Here's Why I Think StrongPoint (OB:STRO) Is An Interesting Stock

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like StrongPoint (OB:STRO), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for StrongPoint

How Fast Is StrongPoint Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. Impressively, StrongPoint has grown EPS by 32% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

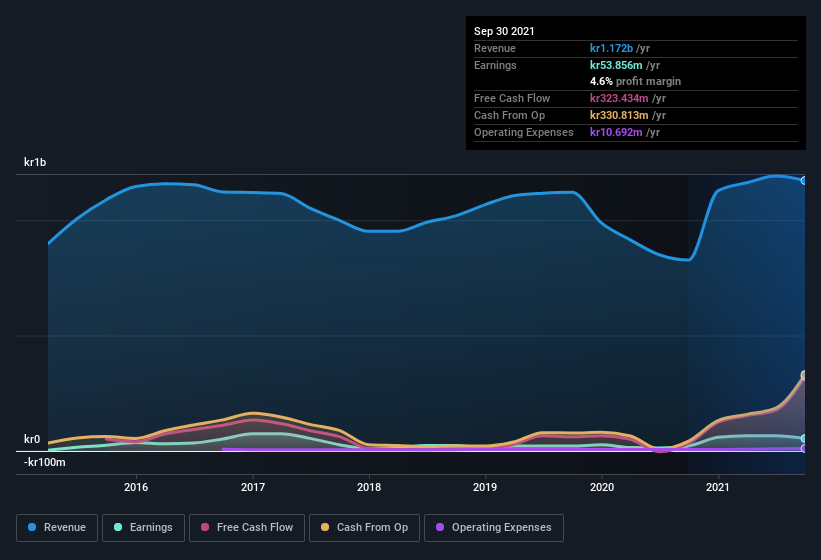

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. On the one hand, StrongPoint's EBIT margins fell over the last year, but on the other hand, revenue grew. So it seems the future my hold further growth, especially if EBIT margins can stabilize.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for StrongPoint.

Are StrongPoint Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's good to see StrongPoint insiders walking the walk, by spending kr3.8m on shares in just twelve months. When you contrast that with the complete lack of sales, it's easy for shareholders to brim with joyful expectancy. Zooming in, we can see that the biggest insider purchase was by Chairman of the Board Morthen Johannessen for kr479k worth of shares, at about kr31.91 per share.

The good news, alongside the insider buying, for StrongPoint bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold kr126m worth of its stock. That's a lot of money, and no small incentive to work hard. Those holdings account for over 11% of the company; visible skin in the game.

Does StrongPoint Deserve A Spot On Your Watchlist?

For growth investors like me, StrongPoint's raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant stake in the company and have been buying more shares. So I do think this is one stock worth watching. We should say that we've discovered 1 warning sign for StrongPoint that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of StrongPoint, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:STRO

StrongPoint

Engages in the development, sale, and implementation of integrated technology solutions to retailers in Scandinavia and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion