Norwegian Air Shuttle (OB:NAS): Evaluating Valuation After 35% Year-to-Date Share Price Surge

Reviewed by Kshitija Bhandaru

Norwegian Air Shuttle (OB:NAS) shares have seen some movement recently, catching the eye of investors who follow the airline sector. With shares up over 35% this year, many investors are reconsidering the company's long-term prospects.

See our latest analysis for Norwegian Air Shuttle.

This year’s impressive 35% share price return suggests investors are waking up to Norwegian Air Shuttle’s recovery story. Momentum has been building in recent months, likely reflecting improved optimism about travel demand and the company’s financial turnaround. This comes even after a tough few years for airline stocks.

If you’re looking for further ideas beyond this sector, now’s an ideal time to broaden your search and discover fast growing stocks with high insider ownership

With the stock’s rapid gains this year and a price target just above current levels, is Norwegian Air Shuttle’s recent rally leaving more room for upside, or has the market already factored in future growth prospects?

Most Popular Narrative: 10.6% Undervalued

Norwegian Air Shuttle’s most-followed narrative values the company at NOK17.3 per share, a figure that stands over 10% higher than the last close of NOK15.47. This outlook is built on expectations of improving passenger demand, new revenue streams, and increasing operational efficiency. These factors place investors’ focus on long-term earnings potential.

The growth in passenger numbers and market share in Norway, along with increasing corporate travel agreements, indicates a robust demand for Norwegian Air Shuttle's services and suggests potential revenue growth in the future. The acquisition of Wideroe and the resulting operational synergies, as well as the launch of a new distribution platform, are expected to streamline operations and enhance efficiency, potentially improving net margins.

Curious what assumptions justify this bullish price? The narrative hinges on rising profits, tighter margins, and an ambitious forward earnings multiple. There is a blueprint beneath the fair value that could surprise even seasoned airline investors. Want to see which bold financial moves drive the optimism? Dive in to see why this target is not just another analyst guess.

Result: Fair Value of NOK17.3 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Norwegian Air Shuttle faces ongoing legal uncertainties and challenges with punctuality. Both factors could limit its growth if not effectively managed.

Find out about the key risks to this Norwegian Air Shuttle narrative.

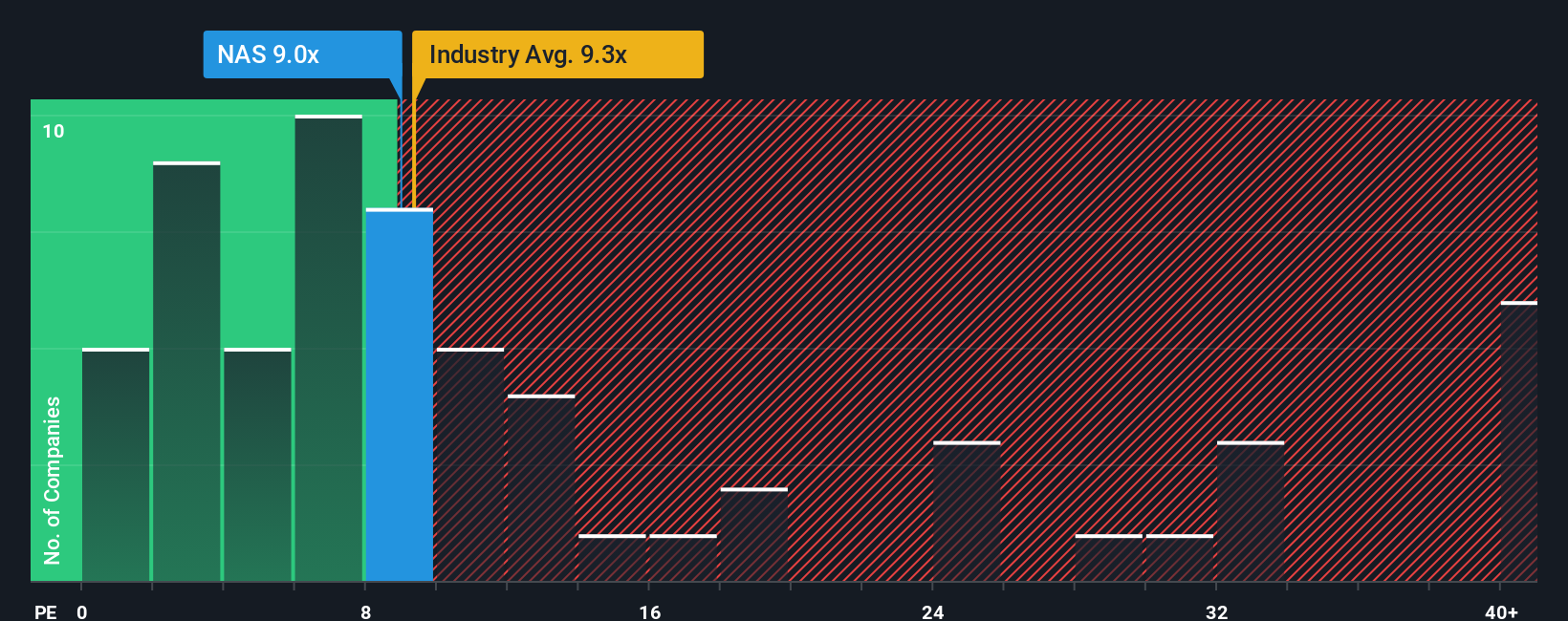

Another View: Earnings Multiple Raises Questions

While the narrative points to Norwegian Air Shuttle as undervalued, our calculation using the price-to-earnings ratio draws a more cautious picture. NAS trades at 9x earnings, which is above the peer average of 4.2x and higher than the fair ratio of 7.8x that the market could eventually approach. This wider gap might signal that investors are paying a premium and raises the risk that the current price is factoring in more optimism than reality. Is the market being too hopeful, or is there hidden value yet to be unlocked?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Norwegian Air Shuttle Narrative

If you’d rather interpret the numbers yourself or feel that your perspective differs, you can draft your own narrative in just a few minutes: Do it your way

A great starting point for your Norwegian Air Shuttle research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities slip through your fingers. Supercharge your research and get a head start with stocks that meet your interests and goals:

- Capitalize on tomorrow’s AI disruptors by checking out these 24 AI penny stocks to spot pioneers at the forefront of artificial intelligence innovation.

- Take the guesswork out of value investing by targeting these 910 undervalued stocks based on cash flows to find companies trading below their intrinsic worth.

- Boost your income stream by selecting these 19 dividend stocks with yields > 3% with robust yields and the potential for sustainable, long-term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norwegian Air Shuttle might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NAS

Norwegian Air Shuttle

Provides air travel services in Norway and internationally.

Fair value with moderate growth potential.

Market Insights

Community Narratives