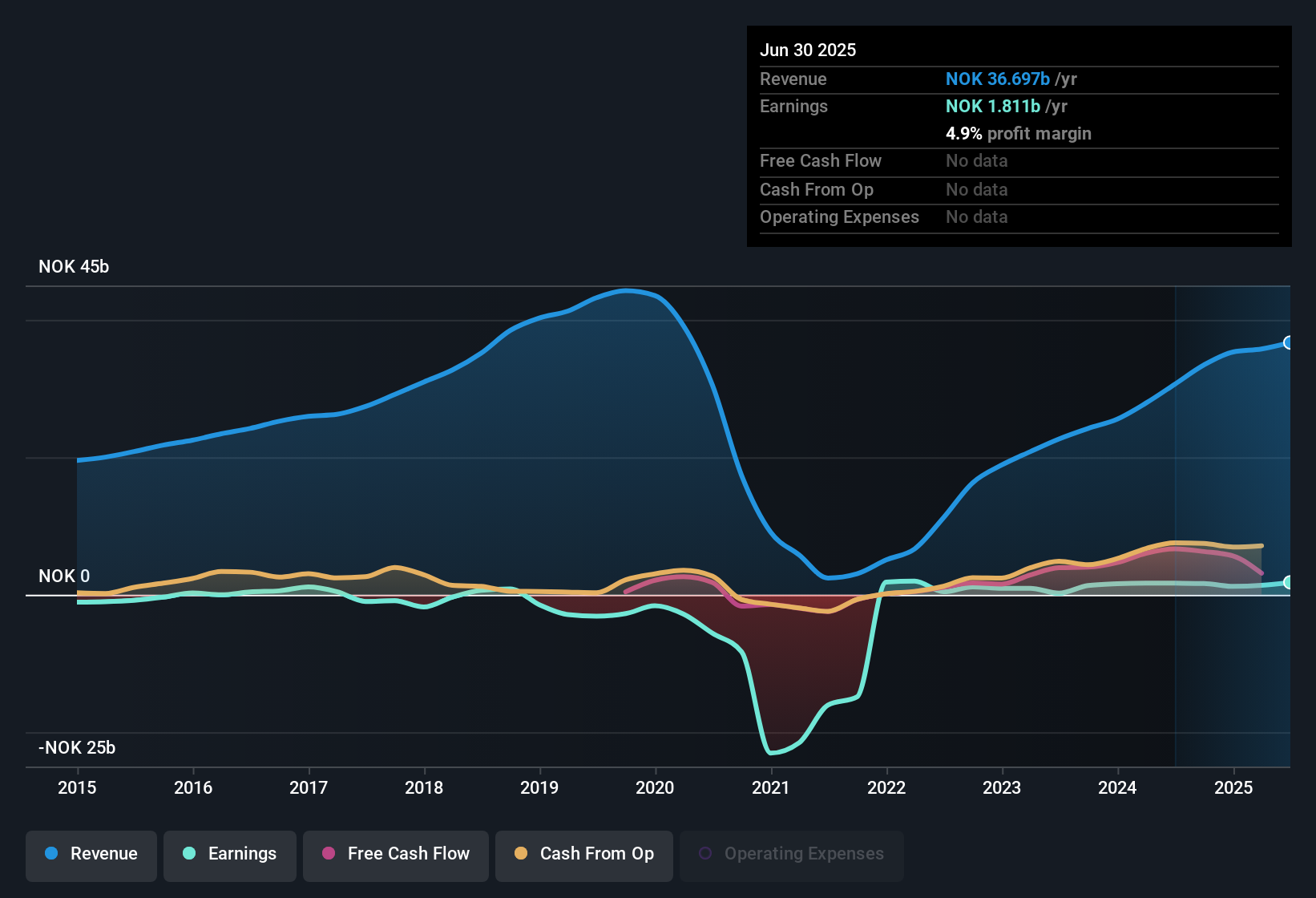

Norwegian Air Shuttle (OB:NAS) delivered robust growth in recent years, with revenue forecast to rise 6.7% annually and earnings having grown by an impressive 78.8% per year over the last five years. However, the outlook is more muted as current earnings are projected to expand by just 0.4% per year, which is well below the Norwegian market’s 13.7% expectation. Net profit margins narrowed to 4.9% from 5.5% a year ago. Despite these softer forward numbers, the company’s sustained profit growth and revenue momentum continue to highlight its story for investors.

See our full analysis for Norwegian Air Shuttle.Up next, we’ll see how these earnings results compare with the broader narratives circulating in the market and within the Simply Wall St community, spotlighting both consensus and controversy.

See what the community is saying about Norwegian Air Shuttle

Pace of Future Profit Slows Dramatically

- Analysts estimate earnings will rise to NOK 2.6 billion by September 2028, up from NOK 1.8 billion now, representing just 0.4% annual growth, which is far below the Norwegian market’s 13.7% rate.

- Analysts' consensus view supports this long-term, slow growth thesis:

- Despite a robust track record with past earnings rising 78.8% annually, consensus expects earnings growth to cool significantly and notes profit margins may only lift modestly from 4.9% today to 5.9% in three years.

- What is notable is that, even with projected revenue gains from stronger passenger numbers and new corporate contracts, analysts disagree on upside. The most optimistic see NOK 3.4 billion in earnings, while the lower range is just NOK 1.7 billion, underscoring varying conviction in the airline’s ability to reaccelerate profit.

For a balanced take on why recent results are splitting analysts, and what could shift growth higher or lower, see the detailed consensus narrative.

📊 Read the full Norwegian Air Shuttle Consensus Narrative.Profit Margins Lag Market Despite Cost Initiatives

- Norwegian Air Shuttle’s net profit margin stands at 4.9%, a step down from last year’s 5.5% and trailing the pace expected by analysts, who see only a one-point expansion over three years.

- According to the consensus narrative, operational improvements and cost-reduction programs such as Program X and synergy from the Wideroe acquisition are supposed to lift efficiency:

- Yet, margins are not improving rapidly, partly due to persistent headwinds like competition from SAS's aggressive corporate pricing and foreign exchange swings increasing costs.

- This creates tension with bullish hopes that new platforms and macroeconomic tailwinds will provide an earnings boost, as execution risks around punctuality (now at 78.4%) and fleet expansion remain front of mind for investors.

Valuation Signals: Undervalued Fundamental but Peer Premium

- The current share price of NOK 15.55 is well below the DCF fair value of NOK 63.83, suggesting the stock screens as fundamentally cheap, yet its price-to-earnings ratio of 9.1x sits above the peer group average (3.6x) while slightly undercutting the global airline industry (9.7x).

- The consensus narrative points out that analysts’ target price stands at NOK 18.08, roughly 16% upside, but there is considerable debate about whether Norwegian deserves a premium to peers:

- Bulls emphasize the airline's renewed profitability and growth in passenger numbers, but skeptics highlight concerns over financial strength, legal risks, and the need for the company to justify a future PE of 11.6x, which is above both its current ratio and the industry standard.

- This tug-of-war between perceived undervaluation and peer premium keeps investors watching both competitive dynamics and the balance sheet closely.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Norwegian Air Shuttle on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Noticing something others might miss? Share your unique view in just a few minutes and shape your own narrative: Do it your way.

A great starting point for your Norwegian Air Shuttle research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Norwegian Air Shuttle faces muted earnings growth and peer valuation concerns, with lingering questions about its ability to justify a higher price-to-earnings ratio.

If you’d prefer companies with stronger value signals and upside potential, use our these 877 undervalued stocks based on cash flows to focus on those trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norwegian Air Shuttle might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NAS

Norwegian Air Shuttle

Provides air travel services in Norway and internationally.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives