3 Global Stocks Estimated To Be Trading Below Fair Value In May 2025

Reviewed by Simply Wall St

As global markets react positively to the recent U.S.-China tariff suspension, with major indices such as the Nasdaq Composite and S&P 500 showing significant gains, investors are keenly observing how these developments might influence broader economic trends. Amidst easing inflationary pressures and shifting consumer sentiment, identifying stocks that are potentially undervalued becomes particularly relevant for those looking to capitalize on market inefficiencies. In this context, a good stock is often characterized by strong fundamentals and a valuation that suggests it is trading below its intrinsic worth, offering potential for growth as market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shenzhen KSTAR Science and Technology (SZSE:002518) | CN¥22.66 | CN¥45.07 | 49.7% |

| Zhuhai CosMX Battery (SHSE:688772) | CN¥13.50 | CN¥26.95 | 49.9% |

| Brangista (TSE:6176) | ¥591.00 | ¥1174.50 | 49.7% |

| Lectra (ENXTPA:LSS) | €23.70 | €46.94 | 49.5% |

| Kolmar Korea (KOSE:A161890) | ₩85200.00 | ₩168919.13 | 49.6% |

| Boreo Oyj (HLSE:BOREO) | €15.45 | €30.61 | 49.5% |

| Montana Aerospace (SWX:AERO) | CHF19.92 | CHF39.83 | 50% |

| Kanto Denka Kogyo (TSE:4047) | ¥833.00 | ¥1650.53 | 49.5% |

| 3U Holding (XTRA:UUU) | €1.525 | €3.03 | 49.7% |

| SpiderPlus (TSE:4192) | ¥462.00 | ¥918.79 | 49.7% |

Here's a peek at a few of the choices from the screener.

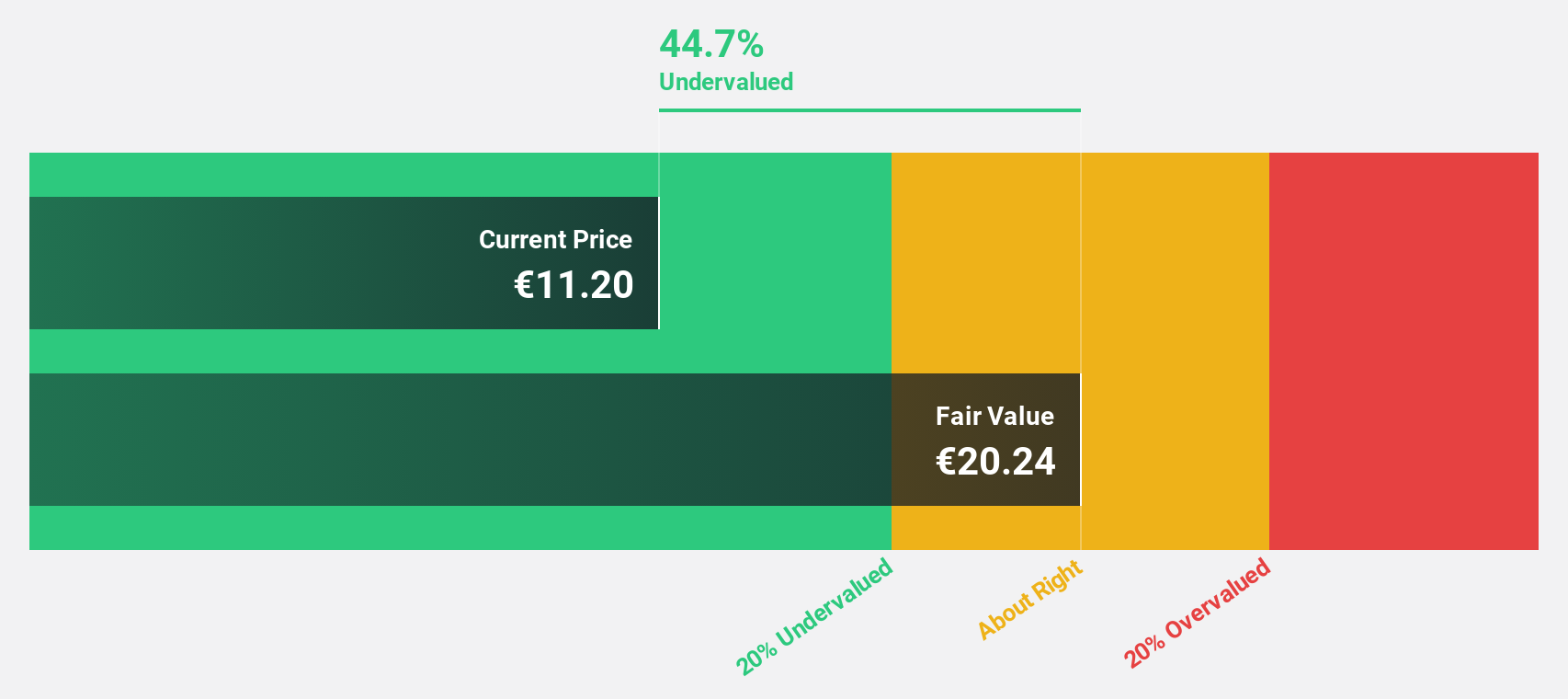

Almirall (BME:ALM)

Overview: Almirall, S.A. is a biopharmaceutical company specializing in skin health, operating across various regions including Spain, Europe, the Middle East, the United States, Asia, and Africa with a market cap of €2.23 billion.

Operations: Almirall generates its revenue from its focus on dermatological products and treatments across multiple regions including Europe, the United States, and other international markets.

Estimated Discount To Fair Value: 26.5%

Almirall is trading at €10.46, significantly below its estimated fair value of €14.23, indicating potential undervaluation based on discounted cash flow analysis. Despite a low forecasted return on equity of 9.5% in three years, earnings are expected to grow at 32.87% annually, outpacing the Spanish market's growth rate. Recent earnings reports show strong performance with Q1 net income rising to €21.6 million from €7.4 million last year, supporting positive future prospects despite share price volatility and one-off financial impacts.

- The growth report we've compiled suggests that Almirall's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Almirall.

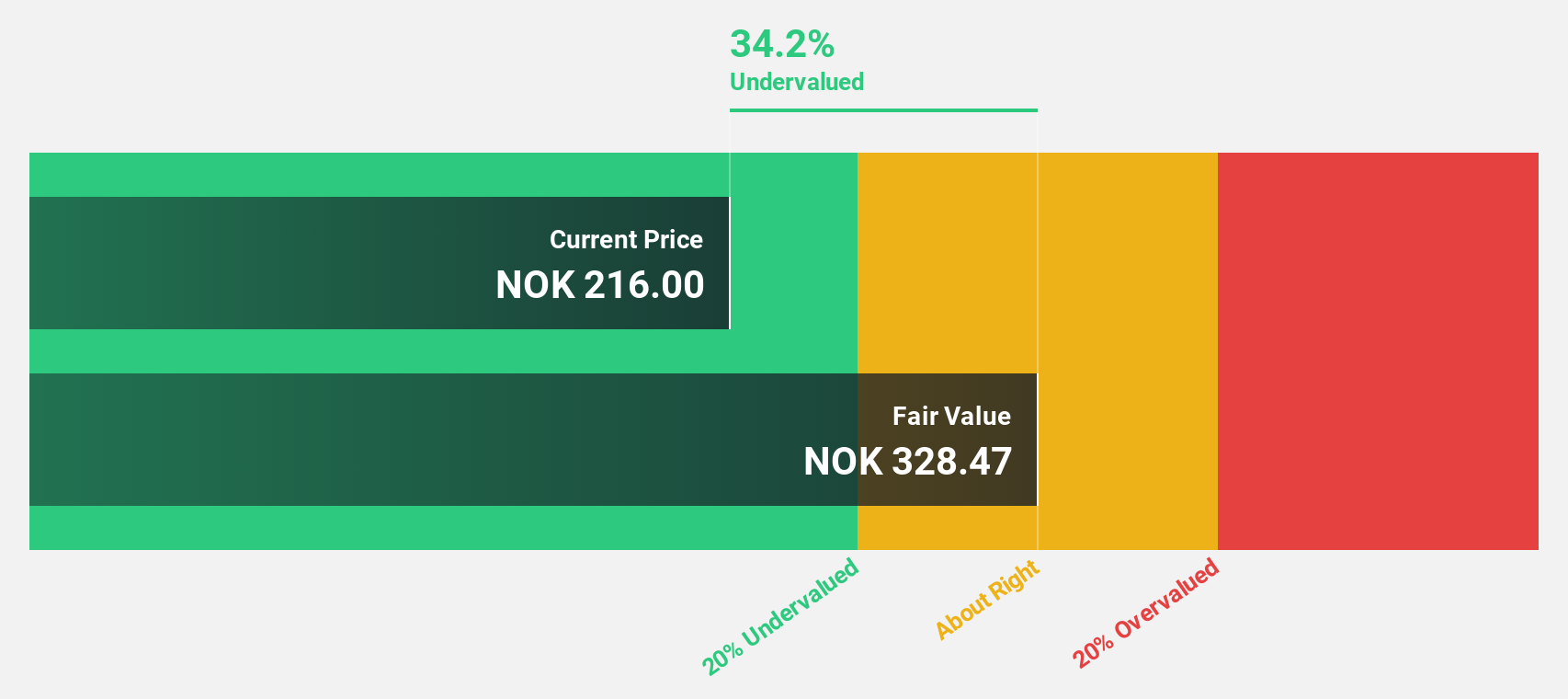

Norbit (OB:NORBT)

Overview: Norbit ASA offers technology solutions across various industries and has a market capitalization of NOK12.42 billion.

Operations: Revenue Segments (in millions of NOK):

Estimated Discount To Fair Value: 41.9%

Norbit ASA is trading at NOK 195.2, significantly below its estimated fair value of NOK 335.92, highlighting potential undervaluation based on discounted cash flow analysis. Despite insider selling, the company's earnings grew by 85.1% last year and are forecasted to grow at 23.4% annually, surpassing the Norwegian market's growth rate. Recent Q1 results show strong performance with net income rising to NOK 89.7 million from NOK 30.2 million a year ago, supporting positive future prospects amidst new contracts and strategic growth initiatives.

- The analysis detailed in our Norbit growth report hints at robust future financial performance.

- Navigate through the intricacies of Norbit with our comprehensive financial health report here.

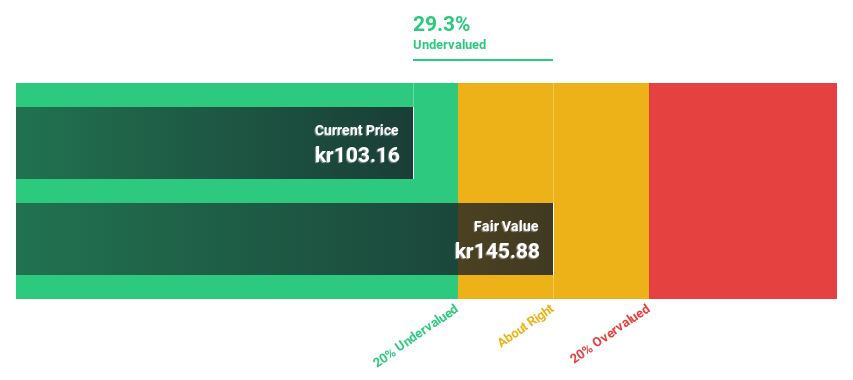

Asmodee Group (OM:ASMDEE B)

Overview: Asmodee Group AB (publ) is involved in the publishing and distribution of tabletop games, with a market capitalization of SEK29.55 billion.

Operations: The company generates revenue primarily from its Games & Toys segment, amounting to €1.30 billion.

Estimated Discount To Fair Value: 15.1%

Asmodee Group AB is trading at SEK 126.44, below its estimated fair value of SEK 148.86, suggesting undervaluation based on cash flows. Although revenue grew by 2.8% last year and is forecast to grow at a modest 5.5% annually, earnings are expected to increase significantly by 68.03% per year over the next three years, outpacing market growth expectations despite a low future return on equity forecast of 8%.

- Our comprehensive growth report raises the possibility that Asmodee Group is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Asmodee Group stock in this financial health report.

Seize The Opportunity

- Discover the full array of 507 Undervalued Global Stocks Based On Cash Flows right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ASMDEE B

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion