Telenor (OB:TEL) Valuation in Focus as Shares Show Gradual Uptrend

Reviewed by Kshitija Bhandaru

Telenor (OB:TEL) shares have edged higher following a recent session, drawing attention to the company’s performance over the past year. Investors are considering what is driving the gradual upward trend in Telenor’s stock price.

See our latest analysis for Telenor.

While there haven’t been any headline-grabbing announcements recently, Telenor’s share price has shown steady momentum throughout the year, reflecting gradually improving investor confidence. Over the past year, the company delivered a modest 0.3% total shareholder return, suggesting that patient investors have seen stable, if unspectacular, progress.

If Telenor’s slow but steady pace has you thinking about where to find stronger momentum, it could be the right moment to broaden your search and discover fast growing stocks with high insider ownership

But with shares trading close to analyst targets and steady financials, the question remains: is Telenor undervalued and offering a hidden buying opportunity, or has the market already priced in future growth?

Price-to-Earnings of 22.1x: Is it justified?

Telenor's stock trades at a price-to-earnings (P/E) ratio of 22.1x, which positions it as more expensive than the average telecom stock in Europe. With the last close price at NOK164.9, investors are paying a marked premium for each unit of earnings compared with a typical peer.

The price-to-earnings ratio measures how much investors are willing to pay for a company's recent earnings. In capital-intensive fields like telecommunications, this multiple can highlight whether the market expects resilient profits, industry leadership, or special growth opportunities from a company.

Right now, the market is pricing in higher expectations for Telenor's future compared to the European telecom industry average of 17.9x. However, when set against its peers, Telenor looks attractively valued, as their peer group averages a significantly loftier 34.7x. Insufficient data is available to compare this with a calculated "fair" ratio, so it is difficult to know if the market could pivot even further.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 22.1x (OVERVALUED)

However, slow revenue growth and recent short-term share dips could challenge the optimism and test investor patience if momentum does not improve soon.

Find out about the key risks to this Telenor narrative.

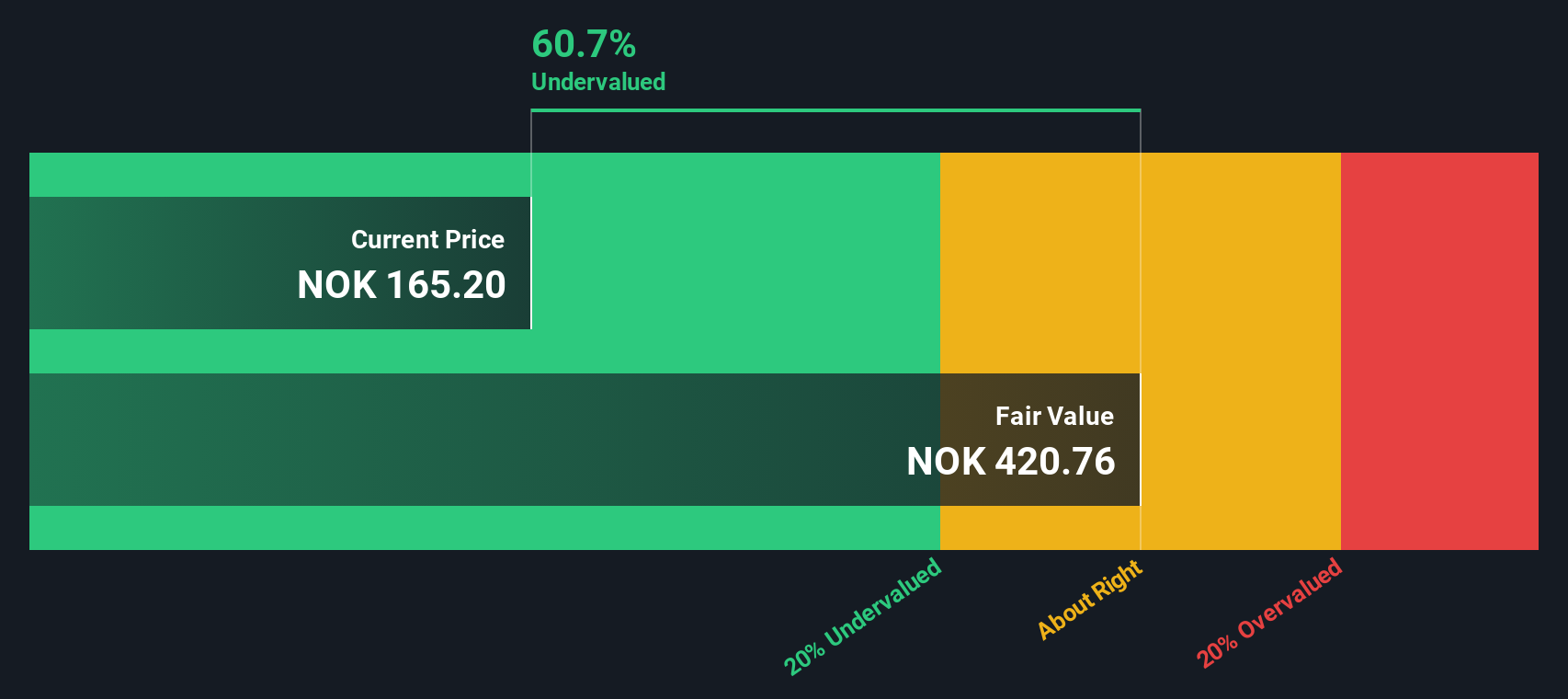

Another View: Discounted Cash Flow Points to Deep Value

While the price-to-earnings ratio signals that Telenor looks pricey compared to industry peers, our DCF model offers a different perspective. With shares trading around NOK164.9 and a DCF-derived fair value estimate closer to NOK420.76, this analysis suggests the stock could be significantly undervalued. Could the market be underestimating Telenor’s actual worth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Telenor for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Telenor Narrative

If you have a different perspective or prefer crunching the numbers yourself, you can easily build your own narrative in just a few minutes using our tools. Do it your way

A great starting point for your Telenor research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your options to just one stock. Let the Simply Wall Street Screener open the door to returns you may not have considered yet.

- Boost your passive income by targeting reliable opportunities with these 19 dividend stocks with yields > 3%, featuring yields above 3% from proven performers.

- Tap into the future of medicine and discover innovation through these 31 healthcare AI stocks, where healthcare meets artificial intelligence for the next generation of growth.

- Capitalize on tomorrow’s potential by seeking out value with these 901 undervalued stocks based on cash flows, which offer strong cash flow at attractive prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telenor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:TEL

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives