- Norway

- /

- Marine and Shipping

- /

- OB:MPCC

Undiscovered Gems Three Promising Stocks To Explore In November 2024

Reviewed by Simply Wall St

As global markets react to the recent U.S. election outcomes, with small-cap indices like the Russell 2000 showing significant gains yet remaining shy of record highs, investors are keenly observing how potential policy changes might impact growth and inflation. Amidst this backdrop, identifying promising stocks requires a focus on those well-positioned to benefit from anticipated regulatory shifts and economic conditions, making them potential undiscovered gems in today's dynamic market environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 169.49% | 12.30% | 1.92% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Bouvet (OB:BOUV)

Simply Wall St Value Rating: ★★★★★★

Overview: Bouvet ASA is a consultancy firm offering IT and digital communication services to public and private sector clients in Norway, Sweden, and internationally, with a market cap of NOK7.47 billion.

Operations: Bouvet generates revenue primarily from IT and digital communication consultancy services. The company's net profit margin is 8.5%, reflecting its ability to convert a portion of its revenue into profit after expenses.

Bouvet, a nimble player in the IT sector, has shown impressive financial health with no debt for over five years and a notable earnings growth of 13.6% last year, outpacing the industry average of 1.7%. Recent results highlight this momentum, with Q3 sales reaching NOK 878.52 million and net income at NOK 77.91 million, both up from the previous year. However, recent significant insider selling could raise eyebrows among investors despite its high-quality earnings and positive free cash flow position. Earnings are projected to grow by 7.66% annually, suggesting potential for continued value creation.

- Click to explore a detailed breakdown of our findings in Bouvet's health report.

Evaluate Bouvet's historical performance by accessing our past performance report.

MPC Container Ships (OB:MPCC)

Simply Wall St Value Rating: ★★★★★★

Overview: MPC Container Ships ASA owns and operates a portfolio of container vessels with a market capitalization of NOK10.00 billion.

Operations: The primary revenue stream for MPC Container Ships comes from its container shipping segment, generating $615.23 million.

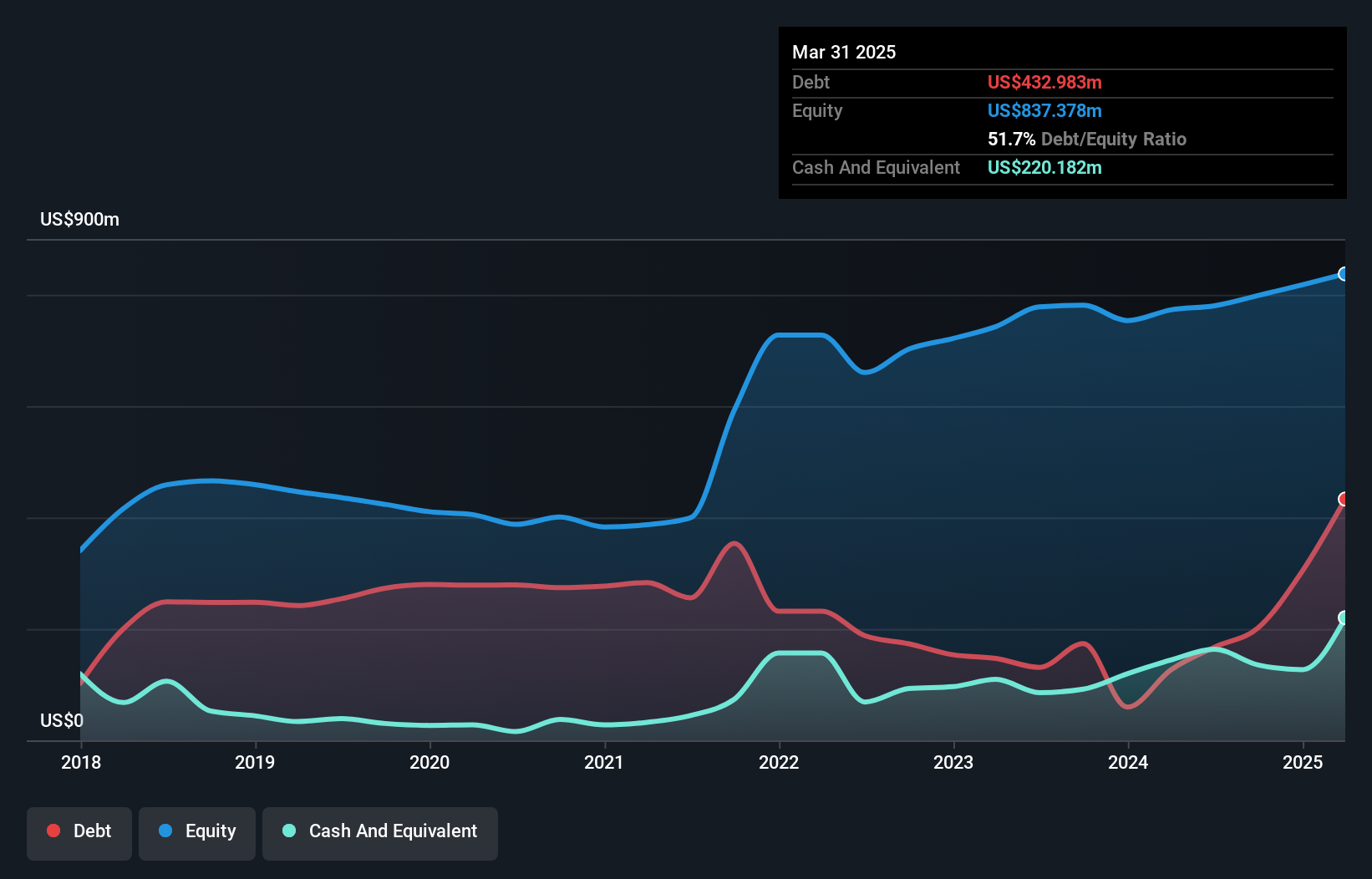

MPC Container Ships, a notable player in the shipping industry, has seen its earnings take a hit with net income dropping to US$64.8 million for Q2 2024 from US$101.44 million the previous year. Despite this, it maintains high-quality earnings and impressive interest coverage at 25.4 times EBIT against debt payments, which is robust by industry standards. The company's net profit margin decreased from 64.5% to 39.8% over the past year, reflecting challenges in market conditions but still indicating profitability strength compared to peers. With a recent $125 million bond offering and revised revenue guidance of up to $520 million for 2024, MPC seems poised for strategic growth despite current hurdles.

- Click here and access our complete health analysis report to understand the dynamics of MPC Container Ships.

Explore historical data to track MPC Container Ships' performance over time in our Past section.

TDC SOFT (TSE:4687)

Simply Wall St Value Rating: ★★★★★★

Overview: TDC SOFT Inc. is a Japanese company that offers IT consulting services, with a market cap of ¥60.53 billion.

Operations: Revenue streams for TDC SOFT primarily stem from its IT consulting services. The company reported a market cap of ¥60.53 billion, reflecting its presence in the Japanese market.

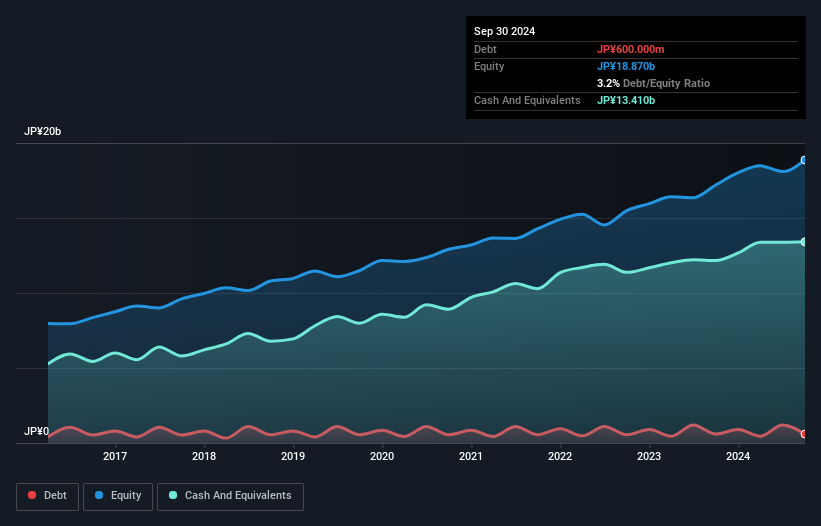

TDC SOFT, a nimble player in the tech space, is making waves with its robust financial health and strategic moves. Over the past year, its earnings surged by 37%, outpacing the broader IT industry growth of 10%. The company’s debt to equity ratio improved from 4.8 to 3.2 over five years, indicating prudent financial management. Trading at nearly 14% below fair value suggests potential upside for investors seeking value opportunities. Recent dividend adjustments reflect a proactive approach to shareholder returns following a stock split in April 2024, underscoring TDC's commitment to balancing growth with investor interests.

- Dive into the specifics of TDC SOFT here with our thorough health report.

Understand TDC SOFT's track record by examining our Past report.

Summing It All Up

- Discover the full array of 4644 Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:MPCC

Undervalued with excellent balance sheet.

Market Insights

Community Narratives