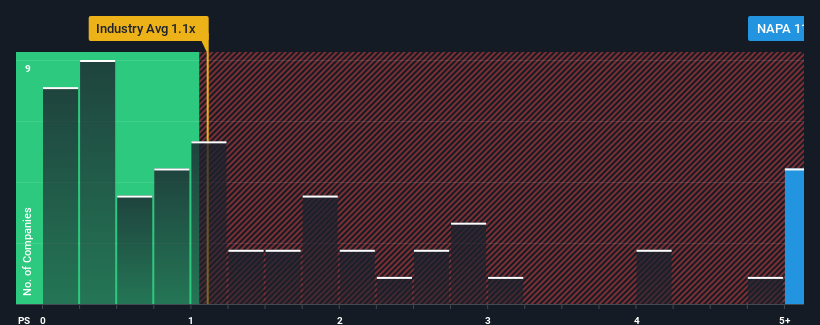

When close to half the companies in the Communications industry in Norway have price-to-sales ratios (or "P/S") below 1.1x, you may consider Napatech A/S (OB:NAPA) as a stock to avoid entirely with its 11.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Napatech

What Does Napatech's Recent Performance Look Like?

Recent times have been pleasing for Napatech as its revenue has risen in spite of the industry's average revenue going into reverse. The P/S ratio is probably high because investors think the company will continue to navigate the broader industry headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Napatech.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Napatech's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 4.5%. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 20% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 48% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 3.9%, which is noticeably less attractive.

With this information, we can see why Napatech is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Napatech's P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Napatech shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Napatech (at least 1 which is concerning), and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Napatech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:NAPA

Napatech

Provides programmable smart network interface cards and infrastructure processing units for cloud, enterprise, and telecom datacenter networks in the Americas and internationally.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion