As European markets experience a wave of optimism with the pan-European STOXX Europe 600 Index rising by 0.90% amid easing inflation and supportive monetary policy from the European Central Bank, investors are keenly exploring opportunities in lesser-known stocks that may benefit from these favorable conditions. In this environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding, especially as economic indicators suggest a resilient backdrop for select small-cap companies across the region.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Dekpol | 63.20% | 11.06% | 13.37% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Philogen (BIT:PHIL)

Simply Wall St Value Rating: ★★★★★★

Overview: Philogen S.p.A. is a biotechnology company focused on developing drugs for oncology and chronic inflammatory diseases, with a market capitalization of approximately €1.11 billion.

Operations: Philogen's revenue stems entirely from its biotechnologies segment, generating €77.65 million.

Philogen, a biotech company, has recently turned profitable with net income reaching €45.29 million in 2024 compared to a net loss of €6.16 million the previous year. The company's debt-to-equity ratio impressively decreased from 1.7% to 0.03% over five years, indicating improved financial stability. Although earnings are forecasted to drop by an average of 63% annually over the next three years, Philogen's interest payments are comfortably covered by EBIT at 423 times coverage, suggesting strong operational efficiency. Additionally, it commenced a share repurchase program aimed at enhancing liquidity and strategic flexibility in May 2025.

- Click here to discover the nuances of Philogen with our detailed analytical health report.

Evaluate Philogen's historical performance by accessing our past performance report.

Faes Farma (BME:FAE)

Simply Wall St Value Rating: ★★★★★★

Overview: Faes Farma, S.A. is a global company engaged in the research, development, production, and marketing of pharmaceutical and healthcare products as well as raw materials, with a market cap of €1.43 billion.

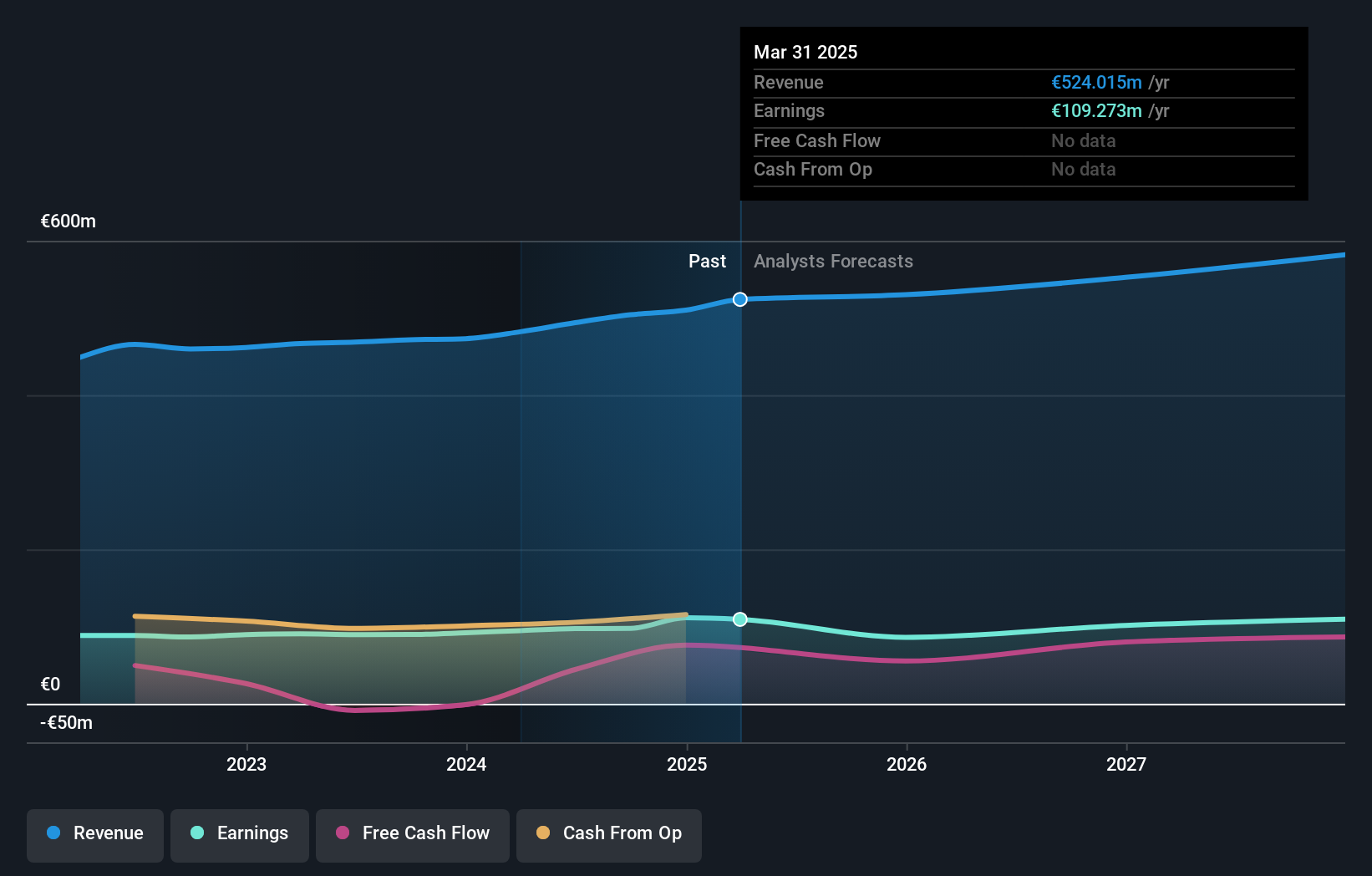

Operations: Faes Farma generates revenue through the sale of pharmaceutical and healthcare products, along with raw materials. The company's net profit margin has shown notable variation over recent periods.

Faes Farma, a nimble player in the pharmaceutical sector, has shown consistent growth with earnings increasing 8.2% annually over the past five years. Despite a one-off gain of €178.8M impacting recent results, its financial health remains robust with a debt-to-equity ratio reduced from 4.5 to 3.6 over five years and more cash than total debt. Recent Q1 results revealed sales of €145.57M and net income of €28.38M, slightly lower than last year’s €30.47M but still competitive in value terms at 16% below estimated fair value amidst industry peers.

Norbit (OB:NORBT)

Simply Wall St Value Rating: ★★★★★☆

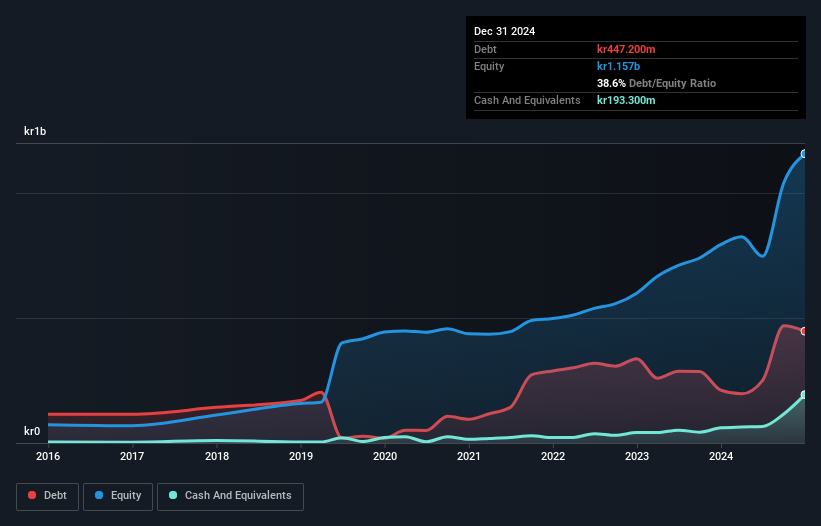

Overview: Norbit ASA offers technology solutions across various industries and has a market capitalization of NOK 13.60 billion.

Operations: Norbit ASA generates revenue through its Oceans, Connectivity, and Product Innovation and Realization (PIR) segments, with the Oceans segment contributing NOK 855.20 million and PIR adding NOK 558.50 million. The gross profit margin trend is notable for its fluctuations over recent periods.

Norbit's recent performance has been notable, with earnings surging by 85% over the past year, outpacing the electronic industry average. The company's net debt to equity ratio stands at a satisfactory 15.5%, and its interest payments are well covered by EBIT at 13.3 times, indicating financial stability. Norbit trades at a significant discount of 35% below its estimated fair value, presenting potential investment appeal. Recent strategic moves include securing contracts worth NOK 125 million in defense and security sectors and announcing a dividend of NOK 3 per share, underscoring robust growth prospects despite potential challenges like supply chain issues and regulatory uncertainties in the EU market.

Taking Advantage

- Take a closer look at our European Undiscovered Gems With Strong Fundamentals list of 333 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:FAE

Faes Farma

Researches, develops, produces, and markets pharmaceutical products, healthcare products, and raw materials internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives