- Norway

- /

- Wireless Telecom

- /

- OB:AINMT

Some Ice Group (OB:ICE) Shareholders Have Taken A Painful 79% Share Price Drop

The art and science of stock market investing requires a tolerance for losing money on some of the shares you buy. But it's not unreasonable to try to avoid truly shocking capital losses. So spare a thought for the long term shareholders of Ice Group ASA (OB:ICE); the share price is down a whopping 79% in the last twelve months. That'd be enough to make even the strongest stomachs churn. To make matters worse, the returns over three years have also been really disappointing (the share price is 69% lower than three years ago). But it's up 5.0% in the last week.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

View our latest analysis for Ice Group

Ice Group isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Ice Group saw its revenue grow by 26%. That's definitely a respectable growth rate. However, it seems like the market wanted more, since the share price is down 79%. One fear might be that the company might be losing too much money and will need to raise more. It seems that the market has concerns about the future, because that share price action does not seem to reflect the revenue growth at all.

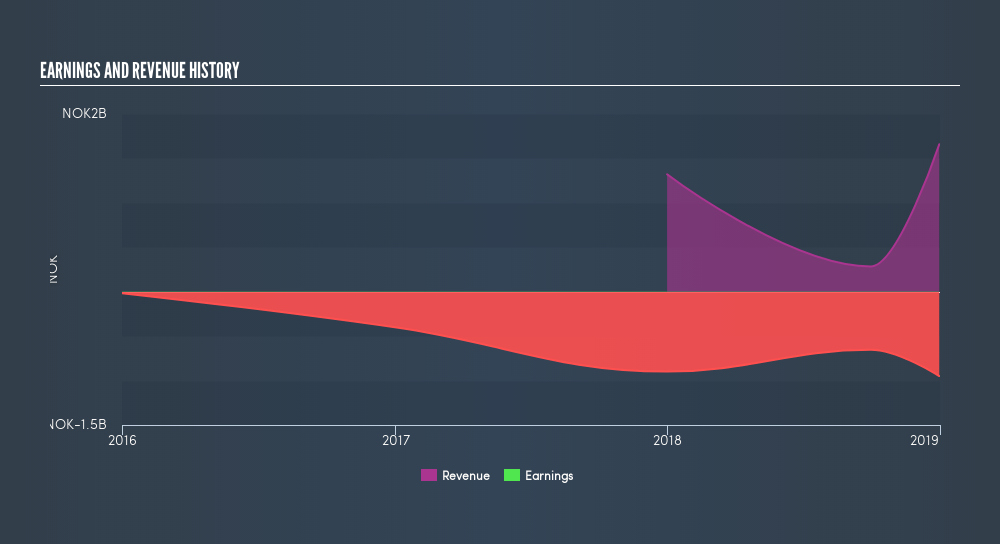

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

This free interactive report on Ice Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Ice Group shareholders are down 79% for the year, but the broader market is up 0.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Shareholders have lost 32% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. You could get a better understanding of Ice Group's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

But note: Ice Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NO exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OB:AINMT

AINMT

AINMT ASA provides telecommunications services in Norway and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives