- Sweden

- /

- Capital Markets

- /

- OM:FLAT B

Undiscovered Gems in Europe to Explore December 2025

Reviewed by Simply Wall St

As the European markets show signs of steady economic growth and benefit from looser monetary policies, the pan-European STOXX Europe 600 Index has risen by 1.60%, reflecting a positive sentiment across major stock indexes like Italy's FTSE MIB and the UK's FTSE 100. In this environment, where central banks such as the ECB maintain stable rates amidst cautious optimism, identifying promising small-cap stocks can be particularly rewarding for investors seeking to capitalize on under-the-radar opportunities in Europe's dynamic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 5.37% | 4.80% | 13.56% | ★★★★★★ |

| Evergent Investments | 3.63% | 11.51% | 22.05% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Dn Agrar Group | NA | 29.02% | 36.03% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Bonheur (OB:BONHR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bonheur ASA, with a market cap of NOK10.82 billion, operates in the renewable energy, wind service, and cruise industries across various regions including the United Kingdom, Norway, Europe, Asia, the Americas, Africa, and internationally.

Operations: Bonheur ASA generates revenue primarily from its wind service segment at NOK5.09 billion and cruise operations at NOK3.78 billion, with additional income from renewable energy amounting to NOK2.56 billion.

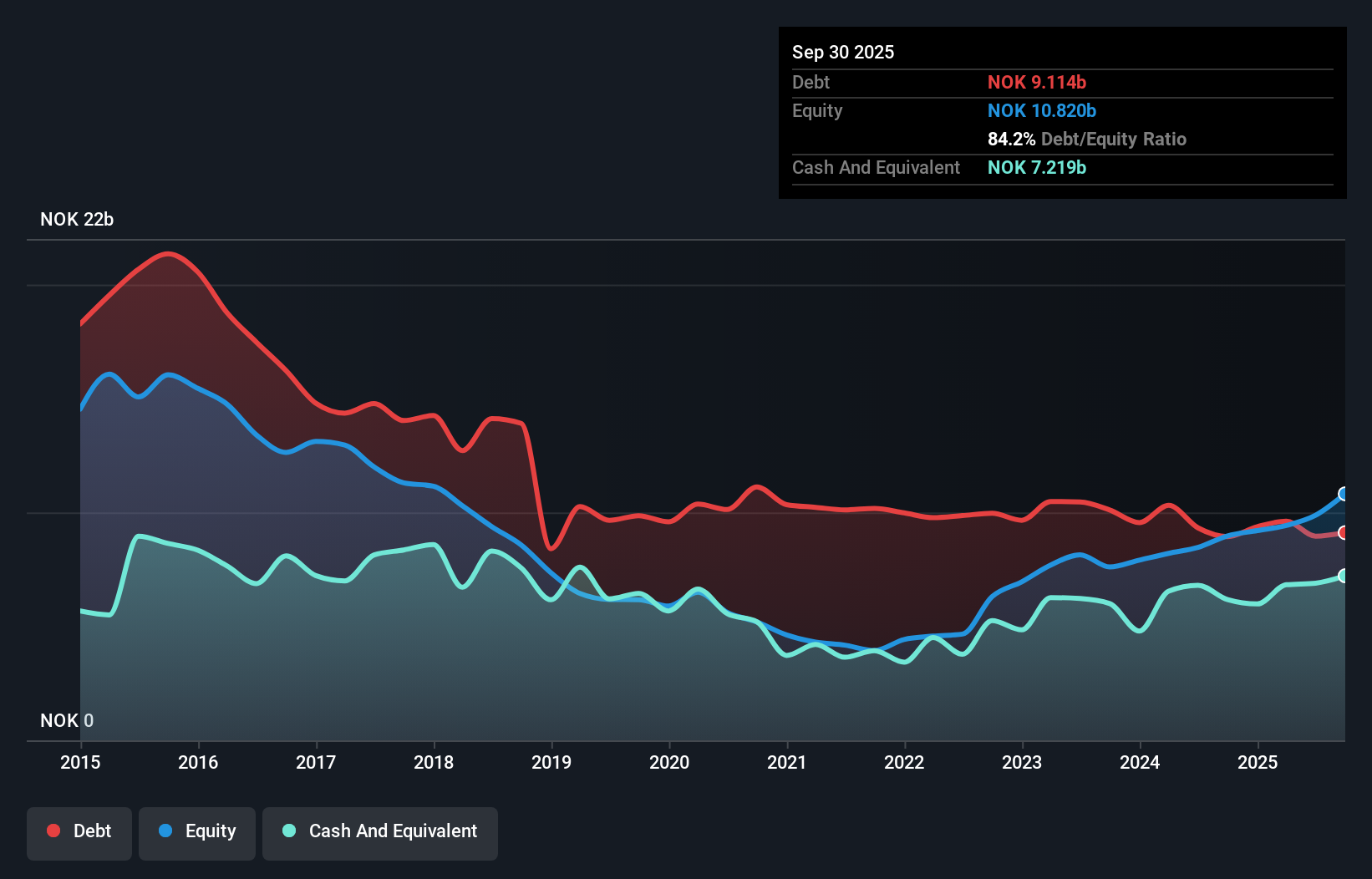

Bonheur, a dynamic player in the Industrials sector, has shown impressive earnings growth of 19.5% over the past year, outpacing the industry's 8.5%. The company's net debt to equity ratio stands at a satisfactory 17.5%, and its interest payments are well covered by EBIT at 9.2 times. Despite sales dipping to NOK 3,406 million from NOK 3,606 million year-over-year for Q3, net income surged to NOK 461 million from NOK 271 million. Trading at nearly three-quarters below estimated fair value suggests potential upside; however, future earnings are forecasted to decline by an average of 7.2% annually over the next three years.

- Click here to discover the nuances of Bonheur with our detailed analytical health report.

Review our historical performance report to gain insights into Bonheur's's past performance.

Norbit (OB:NORBT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Norbit ASA is a technology solutions provider serving various industries, with a market capitalization of NOK11.57 billion.

Operations: Norbit ASA's revenue primarily stems from its Oceans, Connectivity, and Product Innovation and Realization (PIR) segments, with Oceans contributing NOK933.50 million and PIR adding NOK826.90 million. The company has a market capitalization of NOK11.57 billion.

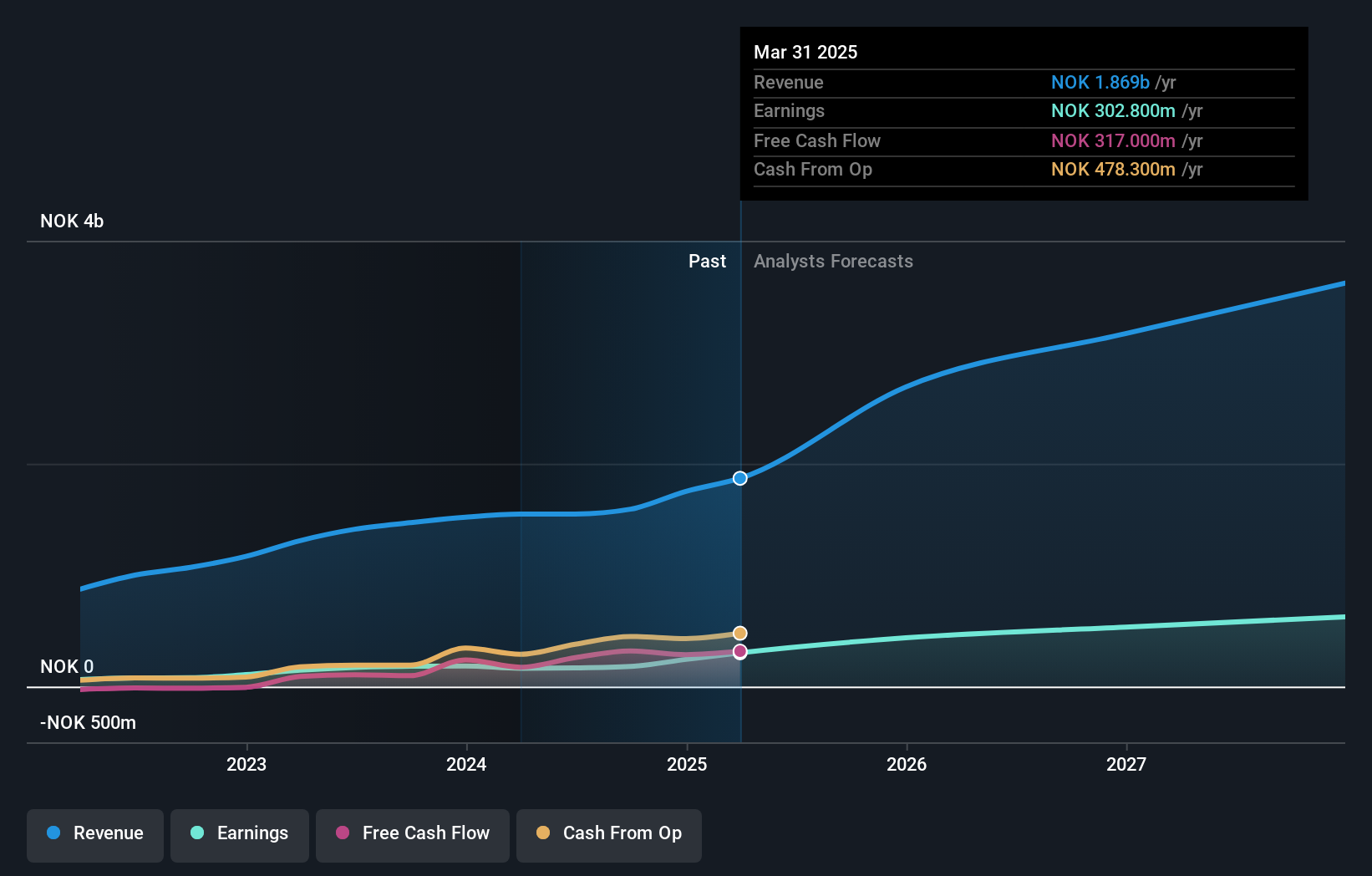

Norbit has shown impressive growth, with earnings surging 110% over the past year, outpacing the broader electronics industry. Its net debt to equity ratio stands at a satisfactory 25.6%, indicating sound financial management despite a rise in overall debt from 23.4% to 37.1% over five years. The company is trading at a value that's approximately 10% below its fair estimate, suggesting potential upside for investors. Recent orders worth NOK 160 million and NOK 120 million highlight strong demand in key sectors, while future revenue projections between NOK 2.5 billion and NOK 2.6 billion underscore positive momentum moving forward.

- Unlock comprehensive insights into our analysis of Norbit stock in this health report.

Gain insights into Norbit's historical performance by reviewing our past performance report.

Flat Capital (OM:FLAT B)

Simply Wall St Value Rating: ★★★★★★

Overview: Flat Capital AB (publ) is an investment company that targets entrepreneurial ventures globally, with a market cap of SEK7.61 billion.

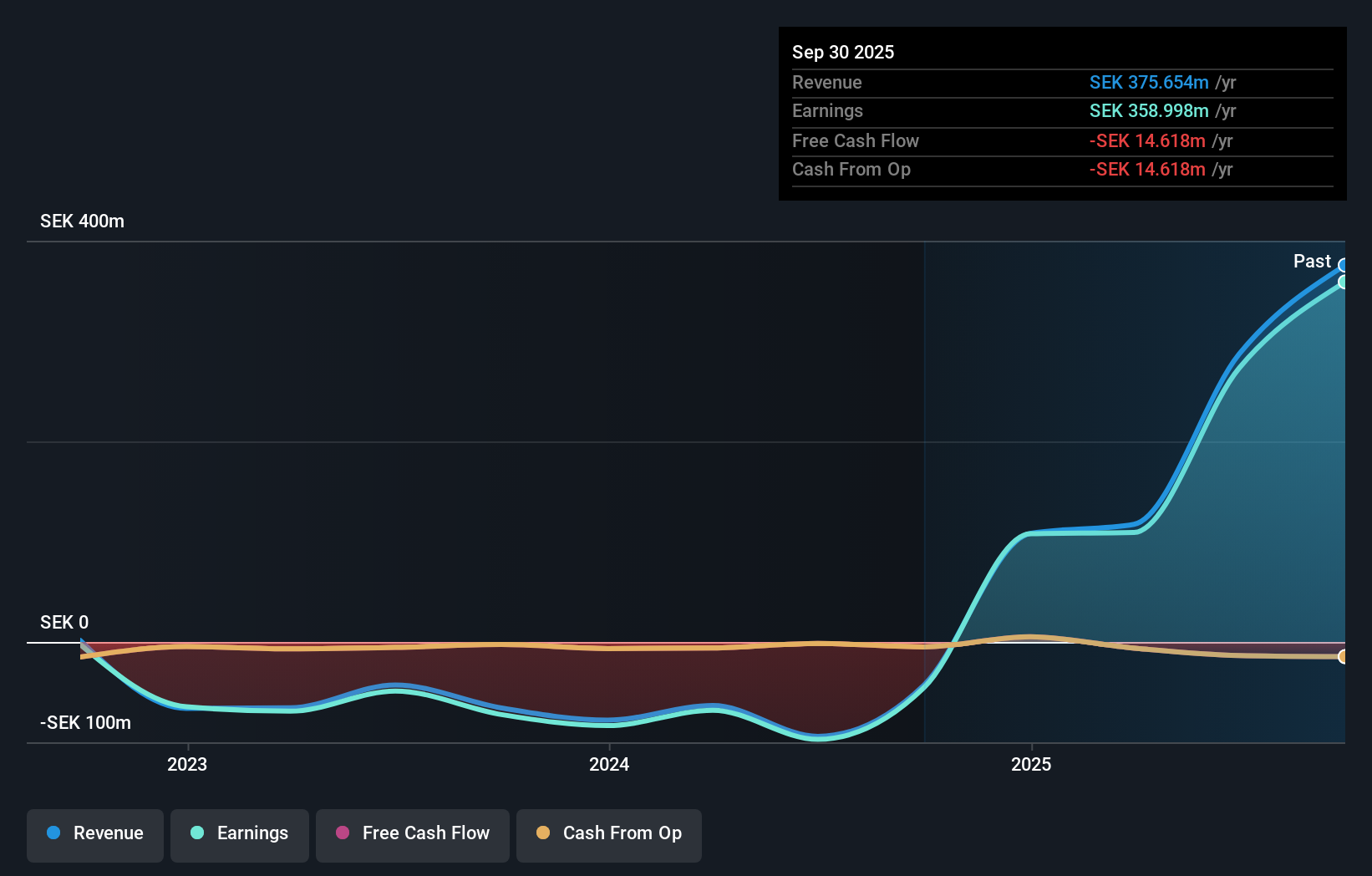

Operations: Flat Capital AB (publ) generates revenue primarily from its venture capital activities, amounting to SEK375.65 million. The company's financial performance includes a focus on net profit margin trends, which provide insight into its profitability dynamics.

Flat Capital, a nimble player in the market, has recently turned profitable, marking a significant shift from its previous performance. With no debt on its books now compared to a 10% debt-to-equity ratio five years ago, it boasts financial stability. Its price-to-earnings ratio of 21.2x is slightly below the Swedish market average of 21.7x, suggesting potential value for investors. Recent earnings show impressive growth with third-quarter revenue jumping to SEK 112.63 million from SEK 22.86 million last year and net income leaping to SEK 108.54 million from SEK 22.48 million previously, reflecting robust operational improvements and strategic maneuvers like Cicero Fonder AB's recent stake acquisition enhancing its profile further in the investment community.

- Click here and access our complete health analysis report to understand the dynamics of Flat Capital.

Examine Flat Capital's past performance report to understand how it has performed in the past.

Key Takeaways

- Get an in-depth perspective on all 309 European Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FLAT B

Flat Capital

Operates as an investment company that focuses on companies with various entrepreneurs worldwide.

Flawless balance sheet with acceptable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion