- Norway

- /

- Marine and Shipping

- /

- OB:KCC

Improved Earnings Required Before Klaveness Combination Carriers ASA (OB:KCC) Shares Find Their Feet

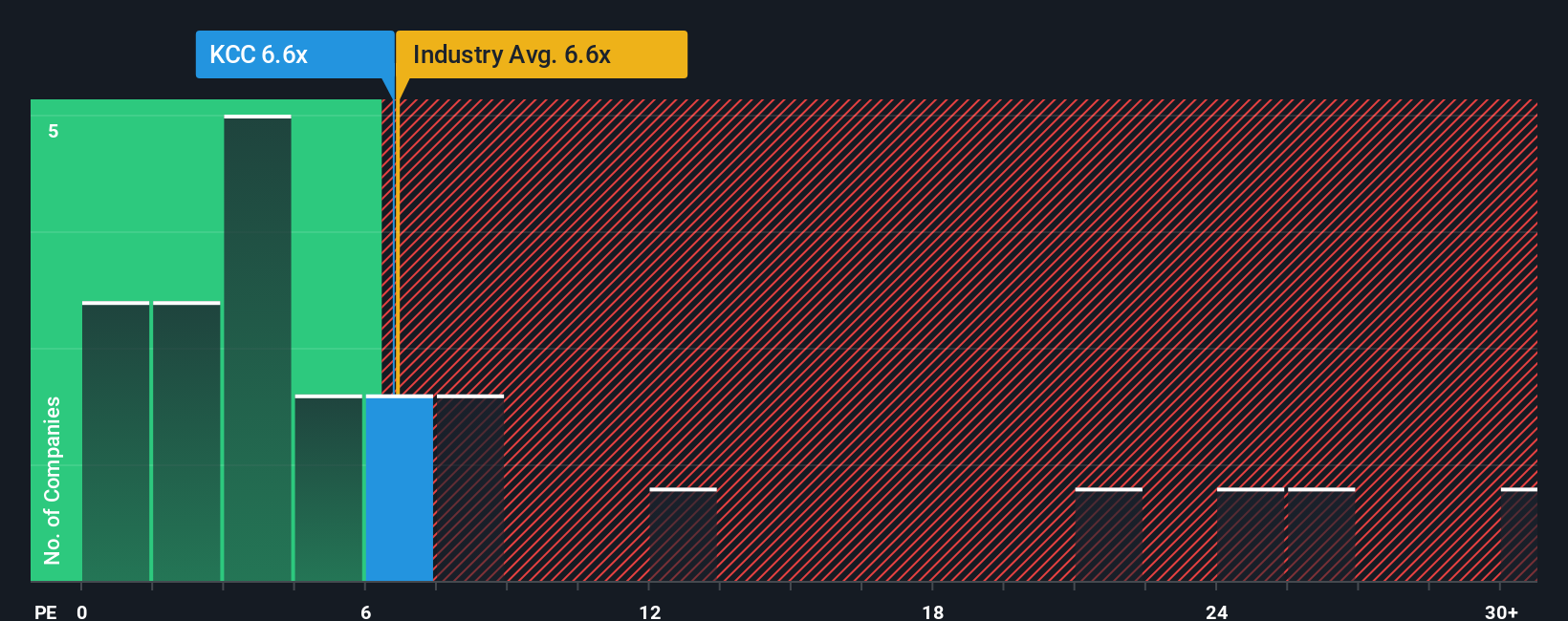

With a price-to-earnings (or "P/E") ratio of 6.6x Klaveness Combination Carriers ASA (OB:KCC) may be sending bullish signals at the moment, given that almost half of all companies in Norway have P/E ratios greater than 13x and even P/E's higher than 22x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, Klaveness Combination Carriers' earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Klaveness Combination Carriers

What Are Growth Metrics Telling Us About The Low P/E?

Klaveness Combination Carriers' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 31%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 54% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 6.7% per annum as estimated by the three analysts watching the company. With the market predicted to deliver 20% growth per annum, the company is positioned for a weaker earnings result.

With this information, we can see why Klaveness Combination Carriers is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Klaveness Combination Carriers maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Klaveness Combination Carriers that you need to be mindful of.

You might be able to find a better investment than Klaveness Combination Carriers. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Klaveness Combination Carriers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:KCC

Klaveness Combination Carriers

Owns and operates combination carriers for the dry bulk shipping and product tanker industries in the Middle East, Australia, Oceania, North East Asia, South America, North America, Europe, Africa, Southeast Asia, and South Asia.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives