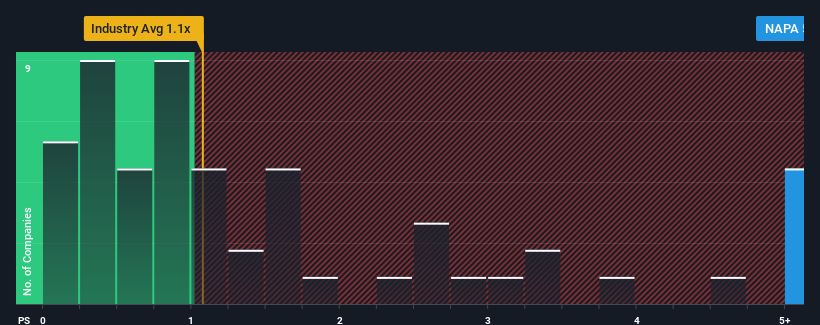

Napatech A/S' (OB:NAPA) price-to-sales (or "P/S") ratio of 5.4x may look like a poor investment opportunity when you consider close to half the companies in the Communications industry in Norway have P/S ratios below 1.1x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Napatech

How Napatech Has Been Performing

Napatech hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Napatech's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

Napatech's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's top line. As a result, revenue from three years ago have also fallen 19% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 37% during the coming year according to the lone analyst following the company. Meanwhile, the broader industry is forecast to contract by 0.8%, which would indicate the company is doing very well.

In light of this, it's understandable that Napatech's P/S sits above the majority of other companies. At this time, shareholders aren't keen to offload something that is potentially eyeing a much more prosperous future.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we anticipated, our review of Napatech's analyst forecasts shows that the company's better revenue forecast compared to a turbulent industry is a significant contributor to its high price-to-sales ratio. Outperforming the industry in this manner looks to have provided investors with a bit of confidence that the future will be bright, bolstering the P/S. We still remain cautious about the company's ability to keep swimming against the current of the broader industry turmoil. Assuming the company's outlook remains unchanged, the share price is likely to be supported by prospective buyers.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Napatech, and understanding should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Napatech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:NAPA

Napatech

Provides programmable smart network interface cards and infrastructure processing units for cloud, enterprise, and telecom datacenter networks in the Americas and internationally.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives