- Norway

- /

- Marine and Shipping

- /

- OB:HSHP

Himalaya Shipping Ltd. (OB:HSHP) Shares Slammed 28% But Getting In Cheap Might Be Difficult Regardless

Himalaya Shipping Ltd. (OB:HSHP) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 12% in that time.

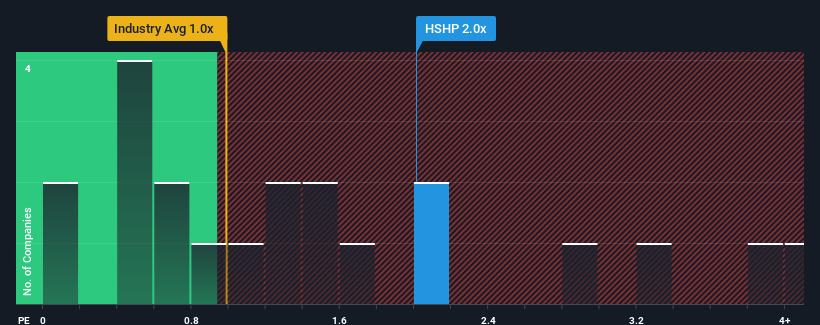

Although its price has dipped substantially, you could still be forgiven for thinking Himalaya Shipping is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2x, considering almost half the companies in Norway's Shipping industry have P/S ratios below 1.2x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Himalaya Shipping

What Does Himalaya Shipping's P/S Mean For Shareholders?

Recent times have been advantageous for Himalaya Shipping as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Himalaya Shipping will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

Himalaya Shipping's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. Although, its longer-term performance hasn't been anywhere near as strong with three-year revenue growth being relatively non-existent overall. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 30% over the next year. That's shaping up to be materially higher than the 0.9% growth forecast for the broader industry.

With this information, we can see why Himalaya Shipping is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Himalaya Shipping's P/S Mean For Investors?

Despite the recent share price weakness, Himalaya Shipping's P/S remains higher than most other companies in the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Himalaya Shipping's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

You need to take note of risks, for example - Himalaya Shipping has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Himalaya Shipping might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:HSHP

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.