Kitron (OB:KIT) Margin Miss Reinforces Valuation Concerns Despite Strong Growth Outlook

Reviewed by Simply Wall St

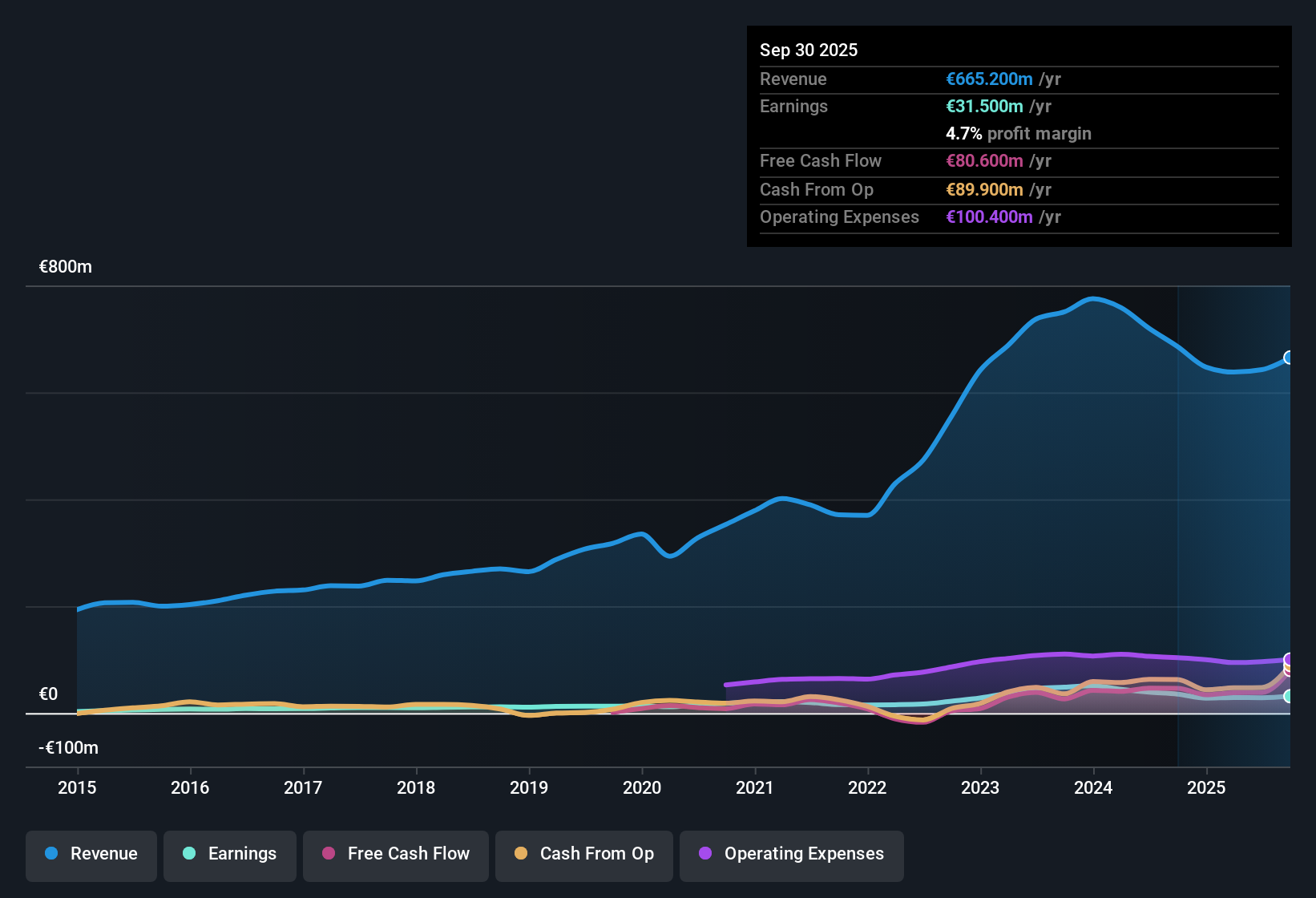

Kitron (OB:KIT) saw its net profit margin slip to 4.5% from 5.4% last year, reflecting a dip in profitability. While earnings declined year over year, forecasts point to a sharp rebound with earnings set to climb 18.26% per year and revenue projected to gain 14% annually. This is well above the 3.9% pace expected for the broader Norwegian market. Despite elevated valuation multiples relative to industry peers, strong growth forecasts on both top and bottom lines remain a key draw for investors.

See our full analysis for Kitron.Next up, we’ll see how these headline numbers measure up against the stories and narratives that investors and the Simply Wall St community are watching most closely.

See what the community is saying about Kitron

Margins Lag Despite Order Backlog

- Analysts expect profit margins to improve from 4.5% currently to 7.0% in three years, highlighting room for operational leverage as the company scales up its Defense & Aerospace contracts and expanded facilities across Norway, Sweden, the EU, and the U.S.

- Analysts’ consensus view notes that while the order backlog grew 11% sequentially, powered by Defense & Aerospace wins and new capacity ramp-ups, gross margin remains pressured by dependence on low-margin defense deals and high input costs.

- Consensus also points out that analysts are forecasting significant margin gains, but these assumptions hinge on sustaining cost controls despite the exposure to high material costs and volatile sector demand.

- Recent declines in Asia demand and medical device revenues could make achieving targeted margin expansion harder if these headwinds persist, putting some tension on the bullish growth case.

- To see how analysts weigh Kitron’s backlog growth against margin risks, read the balanced take in the Consensus Narrative. 📊 Read the full Kitron Consensus Narrative.

Valuation: Discounted Cash Flow vs. Peer Multiples

- Kitron’s share price of 70.25 NOK trades well below its DCF fair value estimate of 124.35 NOK. However, its price-to-earnings ratio of 42.1x remains above both the peer average of 37.5x and the broader European Electronic industry average of 25.5x.

- Analysts’ consensus view underscores a key tension: while Kitron looks undervalued versus its DCF fair value, it screens expensive on traditional earnings multiples, suggesting the market is pricing in aggressive growth expectations.

- The current price sits 9.9% above the analyst price target of 63.92 NOK, challenging the idea of undervaluation despite favorable growth projections.

- Achieving the analysts’ consensus target by 2028 would require strong execution on revenue and margin improvements, with consensus forecasts pointing to €1.0 billion revenue and a substantial rise in earnings over the next three years.

Market Expansion and Production Capacity

- Kitron’s investments are enabling it to triple production capacity in both the EU and U.S., with M&A and new facilities designed to capture additional market share as sector demand grows.

- According to the analysts’ consensus narrative, these moves strongly support the bullish case for accelerating top-line growth through Defense & Aerospace innovation and expanded contract wins.

- This positive backdrop is balanced by consensus caution that scaling up capacity introduces operational risks, especially if regional demand slows or cost inflation persists, potentially impacting future EBIT margins and cash flows.

- Capacity expansion and backlog growth are two levers the market is watching most closely for upside, but depend on the company’s ability to control costs and flexibly meet shifting sector demand.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Kitron on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the numbers? Make your unique viewpoint heard and shape your own investment narrative in just a few minutes: Do it your way

A great starting point for your Kitron research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Kitron’s elevated valuation, pressure on margins, and dependence on volatile defense contracts create uncertainty around achieving sustainable earnings growth.

If that gives you pause, discover more companies trading at compelling prices and stronger value by checking out these 878 undervalued stocks based on cash flows that could better fit your investment criteria.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kitron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:KIT

Kitron

Operates as an electronics manufacturing services provider in Norway, Sweden, Denmark, Lithuania, Germany, Poland, the Czech Republic, India, China, Malaysia, and the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives